Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Dec 08, 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Into mid-December, a flurry of central bank meetings is anticipated including in the US, UK and Eurozone. December flash PMI releases will also be due for the earliest look into economic conditions across major developed economies in the final month of the year. Additional key economic data releases due in the week include US CPI, UK GDP and labour market data, eurozone industrial production, Japan's Tankan survey and monthly production and retail sales data from both the US and mainland China.

The December 12-13 Federal Open Market Committee (FOMC) meeting will be the focus amid an ongoing disconnect between the Fed's hawkish-leaning rhetoric and the market's conviction of early rate cuts. Risky assets, including equities, remained supported ahead of the US labour market report this week, bringing added attention to how the Fed may help shape the market's views on the interest rate path forward in its December meeting. As far as Fed chair Jerome Powell's recent speech showed, the market is placing far greater focus on data indications and indeed, price indications, including from S&P Global US PMI data, have showed that CPI may further ease and even close in on the Fed's 2% target soon. More up-to-date December flash PMI data will also be due Friday for the freshest insights into price trends in the US in the final month of 2023.

Central bank meetings in the UK and Eurozone also take place in the week. While further hikes have been ruled out by the market, uncertainty surrounding the timing for the lowering of interest rates remains. Both the UK and Eurozone have been facing considerable slowdown in economic activity of late and October's UK GDP will be updated for an official confirmation of the softening trend.

In APAC, several central bank meetings are also anticipated, though the focus may well be with data including activity numbers from mainland China. Recent Caixin PMI figures outlined slight improvements in both manufacturing output and service activity, preluding higher official industrial production and retail sales readings. Japan's Tankan survey will also be watched for any signs of improvements in the outlook, though our PMI indications have shown softer Q4 conditions thus far when compared to the last quarter.

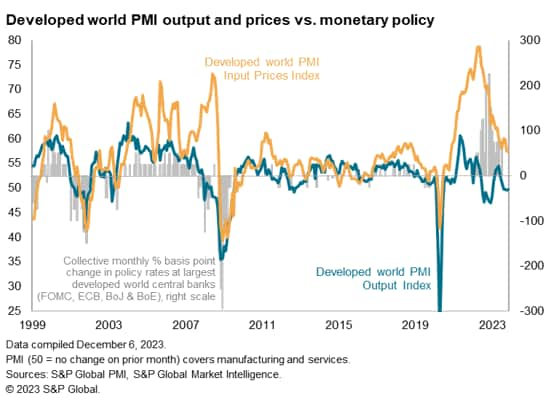

The world's major policymakers continue to tread an uncomfortable path of citing the need to keep interest rates high in the face of slumping inflation and signs of deteriorating economic performance. December's flash PMIs will add to the debate, having so far been largely adding to the case for rates to be cut earlier than central banks have been suggesting.

Although November's final PMI data showed some stickiness of selling price inflation among companies, notably in the service sector, the surveys suggest US Fed and ECB inflation targets have come into view in early 2024. Moreover, global input cost inflation, which tends to lead selling prices, fell further, dropping to a three-year low and is now running below the ten-year average seen prior to the pandemic. In other words, global cost pressures are lower than what might be considered "normal".

Lower costs have been in part a function of lower oil prices, which have continued to decline in December. But companies are also reporting that wage pressures are running lower than earlier in the year thanks to near-stalled jobs growth globally, and - perhaps most importantly - that weak demand is inhibiting scope to raise prices.

This weakness of demand has been most evident in the developed world, and in Europe in particular, though demand growth has also largely stalled in the US.

December's flash PMIs will therefore be eagerly awaited for their indications of how these trends in demand growth, employment and firms' input costs are all progressing as we move into 2024.

For our full recap of the PMIs in 2023, download our "Shifting Sands" report.

