Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Dec 05, 2023

The latest PMI data for the US point to a further cooling of inflation pressures, but the surveys also signal only modest economic growth and near-stagnant employment, with the risk of the expansion losing further momentum as we head towards 2024.

While businesses continued to report further output gains in November, growth remains considerably weaker than seen earlier in the year, and forward-looking indicators point to growth slowing in the months ahead.

Firms have become increasingly concerned about excessive staffing levels in the face of weakened demand, resulting in the smallest jobs gain recorded by the survey since the early pandemic lockdowns of 2020.

The cooling jobs market has been accompanied by lower wage growth which, combined with recent oil price falls, helped pull business cost growth down to its lowest for three years, dropping to a level indicative of inflation approaching the Fed's 2% target in the coming months.

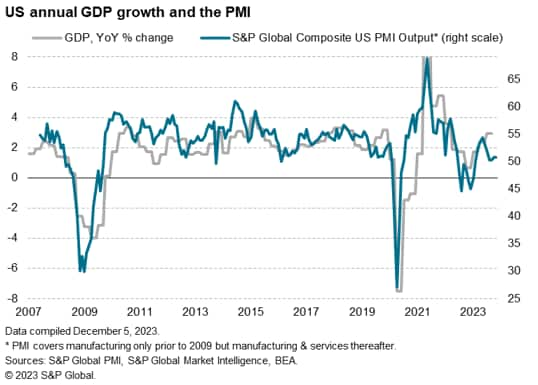

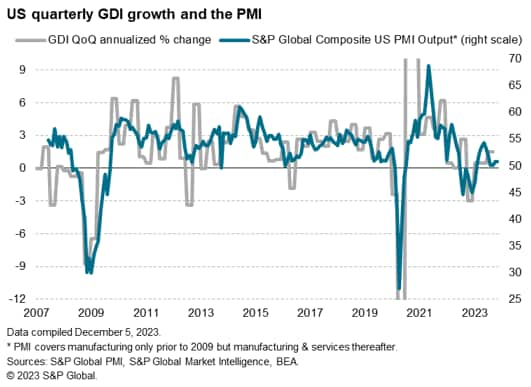

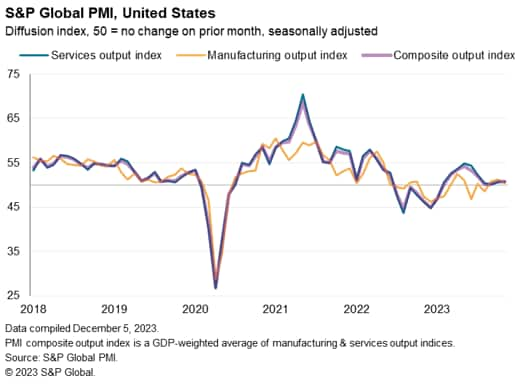

Further modest US economic growth was signalled in November by the S&P Global PMI Composite Output Index, which held steady at 50.7. While down sharply from elevated rates recorded earlier in the year, the index remains resilient by standards seen in the second half of 2022. Nevertheless, at current levels, the PMI is broadly consistent with only modest annual GDP growth of approximately 1.5% so far in the fourth quarter (and annualized quarterly growth of just under 1%).

The PMI also correlates closely with gross domestic income, though here the signal so far for the fourth quarter is for near-stalled growth.

Looking into the details, modest gains were seen in both manufacturing and private services. Although production at manufacturing firms rose for a third successive month in November, the rise was the weakest seen over this period.

Output growth at service sector firms meanwhile ran into a tenth consecutive month, the rate of expansion ticking higher to the fastest since July. It is the service sector's recent lack of growth momentum compared to the spring-summer months that has driven the downshifting in the overall pace of economic expansion signaled by the PMI compared to that seen earlier in the year.

There are a number of concerns to suggest that risks to the near-term outlook are tilted to the downside.

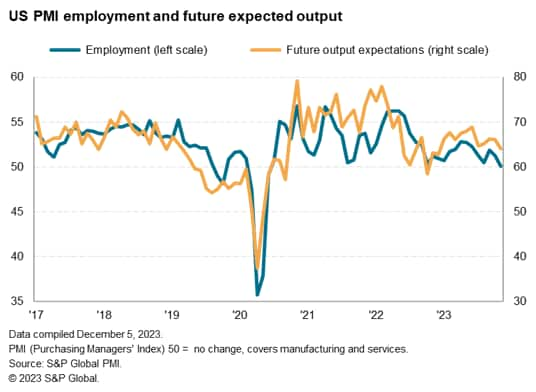

First, business expectations about firms' own output levels in the year ahead fell in November to the lowest seen so far this year. Some improved optimism was seen in manufacturing, albeit the overall mood remaining among the gloomiest seen since the start of the pandemic. Service sector confidence meanwhile slumped to the greatest extent since October 2022.

Second, employment largely stagnated. Measured across manufacturing and services, payrolls rose only marginally in November, registering the smallest in the current period of job creation which began in July 2020.

