Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

By Chris Hudgins

The office sector continues to face difficulties, but there is a distinct separation in performance between the amenity-rich premier office assets and the older, lower-quality buildings where few employees have returned to the office. Low valuations across the office sector, coupled with high interest rates and lenders viewing the sector with greater trepidation, could lead to refinance challenges for landlords with mortgages coming due.

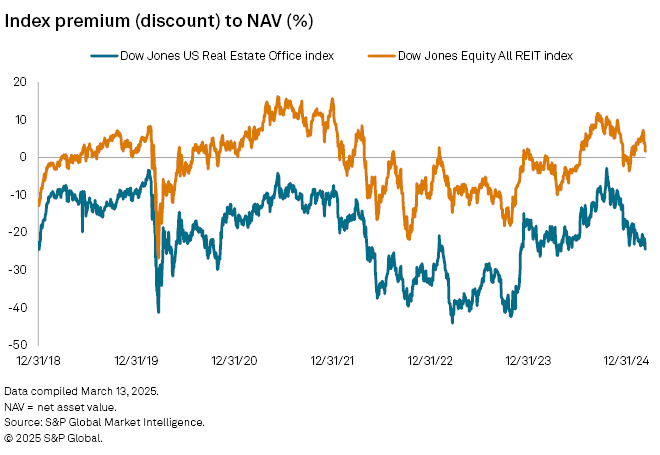

➤ Office real estate investment trusts continued to trade at large discounts to their estimated net asset value (NAV), and the discount has grown since the Federal Reserve signaled it would be more cautious about cutting interest rates in 2025.

➤ Supply dynamics should prove a favorable tailwind for the office market. Some of the existing older office buildings with little leasing demand are going offline. This is because of factors such as residential conversions or landlords simply choosing not to invest more capital to get the property into a leasable state. At the same time, there is little to no new office construction.

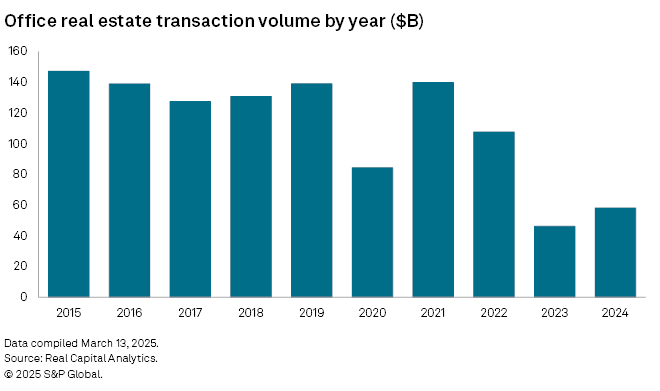

➤ Office property transaction volume increased year over year in 2024, but remained low overall, making price discoverability challenging for the sector.

Valuations down for office REITs

Valuations for office real estate investment trusts have consistently fallen since mid-December after the Federal Reserve signaled it would be more hesitant to cut interest rates in 2025. As of March 12, the office REIT sector traded at a 27.3% median discount to NAV, a 12.7 percentage point decline compared to the 14.6% median discount as of the end of November 2024.

Office REIT stocks trade at a much larger discount to NAV compared to the broader REIT market. On a market-cap-weighted basis, the Dow Jones US Real Estate Office index closed March 12 at a 24.2% discount to NAV, while the broader Dow Jones Equity All REIT index closed the same day at a 1.6% market-cap-weighted premium to NAV.

Premier office buildings, the highest-quality of buildings, continue to outperform the broader office market.

BXP Inc.'s CEO Owen Thomas said on the REIT's fourth-quarter 2024 earnings call that the direct vacancy rate of premier office buildings in the five central business district markets where his company operates — Boston, New York, San Francisco, Seattle and Washington, DC — was 13.2%, versus 18.8% for the broader market. CBRE's research defines premier workplaces as the highest-quality 7% of buildings, which represent 13% of total space in those five central business district markets.

The amount of premier office space available for leasing in BXP's markets declined by 8.8 million square feet over the last three years, whereas available space in the broader office market increased by 15.6 million square feet during the same period.

Thomas said asking rents for premier workplaces were also 50% higher than the broader market, up from approximately a 40% premium three years ago.

While there appears to be clear bifurcation between different quality properties, price discovery remains opaque.

