Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Feb 08, 2023

The UK labour market remained soft at the start of 2023, according to survey data compiled by S&P Global, with employment coming under pressure from weak demand for staff from employers. The number of people placed in permanent jobs fell for a fourth month in a row in January as a result. Staff availability issues also showed further signs of alleviating, helping to bring permanent staff wage growth down in line with the average seen in the five years leading up to the pandemic. Whether the labour market continues to cool remains uncertain, however, as a jump in business confidence tracked by the PMI surveys suggests that hiring could revive in the coming months, thereby putting renewed upward pressure on wages.

Recruitment agencies in the UK reported a fall in the number of people placed in permanent jobs for a fourth successive month in January. The ongoing decline suggests 2023 has started on a sustained weak note after the closing months of 2022 saw the steepest calendar quarter decline for placements since the spring of 2009 - deep in the depths of the global financial crisis - barring only the early lockdown months of the pandemic.

The decline, signalled in the monthly survey of around 400 recruitment consultancies conducted by S&P Global on behalf of KPMG and the REC, was nevertheless weaker than anything seen in the prior three months, hinting at an easing in the rate of job market deterioration. The number of people placed in temporary jobs also picked up slightly, albeit still running at a much reduced rate compared to a year ago.

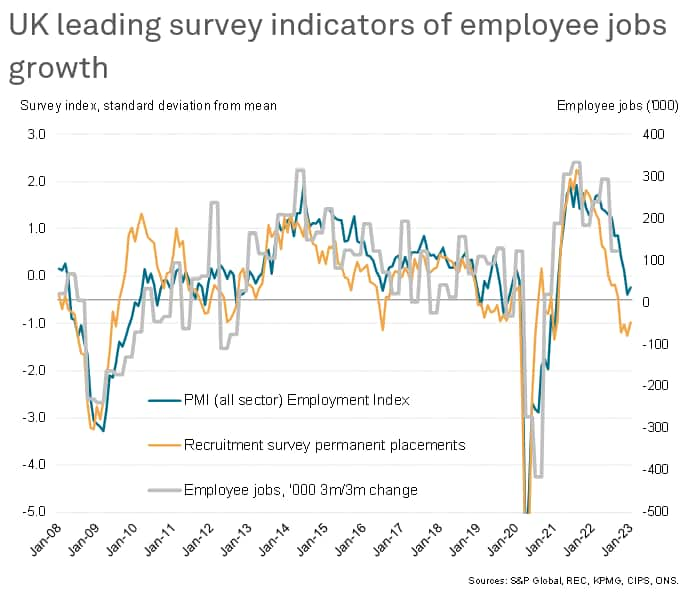

The survey - which has been running since 1997 - has historically acted as a reliable indicator of major changes in labour market trends, with the data tracking permanent placements providing a particularly useful advance guide to official employment payroll numbers. The latest reduction in new job placements is an important advance signal of employment falling after the robust post-pandemic jobs boom.

The fall in the recruitment series is accompanied by a further weak trend in employment recorded by PMI surveys of broader business conditions. Across manufacturing, services and construction, the CIPS/S&P Global PMI surveys have now signalled falling private sector employment for two consecutive months, albeit with the latest data for January signalling a near-unchanged picture as the rate of job losses cooled.

In fact, so far only the recruitment industry survey data are consistent with the official gauge of employment falling in the UK (see chart), though this likely reflects the extent to which the recruitment series tends to lead both the PMI employment index and the official data, as hiring tends to change before actual employment levels change. Typically, faced with disappointing sales or revenues, companies will first enact a hiring freeze before laying off staff. Similarly in an upturn, hiring is of course the natural precursor to higher employment.

