Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — May 02, 2022

By Ben Herzon and William Magee

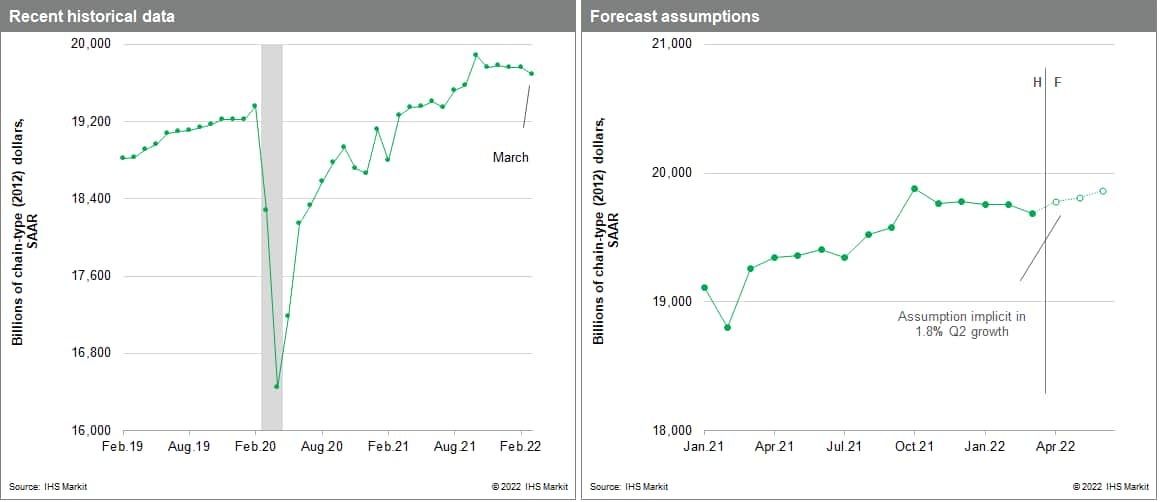

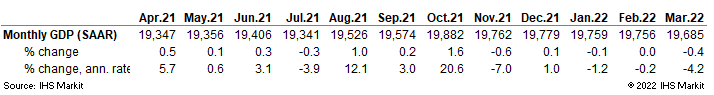

Monthly US GDP declined 0.4% in March following a flat reading in February. The latter was revised up from the prior estimate of a 0.1% decline. The decline in March was more than accounted for by a sharp decline in net exports stemming from a surge in imports. This and a few other small subtractions were partially offset by increases in nonfarm inventory investment, personal consumption expenditures, and nonresidential fixed investment. The level of GDP in March was 1.0% below the first-quarter average at an annual rate. Implicit in our latest forecast of 1.8% GDP growth in the second quarter are increases in GDP averaging 0.3% per month (not annualized) during the three months of the second quarter.

Our index of Monthly US GDP (MGDP) is a monthly indicator of real aggregate output that is conceptually consistent with real Gross Domestic Product (GDP) in the National Income and Product Accounts. The Monthly US GDP Index is consistent with the NIPAs for two reasons: first, MGDP is calculated using much of the same underlying monthly source data that is used in the calculation of GDP. Second, the method of aggregation to arrive at MGDP is similar to that for official GDP. Growth of MGDP at the monthly frequency is determined primarily by movements in the underlying monthly source data, and growth of MGDP at the quarterly frequency is nearly identical to growth of real GDP.

Posted 02 May 2022 by Ben Herzon, US Economist, Insights and Analysis, S&P Global Market Intelligence and

William Magee, Economist, Economics & Country Risk, S&P Global Market Intelligence

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.