Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

SPECIAL REPORTS — Apr 30, 2021

By Dalen Chow

The statistics are staggering. In 2015, 15.5 zettabytes—15.5 trillion gigabytes—of data were created. In 2020, that number nearly quadrupled to 59 zettabytes. In 2024, it is predicted to increase by 150%, or 149 zettabytes.

This deluge of data is increasing the pressure on private equity firms on two fronts: external investment and internal administration. On the external side, firms have to analyze increasing volumes of data to make better decisions about potential portfolio companies. On the internal side, they must also contend with the growing need to provide an increasingly expansive array of data to investors, regulators and other stakeholders.

Much attention has been focused on the external challenges. KPMG reported in 2018 that 18% of private equity firms had already implemented big data into their decision-making processes, a number that has surely grown since then. This external focus is understandable, given that the ability to select superior companies is the key to generating alpha.

But this may have also left internal data challenges neglected—and potential efficiencies unrealized.

We are in the midst of an ongoing shift toward greater transparency—a shift that is quickly requiring private equity firms to upgrade their data management capabilities. According to a recent survey of our clients in the private markets:

Institutional investors are leading the drive toward greater transparency—particularly when it comes to ESG metrics. According to a 2020 trends report from the Forum for Sustainable and Responsible Investment, ESG assets account for one-third of total US assets under management, with institutional investors still the driving force behind this growth.

Collecting ESG information creates its own set of challenges, from gaps in the data to methodological discrepancies among providers. Absent a standardized set of metrics, private equity firms may have to deal with significant duplication, which only adds to the overall data challenge. As a result, internal data challenges at private equity firms continue to grow more complex.

In addition, regulations like the Dodd-Frank Act and the Foreign Account Tax Compliance Act have made compliance requirements far more stringent—a trend that looks set to continue. For instance, in June 2020, the SEC issued a Risk Alert, highlighting that many private fund advisors were not adequately disclosing investment allocations, fund restructurings and cross-transactions, among others.

Despite the mounting data pressures, many private equity firms continue to rely on manual processes and spreadsheets. But when the cost of this approach is quantified, the resulting figures are eye-opening.

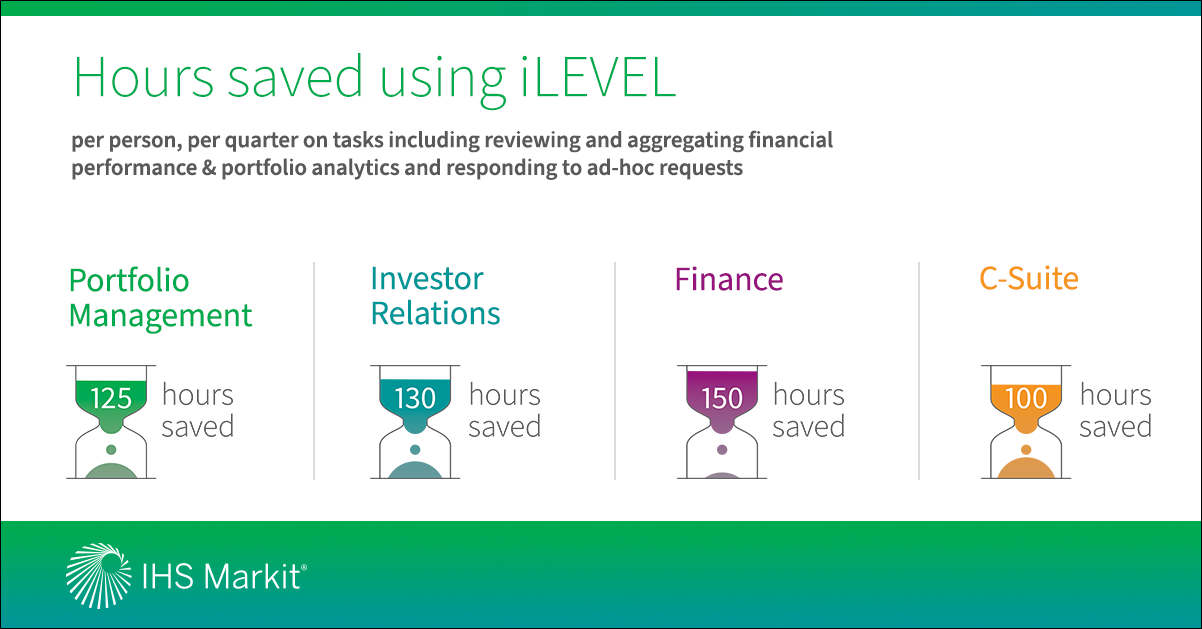

IHS Markit recently surveyed users of iLEVEL, IHS Markit's portfolio monitoring software, to determine the time savings that firms realized by transitioning from a manual to an automated portfolio data management process. The efficiency gains are substantial. In total, each person saved the equivalent of three full workweeks—time they can now use for higher-value activities such as sourcing deals as well as raising and deploying capital. In fact, 72% of survey respondents found that iLEVEL enabled them to avoid hiring additional team members to complete assigned functions within the required timeframes.

With a record $1.9 trillion in dry powder, the global rollout of vaccination programs, a continued low interest rate environment and substantial pent-up demand, 2021 looks to be a bullish year for private equity. According to S&P Global, 68% of surveyed private equity professionals expect deal-making conditions to improve.

In a market with this kind of outlook, having a competitive edge could make a significant difference. These latest survey results suggest that automating the process of collecting and monitoring portfolio data can deliver that edge by quantifiably improving efficiency, service and performance for investment managers.

Learn more about how GPs are tackling the challenges of portfolio data monitoring.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.