Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Feb, 2016 | 08:00

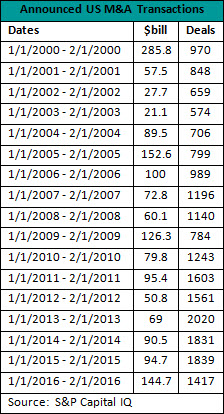

While many financial markets have recently been jarred by turmoil, for merger and acquisition activity the year is starting on the particularly upbeat note. According to data retrieved from S&P Capital IQ, aggregate disclosed deal value for announced U.S.M&A activity to date in 2016 has $144 billion. That represents the best start of the year for deal making since early 2005 when through February 1st of that year over $152 billion in deal activity was announced.

To date in early 2016 the top U.S. M&A deal is Dublin, Ireland-based Shire plc (LSE:SHP) entering into an agreement to acquire Illinois-headquartered biotechnology firm Baxalta Incorporated (NYSE:BXLT) for $36.29 billion on January 11, 2016. That was followed by Johnson Controls Inc. entering into a definitive merger agreement to acquire Tyco International plc for in transaction valued at $31.1 billion on January 24, 2016 and Abbott Laboratories (NYSE:ABT) entering into a definitive agreement to acquire Alere Inc. (NYSE:ALR) in a deal valued at $9.1 on February 1, 2016.

With regard to sectors the healthcare sector commanded the highest total deal value for early 2016 M&A with over $51.6 billion in transactions, or 36% of announced deal value. That was followed by almost $42.6 billion in consumer discretionary M&A deals and $19.4 billion in transactions from the financial sector.

As for deal count during 2016 to date , 1,417 announced M&A transactions have occurred. However, that’s a drop from the early start of 2015 when 1,839 deals took place through the first of February that year.

Also, while the financial sector ranks as the most active in term of individual deals, the pace is slowing. Specifically, in the month of January 2016, the financial sector saw 474 announced transactions, the lowest monthly tally for that sector since February 2014 when 468 deals too place. On the other hand, the new year started with 17 US M&A deals with values of $1 billion or greater being announced. That compares to the comparable period in 2015 when 13 deals of $1 billion or more took place.

Finally, in a sign that anxiety about deal terminations may be inflated, S&P Capital IQ data shows just six previously announced US M&A deal cancelled to date in 2016