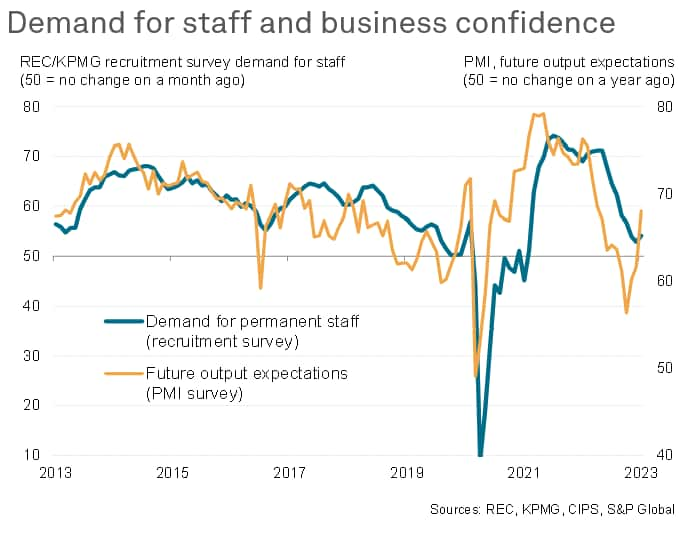

More encouragingly, the recruitment industry survey's gauge of employer-demand for staff rose for the first time in nine months in January. While still signalling one of the weakest improvements in demand for staff since the lockdowns of February 2021, the uplift corresponds with an upturn in business confidence about growth in the year ahead tracked by the PMI surveys.

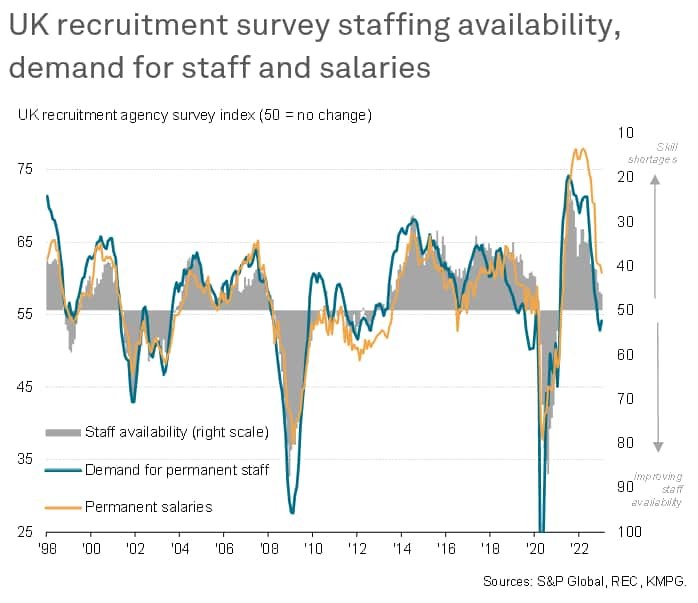

January meanwhile also saw a reduction in the number of recruitment consultancies reporting deteriorating availability of candidates to fill vacancies. While overall staff availability continued to worsen in January, the incidence of permanent labour shortages was the lowest recorded since March 2021 and indicative of the recent record tightness of the labour market starting to cool.

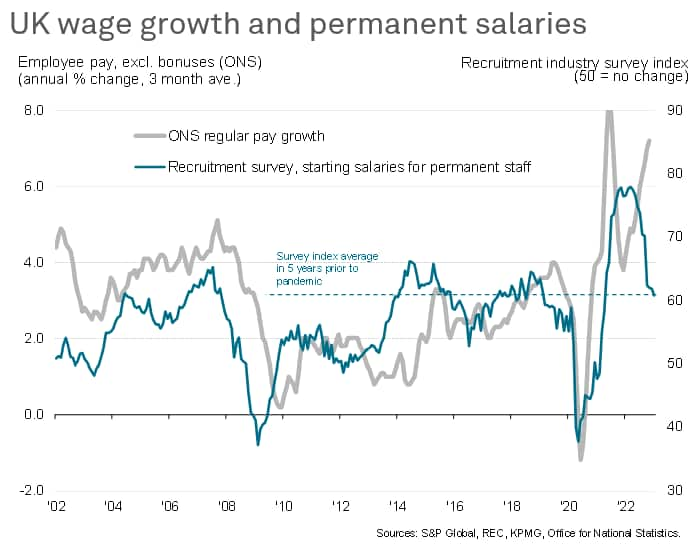

With staff shortages moderating, and demand for staff growing at a much reduced rate compared to that seen throughout much of 2021 and 2022, wage growth has slowed accordingly. The recruitment industry survey's gauge of average salaries awarded to people placed in permanent jobs signalled the softest rate of pay growth for 21 months in January, the rate of inflation easing for a tenth successive month.

The latest slowing of wage growth takes the pace down in line with the average seen in the five years preceding the pandemic, suggesting that the post-pandemic inflation-linked surge in pay growth may start to cool as we head through 2023.

Much of course depends on the degree to which the hiring trend might reaccelerate in the coming months if the employment situation follows the upturn in business confidence tracked by the PMI. February's flash PMI data, due to be published on 21st February, will therefore be eagerly assessed for the updated numbers on both business confidence and employment.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location