Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Aug 27, 2021

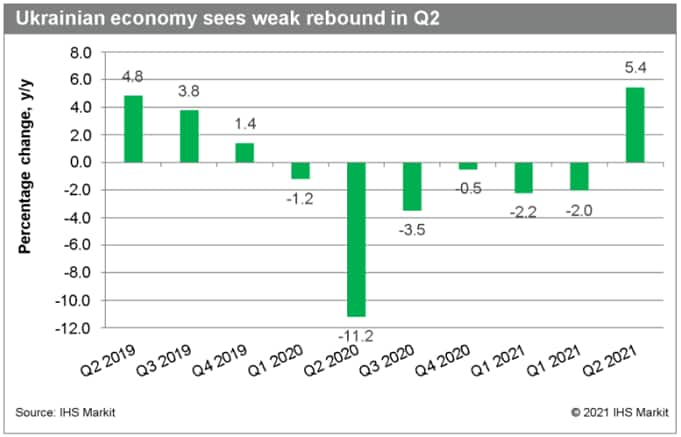

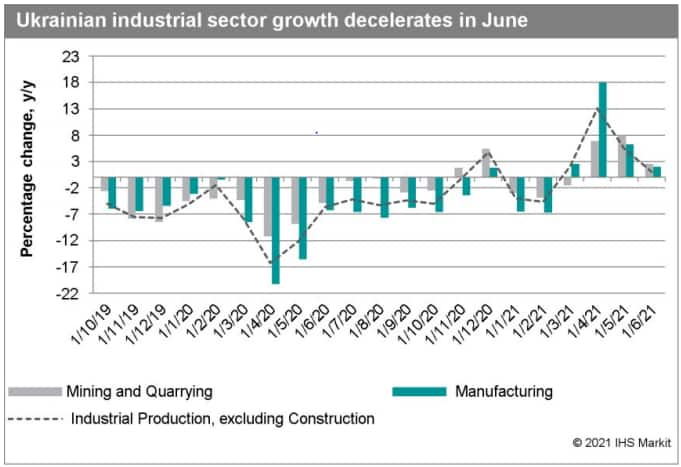

The full breakdown of the real GDP data has yet to be released; however, the available monthly economic data suggest that net exports, weak industrial and construction activity weighed down on final economic activity results in the second quarter. Specifically, the industrial output expanded only by 6.5% y/y in the second quarter, compared to 11.3% y/y losses in the same period of 2020. Output of food and beverages continued to shrink for the eleventh consecutive month. The mining and quarrying sector demonstrated more resilience and posted a stronger recovery compared to the other industrial sectors. Still, the increasing supply of iron ore from Australia, Brazil, and India have been putting pressure on the price competitiveness of key Ukrainian exports.

Retail sales grew by an impressive 23% y/y in the second quarter, although much of this is contributed to the low statistical base effect. Nonetheless, strong retail sales print suggests that private consumption made a positive contribution to real GDP growth. The reopening of the economy in the second quarter most likely helped to reduce the unemployment rate, which had previously increased in the first quarter to 10.5% from 10.1% in the last three months of 2020. The external trade-account deficit remained gap remain modest, but net exports most likely were a drag on the overall growth, due to increased demand for imports.

Clearly, Ukrainian economy has suffered more compared to many of its regional peers from the resurgent coronavirus 2019 disease (COVID-19) cases during March-May. Ukrainian authorities had to reimpose stricter restrictions through April, including in the capital Kyiv. Although COVID-19 cases dropped substantially in May-June, the country remains one of the worst-affected countries in Europe with widespread vaccine resistance. Thus far, only 7.1% of the population has been fully vaccinated.

Improved COVID-19 statistics since June suggest that the services sector will see stronger demand in the coming months. In July, the European Council added Ukraine to the list of countries for easing travel restrictions with the European Union member states. This should further support the rebound in the tourism sector. The agricultural sector's contribution to the recovery is also expected to rise during the remainder of the year. Lastly, expanding construction and fixed investment activity will support growth in the machinery and other manufacturing sectors. Therefore, we anticipate stronger growth rates in the second half of the year, aided by strong domestic demand. Under our revised assumptions, real GDP growth will average at 2.9% in 2021 (down from 3.2%), and 3.8% in 2022 (from 4.0%).

Posted 27 August 2021 by Lilit Gevorgyan, Associate Director, Insights and Analysis, S&P Global Market Intelligence