Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Aug 03, 2023

PMI survey data from S&P Global and Caixin showed the mainland Chinese economy losing growth momentum at the start of the third quarter. A renewed manufacturing downturn was accompanied by relatively subdued service sector growth compared to earlier in the year. There were nevertheless some brighter aspects to the survey to counter the gloom, with manufacturing optimism lifting higher and service sector new business inflows growing at a faster rate than June.

Sector divergences played out in pricing power. While manufacturers offered discounts amid falling demand, service sector companies - riding a post-pandemic wave of increased spending - were able to raise their rates on average.

The overall inflation picture nonetheless remained subdued, which, combined with the sluggish demand picture and disappointing second quarter GDP numbers, will likely add to calls for further government stimulus.

The post-pandemic recovery in mainland China lost further momentum in July. The headline Caixin PMI, compiled by S&P Global, signalled a cooling in the rate of output growth for a second successive month at the start of the third quarter, registering the weakest expansion since January.

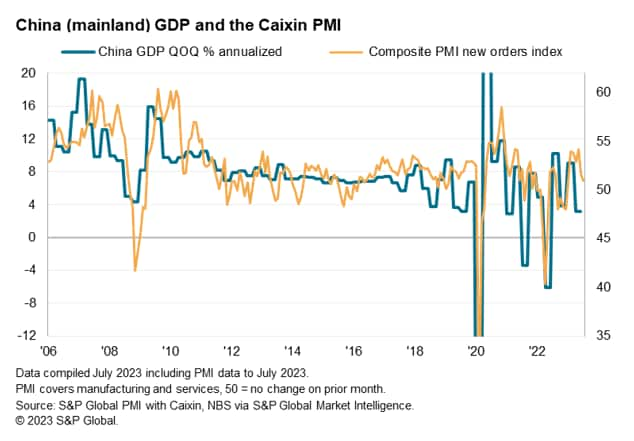

July's survey data follow disappointing GDP data for the second quarter, which showed the economy growing at an annualized quarterly rate of just 3.2%, down from 8.8% at the start of the year.

Both the PMI and the official data therefore pointed to a significant loss of growth momentum since the initial boost the economy received from the relaxation of COVID-19 containment measures at the start of the year.

Leading the weakness in July was a renewed fall in manufacturing output, which declined in July for the first time since January. New orders received by factories likewise fell, having risen in both May and June, dropping at the fastest rate since last December. Exports of goods fell especially sharply, deteriorating at a rate not seen since last September.

Although the service sector continued to grow in July, the rate of expansion remained far weaker than the gains seen in earlier months of the year, albeit edging up slightly on June. New business inflows into the service sector likewise remained subdued compared to the peak seen back in March, though also revived somewhat compared to June despite services export growth sliding to the lowest so far this year.

The sector data therefore suggest that the goods producing sector has become an increasing drag in the mainland Chinese economy as it headed into the third quarter, with economic growth having become increasingly reliant on the service sector. Encouragingly, although service growth has cooled since the initial reopening of the economy, it remains resilient.

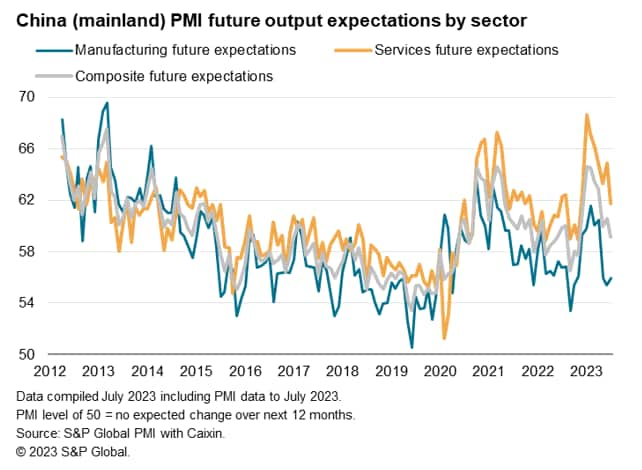

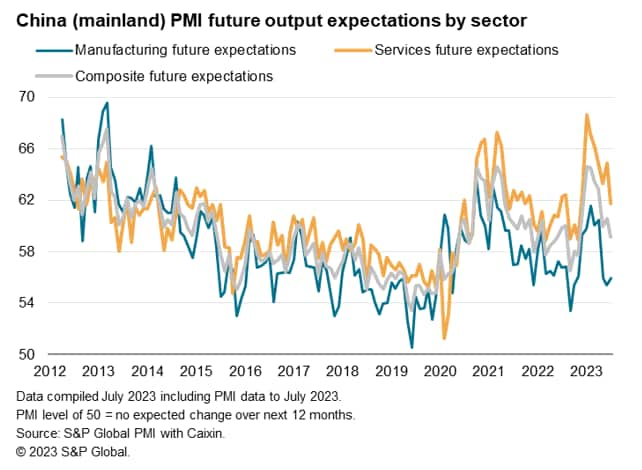

Looking ahead, July saw some improvement of output expectations among manufacturers, albeit remaining relatively subdued by historical standards. Future business expectations meanwhile deteriorated in the service sector to the lowest since last November, though in this case the level optimism remains elevated.

The overall message from the forward-looking PMI future expectations indices is therefore one of manufacturing potentially steadying in a period of malaise, while the service sector is expected to lose some further growth momentum. This of course ignores any government interventions which might take place in the coming months.

The sectoral divergence in demand was reflected in differing price trends. While weak demand and lower input costs prompted further discounting by manufacturers, leading to a fifth successive month of falling factory gate prices in July - the rate of decline of which remained among the highest seen since 2016 - service providers managed to hike their prices on average. However, the overall rise in services charges remained muted. Overall, selling prices for goods and services consequently fell on average for a fourth month in a row.

A further encouraging signal on inflation comes from a relatively modest lengthening of supplier delivery times in July. Supply chain delays are highly correlated with inflation, and a recent improvement in supplier performance (i.e. shorter delivery times) preceded the latest cooling of inflation in June, which showed prices unchanged on a year ago. While a slight uptick in inflation pressures from supply chains is signalled for July, the pressure remains muted by historical standards.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.