Property transactions remained low for all commercial real estate in 2024, including office. Office real estate transactions in the US totaled approximately $58.18 billion in 2024, up 26% from $46.19 billion the year prior, but less than half of the $139.09 billion of office transactions in 2019, according to data from Real Capital Analytics.

Elevated interest rates coupled with significant bid-ask spreads between buyers and sellers have kept many deals on the sidelines for the time being. As more investment properties come to the market, REITs with capital on hand and strong balance sheets may find unique opportunities in the future.

Stress in office loan portfolios remain elevated

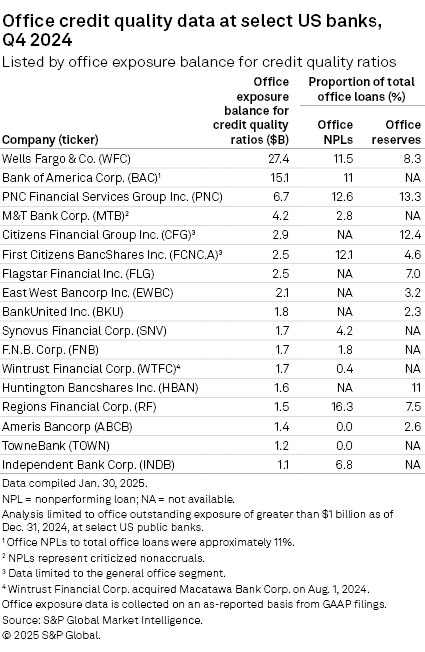

Credit quality of office loans remained stressed for many of the top office lenders as of year-end 2024.

In an analysis of banks that reported at least $1 billion in outstanding office loans as of Dec. 31, 2024, Wells Fargo & Co., the largest office loan lender in an analysis, reported that 11.5% of its $27.4 billion office loan portfolio were nonperforming as of 2024 year-end. Bank of America Corp. and PNC Financial Services Group Inc. reported similar levels of nonperforming office loans, at 11% and 12.6%, respectively.

Interest rate hikes over the last three years have made refinancing increasingly difficult for office property owners who originated loans at much lower rates and are now struggling with higher vacancy rates and persistent remote work trends.

Banks continued to hold loan-loss reserves at high-single or low-double digits for loans tied to office properties to help prepare for rough sledding ahead. Banks also claimed that they have low loan-to-value ratios on their office loans, giving them significant equity cushions. While price discovery remains challenging to come by given the low transaction volume in the marketplace, price declines might have been severe enough to wipe out those cushions, especially for lower-quality office assets.

With elevated stress in the office sector, many of the banks with the largest exposure to the sector are paring back their office loan portfolios and reducing their exposure. In an analysis of 26 banks with more than $1 billion each in office loans, 20 reduced the total balance of their office loan portfolios in the fourth quarter of 2024 compared to the quarter prior.

Outlook for office sector

While leasing activity and demand for high-quality premier office properties remained strong, concerns around office CRE overall are likely to linger for at least a couple more years, with the highest concern around lower-quality office buildings.

While it is still early into President Donald Trump's second term, his planned policy to have federal workers return to in-office work could support the Washington, DC office market. Bringing federal employees back to the office could motivate government-adjacent employees, such as government contractors, to work more from their offices. The additional street life from more employees working from the office would also be an uplift to local retailers and restaurants in the area.

That being said, the Trump administration has also implemented layoffs within the federal workforce, potentially outweighing any gains from their return-to-office efforts for the DC market.

Supply dynamics should also prove a favorable tailwind for the office market in the coming years. A portion of the existing older supply of office buildings with little leasing demand is going offline, while there is little to no new office construction.

Office-to-residential conversion projects continue to gain steam in New York City. On SL Green Realty Corp.'s fourth-quarter 2024 earnings call, the REIT's CEO Marc Holliday categorized the office-to-residential conversion opportunities in the city as "kind of a triple win," and clarified that the conversions take obsolete space off the market, help address the housing crisis and help revitalize city life.

Banks continue to monitor their office loan portfolios, with many setting aside loss reserves for loans that may not be re-financeable in the current environment. Banks are expected to continue to view the asset class with caution and likely will extend new credit with less favorable terms and pricing to borrowers. Many traditional lenders do view CRE loans, including certain smaller office loans, as part of their core competency and should continue to service existing customers.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.