Manufacturing jobs were cut for the second month in a row - representing the first time (barring COVID-19 lockdowns) that the US survey has seen back-to-back monthly falls in factory jobs since the start of 2010. Service sector jobs growth meanwhile sank to the lowest since October 2022, all but stalling to represent a substantial cooling in the hiring rate compared to earlier in the year.

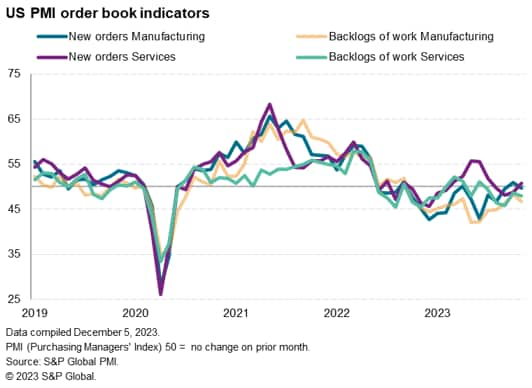

Clues to the deterioration in business sentiment and hiring can be gleaned from the survey's order book indicators. New orders into US factories have fallen in all bar three of the past 18 months, contracting further in November, albeit only slightly. It was a more encouraging picture in services, where new business inflows rose for the first time in four months, though the increase was only very modest. Importantly, the weakness of these new order inflow trends led to a further decline in firms' backlogs of orders, for which rates of contraction accelerated in both manufacturing and services.

The depletion of backlogs indicates that demand is not growing quickly enough to replenish pipelines of existing orders for companies to work through, causing firms to grow increasingly concerned over future capacity requirements.

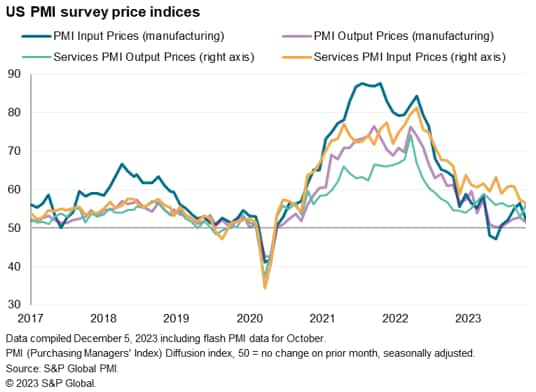

Weak demand also played a role in reducing firms' pricing power, both for goods and services. A renewed lowering of oil prices also helped reverse the recent acceleration of input cost inflation in manufacturing, bringing the monthly rise back down to a level well below the long run series average. A moderation was also seen in manufacturers' selling price inflation.

Service sector input cost inflation, a large element of which is wages, meanwhile cooled to its lowest since October 2020. Average rates levied for services rose at a faster rate, however, thereby remaining elevated by historical standards of the survey.

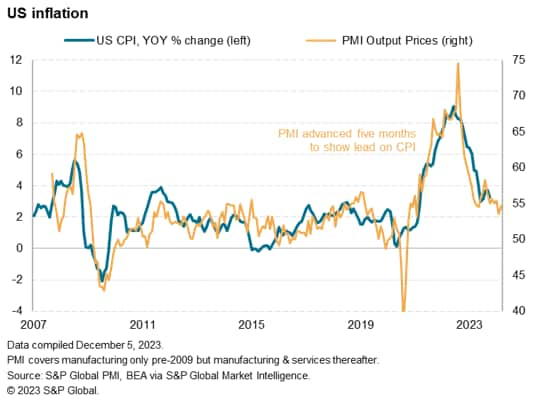

The uptick in service sector selling price inflation therefore adds to signs of some stickiness of consumer price inflation in the coming months. More encouragingly, the overall signal from the PMI Composite Output Charges Index (a weighted average of goods and services) is that this stickiness is only modestly above the Fed's 2% target.

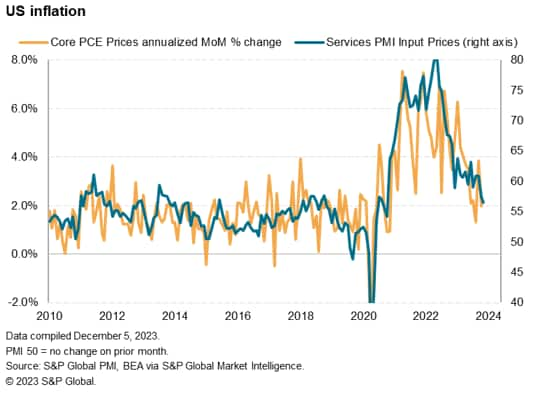

More encouragement in the inflation fighting front can be gleaned from the Composite Input Cost Index, which fell in November to its lowest since October 2020, down to a level only one index point above the survey's decade average prior to the pandemic, which is broadly consistent with core PCE inflation running at an annualized rate only marginally above 2%.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location