Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JUNE 03, 2025

By Tim Zawacki

The remarkable success of the annuity business in the first quarter of 2024 created an especially challenging comparison that the US life insurance industry could not match in the opening three months of 2025.

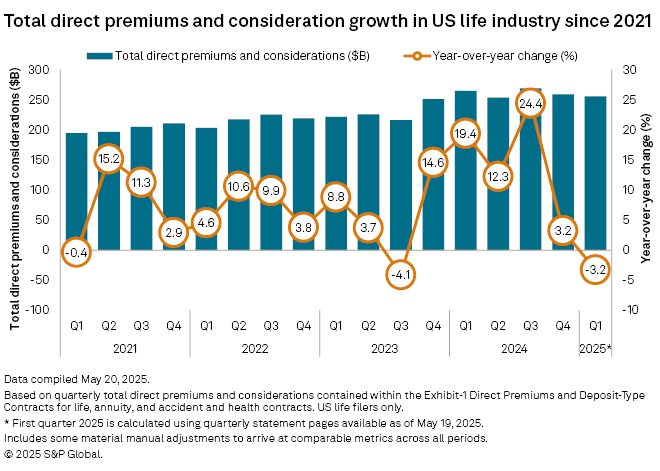

Strong sales of individual annuities and several large pension risk transfer transactions in the group annuity business pushed US life industry direct life, annuity and accident and health premium volume to a 19.4% year-over-year increase in the first quarter of 2024, reaching $264.62 billion, according to our analysis based on disclosures on Exhibit 1 of quarterly statutory statements. Business volume slipped by 3.2% to $256.03 billion in the first quarter of 2025, marking the first retreat in six quarters and only the second decline in 16 quarters.

Industry-level values presented in this article for the first quarter of 2025 and prior periods contain multiple material adjustments to data available on the S&P Capital IQ Pro platform due to reporting anomalies, a company reclassification and regulatory constraints. Please read the Methodology section for a full discussion of the nature and effects of these adjustments.

Jumbo pension risk transfer deals executed by Prudential Financial Inc. in the first quarter of 2024 served as the primary driver of the 2025 retreat. Total group annuity direct premiums and considerations, which include single-premium pension risk transfer group annuities, plunged by 23.0% in the first quarter. The individual annuity business also contributed to the decline, with direct premiums and considerations slipping by 1.6% from an all-time first-quarter high in the year-earlier period.

Our outlook for 2025 continues to call for difficult comparisons in the first three quarters of the year based on the comparable 2024 periods' extremely strong annuity production, which would be challenging for the industry to replicate. The industry was due for a slowdown after four consecutive periods of double-digit growth rates through the third quarter of 2024. Current supply-and-demand dynamics yield conflicting signals regarding the potential for a rebound later in the year.

A confluence of strong supply and demand for individual annuities led to outsized growth through much of the first half of the 2020s, including double-digit year-over-year growth 13 times in a stretch of 16 quarters through Sept. 30, 2024. Growth rates have since slowed, with most individual annuities showing year-over-year declines in both the fourth quarter of 2024 and the first quarter of 2025.

Athene Holding Ltd.'s primary US life subsidiary Athene Annuity and Life Co., the largest individual writer in the category, posted a year-over-year decline of 0.9% in direct premiums and considerations. But these modest changes in individual annuity volumes were the exception, not the rule, among the largest writers. Of the 22 individual entities that posted more than $1.5 billion in individual annuity volume in the first quarter of 2024, 16 produced results for the opening three months of 2025 that represented at least a double-digit increase or decrease.

Entities with year-over-year declines in excess of 40% included Nationwide Life Insurance Co., Delaware Life Insurance Co., Symetra Life Insurance Co., Protective Life Insurance Co. and EquiTrust Life Insurance Co. Individual annuities at the combination of Massachusetts Mutual Life Insurance Co. and its MassMutual Ascend Life Insurance Co. fell by 28.8% during the first quarter, with a MassMutual regulatory filing citing lower fixed annuity sales. At the other end of the spectrum, New York Life Insurance & Annuity Corp., USAA Life Insurance Co. and Pacific Life Insurance Co. each more than doubled their individual annuity direct premiums and considerations.

LIMRA's U.S. Individual Annuities Sales Survey for the first quarter showed strong growth in registered index-linked annuities and variable annuities, offset by a decline in fixed annuities. This pattern aligns with the broader industry performance observed in our analysis.

The group annuity business served as the biggest drag on year-over-year comparisons as direct premiums and considerations fell to $41.38 billion from $53.73 billion in the year-earlier period. The Prudential Insurance Company of America, which booked jumbo pension risk transfer transactions in the first quarter of 2024 with Verizon Communications Inc. and Shell USA Inc., was responsible for the decline as its group annuity volumes tumbled to $3.49 billion from $18.31 billion. Due to the episodic nature of the jumbo portion of the pension risk transfer market, the largest deals have produced outsized increases and decreases in quarterly premium volumes for the industry as a whole.