Monday 11 Dec

Malaysia Industrial Production (Oct)

Norway Inflation (Nov)

Turkey Industrial Production and Unemployment (Oct)

United States Consumer Inflation Expectations (Nov)

Tuesday 12 Dec

Australia Westpac Consumer Confidence (Dec)

Japan PPI (Nov)

Philippines Trade (Oct)

United Kingdom Labour Market Report (Oct)

Eurozone ZEW Economic Sentiment (Dec)

Brazil Inflation (Nov)

India Industrial Production and Inflation (Nov)

United States CPI (Nov)

Wednesday 13 Dec

South Korea Unemployment (Nov)

Japan Tankan Large Manufacturers Index (Q4)

China (Mainland) New Yuan Loans, M2, Loan Growth (Nov)

United Kingdom monthly GDP, incl. Manufacturing, Services and Construction Output (Oct)

United Kingdom Goods Trade (Oct)

South Africa Inflation (Nov)

Eurozone Industrial Production (Oct)

United States PPI (Nov)

United States Fed FOMC Interest Rate Decision

Brazil BCB Interest Rate Decision

Thursday 14 Dec

New Zealand GDP (Q3)

Japan Machinery Orders (Oct)

Australia Employment (Nov)

Hong Kong SAR HKMA Interest Rate Decision

Japan Industrial Production (Oct, final)

India WPI (Nov)

China (Mainland) FDI (Nov)

Philippines BSP Interest Rate Decision

Switzerland SNB Interest Rate Decision

Taiwan CBC Interest Rate Decision

Norway Norges Bank Interest Rate Decision

United Kingdom BoE Interest Rate Decision

Eurozone ECB Interest Rate Decision

United States Retail Sales

United States Business Inventories (Oct)

Friday 15 Dec

Australia Judo Bank Flash PMI, Manufacturing & Services*

Japan au Jibun Bank Flash Manufacturing PMI*

UK S&P Global/CIPS Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

Singapore Non-oil Domestic Exports (Nov)

China (Mainland) Industrial Production, Retail Sales (Nov)

Eurozone Trade (Oct)

United States Industrial Production (Nov)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

December flash PMI releases

Flash PMI releases for the final month of 2023 will be due Friday, December 15 as we await indications of manufacturing and service sector conditions across major developed economies before worldwide readings are available in the new year. This comes after global manufacturing business conditions worsened for a fifteenth successive month in November, while service sector conditions slightly improved.

Americas: Fed FOMC, BCB meetings; US CPI, industrial production and retail sales; Brazil inflation

December's Federal Open Market Committee (FOMC) meeting is expected to unfold with no changes to rates according to consensus. Instead, the focus will be on the Fed's expected course of action in 2024, with the market having almost fully priced in at least one rate cut by mid-year based on indications from the CME FedWatch tool.

US CPI will also be closely tracked for further confirmation of the softening inflation trend as preluded by PMI price indices. Activity data such as industrial production and retail sales are also released in the week to help guide Q4 growth estimates.

EMEA: ECB, BoE meetings; UK GDP and labour market report; Eurozone industrial production, ZEW index

Both the European Central Bank and Bank of England are expected to stand pat in their final monetary policy meetings of 2023, with guidance going into 2024 the key area of focus.

On economic data, besides the December flash PMI releases, UK's October GDP and labour market data will be keenly anticipated. Previously, PMI data revealed that the UK economy has struggled to maintain nay growth momentum in the fourth quarter, while employment has also remained under pressure. Additionally, eurozone industrial production will also be updated, for which further weakness appears to be on the cards, alongside the ZEW survey.

APAC: China industrial production, retail sales; Japan Tankan; Australia employment, BSP, HKMA, CBC meets

In APAC, key releases include mainland China's activity data, the Bank of Japan's Tankan survey and Australia's employment data. The consensus currently points to higher industrial production and retail sales readings for mainland China in line with Caixin PMI indications.

Central bank meetings in the Philippines, Hong Kong SAR and Taiwan also unfold in the week.

Worldwide employment stalls as businesses report further weakness of demand - Chris Williamson

India seizes crown of fastest growing G20 economy - Rajiv Biswas

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location