Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Aug, 2018

Insurance

By Tim Zawacki

Highlights

S&P Global Market Intelligence's 2018 US Life and Annuity Insurance Market Report projects an acceleration of growth in direct premiums and considerations in 2018 as the industry is poised to benefit from the removal of a key regulatory overhang.

Regulatory, legislative and judicial changes will impact growth in direct premiums and considerations in 2018, according to S&P Global Market Intelligence's 2018 US Life and Annuity Insurance Market Report.

Sluggish sales of individual annuities in 2017 resulting from uncertainty regarding the implementation of the US Labor Department's fiduciary rule and a March ruling by a federal appellate court set the stage for favorable top-line comparisons in 2018 and 2019. Net premiums and considerations in several lines will show the effects of at least one US-domiciled carrier's reaction to the Base-Erosion and Anti-Abuse Tax, or BEAT, component of the December 2017 federal tax reform.

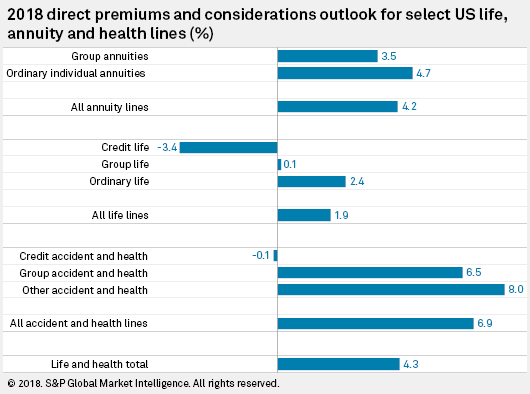

S&P Global Market Intelligence projects overall growth in direct life, annuity and accident and health premiums and considerations of 4.3% in 2018, up from expansion of 1.3% in 2017. By product segment, we project that ordinary individual and group annuities will see combined growth in direct premiums and considerations of 4.2% in 2018, compared to a decline of 3.1% in 2017. This reflects increased optimism for sales following what had been, in some cases, historically low results.

Historical results are based on the aggregation of data at the line-of-business level reported by US-domiciled entities that file life statement blanks with the National Association of Insurance Commissioners. The analysis excludes select entities that generated the vast majority of their business from outside of the United States.

Continued strong growth in direct accident and health premiums written by life statement filers also contributes to the overall outlook for the sector's expansion, offsetting a normalization in growth rates for the life insurance business. S&P Global Market Intelligence projects growth of 6.9% in direct accident and health premiums and 1.9% in direct ordinary and group life premiums as compared with rates of expansion of 6.7% and 4.5%, respectively, in 2017.

Nowhere to go but up

The LIMRA Secure Retirement Institute forecast growth of between 5% and 10% in total annuity sales in 2018 and up to 5% in 2019. Its 2018 outlook assumes higher sales of a range of products, including indexed annuities and annual variable annuities.

Individual annuity sales as measured by a LIMRA Secure Retirement Institute survey declined by 8%, overall, in 2017, with weakness in trends among both variable and fixed products. Direct first-year and single premiums and considerations in the ordinary individual annuity business as reported on annual statutory statements fell by 9.5% in 2017 — the largest reduction in that measure of growth in at least the past 10 years.

Though direct ordinary individual business volume grew less than 0.6% in the first quarter of 2018, the expansion was noteworthy in that it represented the first time in two years that premiums and considerations did not decline. Four times during that eight-quarter stretch, direct premiums and considerations fell by double-digit percentages.

A split March decision by the Fifth Circuit US Court of Appeals effectively dealt a death blow to the Labor Department's fiduciary rule, months after President Donald Trump's administration signaled that it would not actively enforce certain key provisions. The industry had been particularly opposed to the rule's best-interests contract exemption that conferred a private right of legal action related to commission-based products.

While certain states have indicated an interest in reviving elements of the rule and the SEC has set out to draft its own best-interests regulation, the industry has taken some comfort that the federal agency will pursue a more collaborative approach to rulemaking in seeking to preserve customer access to a range of retirement savings products and services.

To the extent regulatory uncertainty remains, the anemic sales trends of mid-2017 offer easy comparisons from which the industry should show significant expansion.

Other lines of business in which 2017 direct premiums and considerations provide either easy or challenging comparisons include group life and other accident and health. In group life, the 2017 results of Zurich American Life Insurance Co. and Nationwide Life Insurance Co. were significantly elevated by bank-owned or corporate-owned life insurance transactions. Group life direct premiums increased by 9.4% during the year after they fell by 3.6% in 2016.

In the other accident and health line, meanwhile, two UnitedHealth Group Inc. subsidiaries exited significant portions of their individual health businesses at the start of 2017. Direct other accident-and-health premiums increased by less than 0.2% on an industrywide basis in 2017, but would have expanded by 3.7% when excluding those subsidiaries' results.

Net noise

Growth in net premiums and considerations is subject to considerably more uncertainty given the extent to which one-off affiliated and unaffiliated reinsurance transactions may take business into or out of the scope of US statutory data. Year-over-year changes in net premiums and considerations have ranged from a decline of 8.9% to an increase of nearly 15.9% in the last five years. The 2017 decline was just 0.3% across life, annuity and health business lines despite a series of multibillion-dollar recaptures and cessions.

The combination of Hannover Life Reassurance Co. of America's reaction to the BEAT and the reinsurance of legacy business by life units of American International Group Inc. has already created volatility in the industry's assumed and ceded premiums in 2018. Hannover Life restructured certain of its retrocession agreements to avoid what it characterized as the "severe surplus strain" that would have resulted from its transactions with foreign affiliates through the new tax. And a new Bermuda affiliate assumed the AIG legacy business, taking it outside of the scope of US statutory data, as the group reported ceded premiums of $31.93 billion for the first quarter and total net premiums of a negative $27.36 billion in the life, annuity and accident and health lines.

Given the prospects for other large life groups to use reinsurance, M&A or some combination of the two to address their legacy exposures, net premium trends are likely to remain a moving target and the source of considerable volatility in the industry's future results.

The projections represent the product of a sum-of-the-parts analysis of line-of-business-level results for private carriers in the US life, annuity and health industry modeled largely on Exhibits 1 and 2 to annual statutory statements. While S&P Global Market Intelligence does not project results for individual carriers or life groups, certain significant company-specific activities help inform the line-of-business level outlook. In addition, the outlook attempts to exclude the impact of select one-off events that involved the on-shoring or offshoring of business to such an extent that it dramatically impacted industry level financials on a historical basis. Macroeconomic inputs reflect consensus estimates compiled by The Wall Street Journal and the outlook published by the Congressional Budget Office in January. The outlook is subject to change periodically and as events warrant.

Event