Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Nov 11, 2024

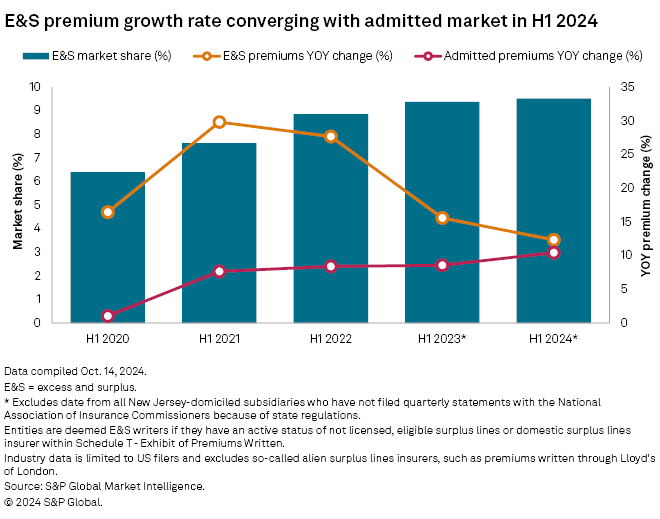

Premium dollars continue to flow into the US excess and surplus market, which posted year-over-year growth of 12.4% during the first six months of 2024, according to an S&P Global Market Intelligence analysis.

US-domiciled insurers reported $48.62 billion in excess and surplus (E&S) direct premiums written in the 50 US states plus the District of Columbia during the first half of 2024, equating to 9.5% of the total premiums written for US property and casualty (P&C) insurers. E&S underwriters collectively reported $43.28 billion in direct premiums during the prior-year period.

In comparison, US P&C insurers, excluding E&S premiums, saw direct premiums written grow by 10.5% during the first six months of 2024. In total, admitted P&C insurers reported $462.41 billion in direct premiums in the first half of this year versus $418.66 billion during the first half of 2023.

Surplus line carriers tend to cover complex or high-risk business for which policyholders cannot find insurance within the traditional or admitted market. The regulatory model tends not to be as strict as the framework for admitted carriers, which affords E&S underwriters greater flexibility in setting premium rates and terms for its policies.

Berkshire reigns supreme

Berkshire Hathaway Inc. remains the largest E&S underwriter in the US based on the first half of 2024. The insurance behemoth reported $4.60 billion in E&S premiums during the first half of 2024, an increase of 1.9% from the prior year. About 15% of the insurer's total premiums were from its surplus units in 2024, almost a 1-percentage-point decrease from the first half of 2023.

The lower share of E&S premiums compared to total premiums for Berkshire is mainly due to the growth of its private auto premiums, which were up about 9% year over year in the first half of 2024. The insurer's Geico Corp. units reported private auto direct premiums written of $20.77 billion in the first six months of 2024, compared to $19.01 billion in the prior year.

|

– Download a template that produces insurers' market share by line of business. – Download an excess and surplus template that provides for a state and line of business breakout. |

American International Group Inc. is the second-largest E&S underwriter in the US. The New York-based insurer's E&S direct premiums grew to $3.07 billion in the first half of 2024, compared to $2.68 billion last year. The share of E&S premiums versus total premiums grew to 36.2% in 2024, versus 32.0% during the same period in 2023.

Fairfax Financial Holdings Ltd., W. R. Berkley Corp. and Markel Group Inc. round out the five largest US E&S underwriters in 2024, with $2.12 billion, $2.05 billion and $1.95 billion, respectively.

The US-based units of MS&AD Insurance Group Holdings Inc.'s year-over-year change of 161.1% was the highest among the E&S underwriters with at least $500 million in direct premiums during the first half of 2024. The group's E&S direct premiums were $999.6 million in the first six months of 2024, with 91.3% being underwritten within its MS Transverse Specialty Insurance Co. subsidiary.

Transverse Specialty reported substantial growth within property lines of business — allied lines, fire and homeowners — during the period. Collectively, the three business lines had $562.9 million in premiums in 2024 compared to $220.6 million in the prior-year period.

Transverse is a "hybrid" fronting company that has historically retained a portion of the business written on its paper. AmRisc LLC has the largest managing general agent relationship with Transverse with its reported $410.1 million in direct premiums in 2024, a 148.7% increase from the prior-year period. AMRISC writes commercial property under the fire and allied reported lines of business.

Excess and surplus underwriter Kinsale Capital Group Inc. also reported sizable growth during the first half of 2024. The Virginia-based insurer reported $978.0 million in US E&S direct premiums, an increase of 23.0% from its first-half 2023 premiums.

Methodology

E&S results are derived from an S&P Global Market Intelligence template that scans Schedule T of annual and quarterly statutory statements for individual entities to identify those companies that list their status as "not licensed," "eligible surplus lines" or "domestic surplus lines insurer." They exclude those entities whose active status in a particular geography shows as "licensed or chartered," "non-domiciled risk-retention group," or "qualified or accredited reinsurer."

Data is limited to US filers and excludes so-called alien surplus lines insurerl.

.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.