Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jul 03, 2023

The health of the US manufacturing sector took a sharp turn for the worse in June, adding to concerns over the economy potentially slipping into recession in the second half of the year.

Factory output declined sharply at the end of the second quarter, according to the S&P Global PMI, dropping at one of the fastest rates seen over the past 13 years.

Leading the darkening picture was a severe drop in demand for goods, with new orders slumping at a rate which was among the steepest since the global financial crisis in 2009.

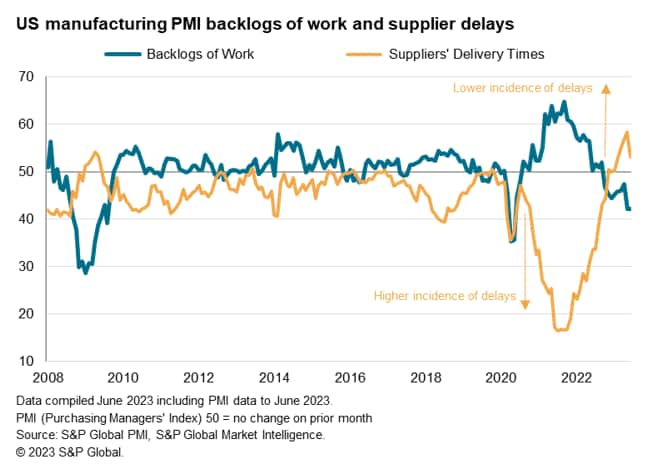

Whereas prior months had seen unprecedented supply chain improvements help companies boost production to fulfil accumulated backlogs of orders, June's ongoing decline in new order inflows mean firms are now coming under increasing pressure to reduce production volumes. Backlogs of work are now falling sharply.

Companies report that customers have become increasingly reticent to spend amid the rising cost of living, higher interest rates, growing concerns about the economic outlook and a switch in spending to services.

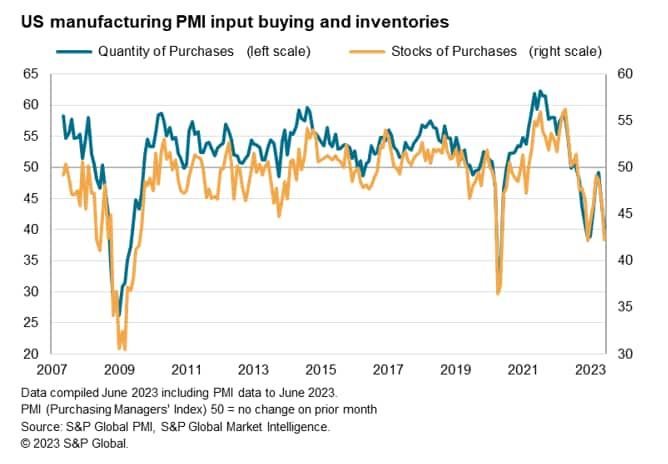

Exacerbating the downturn has been a continued focus on inventory reduction as manufacturers, their suppliers and their customers all seek to cut warehouse stocks in the face of weakening demand.

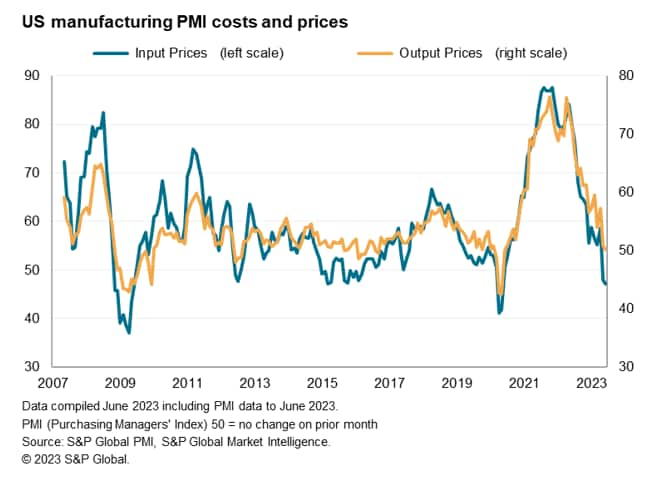

In this environment, pricing power is fading rapidly. Prices charged for inputs by suppliers are now falling at the joint-quickest rate since 2009 barring only the early pandemic lockdown months. Prices charged for goods leaving the factory gate meanwhile barely rose in June amid increasing reports of discounting, indicating a near-total collapse of inflationary pressures in the goods-producing sector.

The focus now turns to the service sector, where inflationary pressures have been more stubborn in recent months amid resurgent post-pandemic demand. The big question is how long this service sector spending can be sustained in the face of headwinds from the cost of living and higher interest rates.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location