Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JUNE 27, 2025

By Noor Ul Ain Adeel

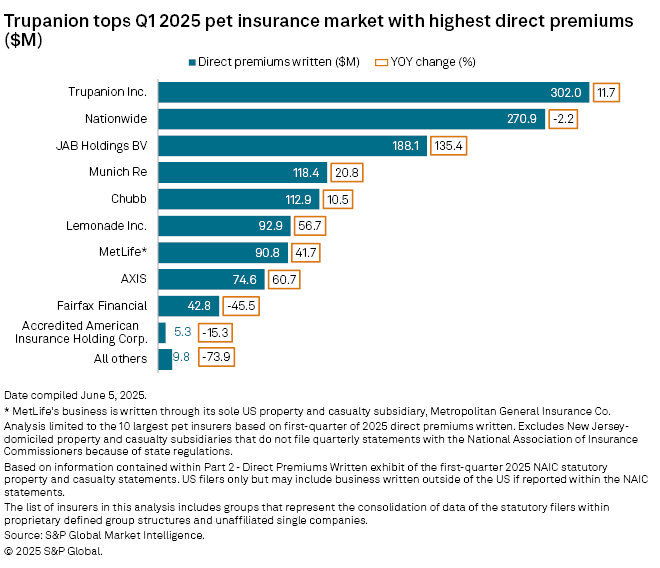

A record $1.31 billion in US pet insurance premiums were written in the first quarter of 2025.

The total was up from $1.12 billion a year earlier and $1.24 billion in the previous quarter.

Pet insurance data was only recently made publicly available. For the first time in the first quarter of 2024, it was reported as a separate business line in quarterly statutory filings. It was also broken out as a distinct section on Schedule P in 2024 annual statements.

The industry has experienced double-digit growth each year since 2017, according to an S&P Global Market Intelligence analysis of full-year pet insurance data. The highest year-over-year growth spurt was in 2021, at a 32.5% increase in net premiums earned.

Leaders

Trupanion Inc.was the largest US underwriter of pet insurance in the first quarter of 2025 with $302.0 million in direct premiums, up 11.7% year over year. It was also the largest underwriter of pet insurance in the US for the full year 2024, with $1.09 billion in direct premiums and a direct incurred loss ratio of 72.3%.

Nationwide Mutual Group took second place for the quarter with $270.9 million, down 2.2% from a year earlier. The decline may be indicative of a wider trend for Nationwide. In June 2024, the company said it was cancelling coverage for about 100,000 pets due to rising inflation in vet care, among other factors.

"We have been working to offer customers new products, which has reduced the number of impacted policies by more than 75 percent," Nationwide added.

|

– Read about the US property and casualty market first-quarter 2025 results.

– Download a template to analyze the P&C insurers' historical market share across all lines of business. |

Increased interest

JAB Holdings BV reported the third-highest direct pet insurance premiums at $188.1 million in the first quarter, and the largest year-over-year increase among the top US pet insurers at 135.4%. The company's pet insurance business is conducted through its subsidiary Independence American Insurance Co.

Independence American Insurance issued a promissory note worth about $250 million in 2022 and spent $1.15 billion in cash to acquire Crum & Forster Pet Insurance Group and Pethealth Inc. from Fairfax Financial Holdings Ltd.

Crum & Forster Chairman and CEO Marc Adee said his company is now looking to reenter the pet insurance market.

"We sold that operation, but are looking to get back in there," Adee said at S&P Global Ratings' 41st Annual Insurance Conference held June 4–5. Crum & Forster still has a wealth of institutional knowledge in the pet insurance space, which is less crowded than other property and casualty niches, he added.

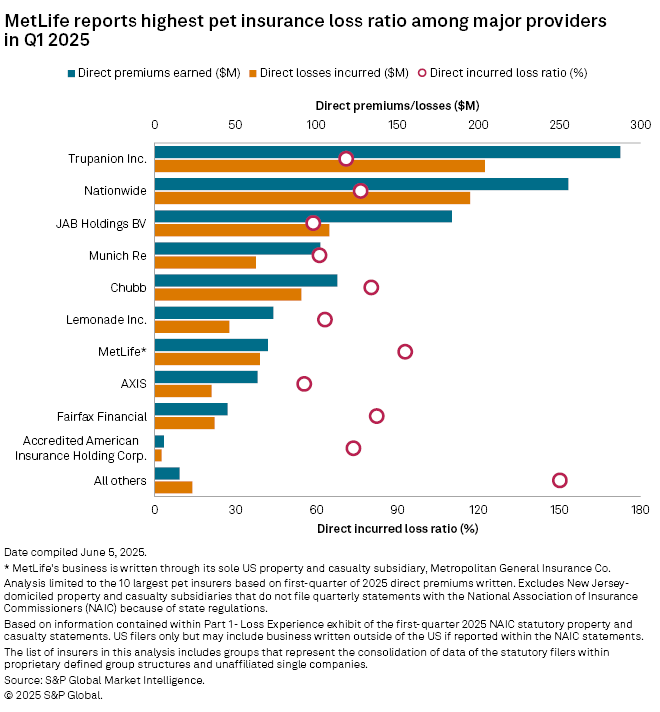

Loss ratios

AXIS Capital Holdings Ltd. reported the lowest direct incurred loss ratio of the group at 55.4% for its pet insurance business, while MetLife Inc. logged the highest direct incurred loss ratio at 92.8%.

Leaders Trupanion and Nationwide booked direct incurred loss ratios of 70.9% and 76.3%, respectively, in the first quarter of 2025.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.