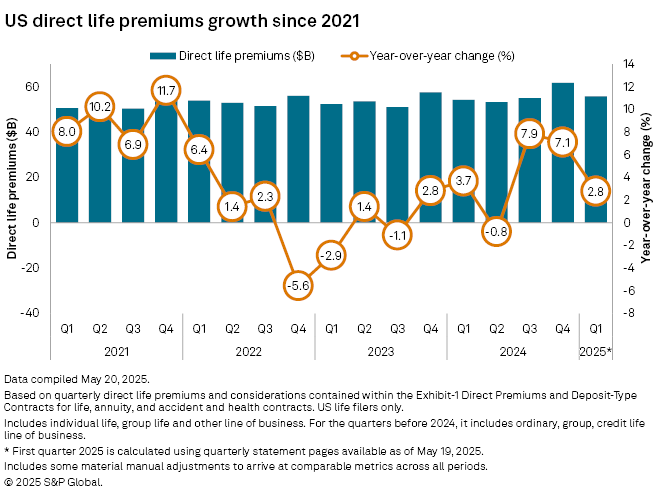

The individual and group life business combined to show a modest year-over-year increase in direct premiums of 2.8%, but the components of that result diverged significantly. While individual life premiums increased by 4.5% year-over-year, group life volumes decreased by 2.7%. The Northwestern Mutual Life Insurance Co. reported individual life business growth of nearly 7.9%, citing strong premium persistency.

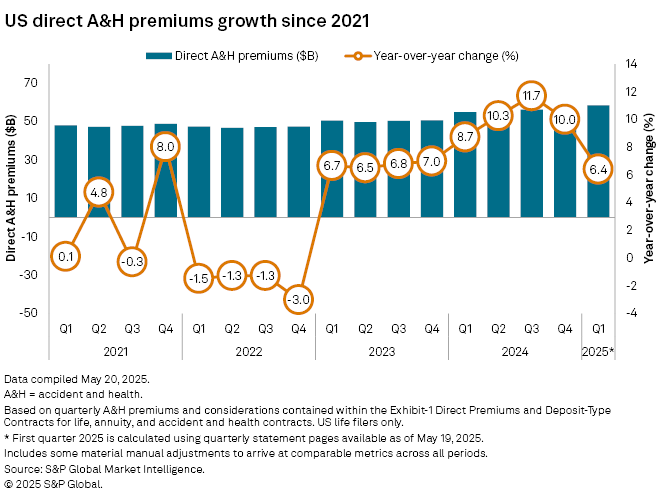

In accident and health, direct premiums increased by 6.4%. That represented the ninth consecutive quarterly increase in the business, though it compared unfavorably to the double-digit rates the industry achieved in the preceding three quarters.

Methodology

Results from statutory filings reflect data on Exhibit 1 of quarterly statements obtained by S&P Global Market Intelligence as of May 19, supplemented by various adjustments stemming from data that was either unavailable or incorrect. The most significant adjustments are as follows:

1) We manually added data for Prudential Insurance Co. of America. Quarterly statutory filings and related data for New Jersey-domiciled companies such as the Prudential subsidiary are not disseminated by regulators for public review by state statute. Prudential posts select statutory results on its investor relations website, which we incorporated where available;

2) The Cigna Group's largest entity, Cigna Health & Life Insurance Co., began filing a health statement blank in the first quarter of 2025 as opposed to life statement blanks in prior periods. S&P Global Market Intelligence's industry aggregates currently reflect the previous reporting. Cigna Health had $28.70 billion in direct premiums in full-year 2024, virtually all in the accident and health lines;

3) The first-quarter 2025 statement of Securian Life Insurance Co., a significant writer of group life business, included blank cells on Exhibit 1. We manually substituted values reported by the company on Schedule T in their absence, and;

4) We used a similar approach to adjusting first-quarter 2024 individual annuity premiums for National Slovak Society Of the USA Inc. The company's Exhibit 1 entry for that period of $1.49 billion dramatically exceeds the value reported on Schedule T and is not supported by entries in Exhibit 1 for the other three reporting periods in 2024.

While the data is subject to change upon the receipt of additional information, we do not expect material changes to the industry totals given the size of the remaining entities for which first-quarter 2025 financials are not available. We nonetheless adjusted our data to use fourth-quarter 2024 premiums data for those entities as a proxy for their first-quarter results, which had an immaterial impact on industry totals.

Please note that due to the adjustments and estimates described above, values and year-over-year percentage changes calculated using S&P Global Market Intelligence industry aggregates for all periods referenced in this article will materially differ..

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.