Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — May 24, 2022

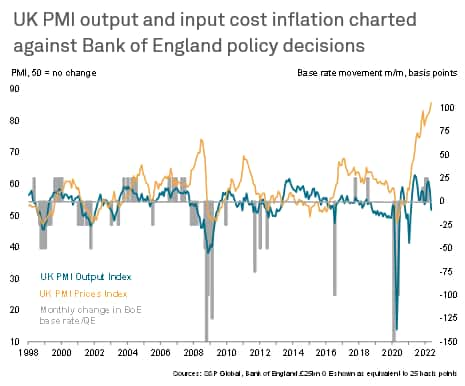

The UK Flash PMI survey data signal a severe slowing in the rate of economic growth in May, with forward-looking indicators hinting that worse is to come. Meanwhile, the inflation picture has worsened as the rate of increase of companies' costs hit yet another all-time high.

The survey data therefore point to the economy almost grinding to a halt as inflationary pressure rises to unprecedented levels.

The tailwind from the reopening of the economy has faded, having been overcome by headwinds of soaring prices, supply delays, labour shortages and increasingly gloomy prospects. Companies cite increasingly cautious moods among households and business customers, linked to the cost-of-living crisis, Brexit, rising interest rates, China's lockdowns and the war in Ukraine.

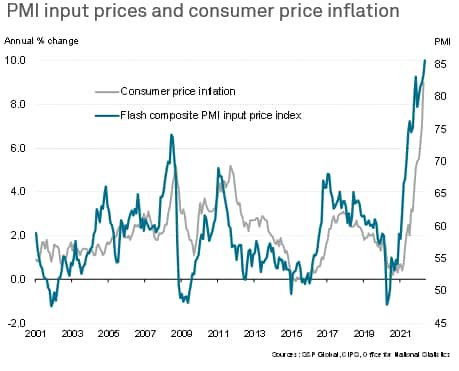

There are some signs that the rate of inflation could soon peak, with companies reporting price resistance from customers, and it is likely that the slowing in demand will help pull prices down in coming months. However, the latest data indicate a heightened risk of the economy falling into recession as the Bank of England fights to control inflation.

The S&P Global/CIPS composite PMI™ fell from 58.2 in April to 51.8 in May, according to the preliminary 'flash' reading, its lowest since the COVID-19 lockdowns of February 2021. Economists polled by Refinitiv had been expecting a far stronger reading, with the consensus signalling only a modest decline to 57.4.

While remaining above 50, to thereby indicate economic expansion, the latest reading signals a severe slowing in the pace of growth midway through the second quarter, roughly indicative of GDP expanding at a quarterly rate of just 0.1%.

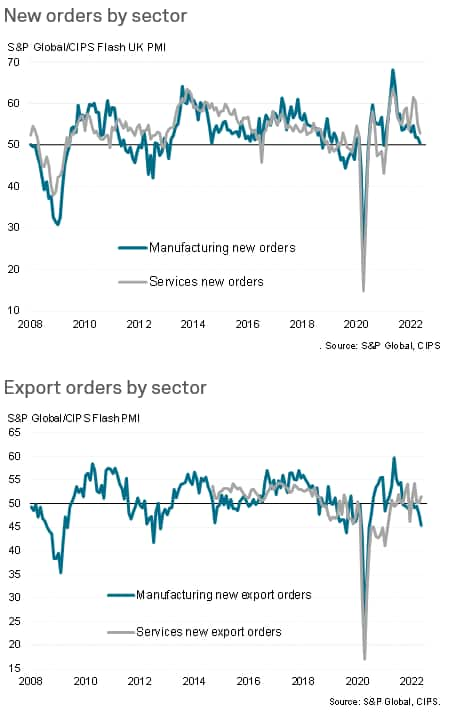

Growth rates cooled sharply across manufacturing and services, both down to the lowest since the lockdowns of early 2021. Manufacturing growth has been weaker than in services in recent months as spending has been diverted from goods to services, in part due to rising prices, and the supply squeeze has limited production, but May saw comparable weak growth rates seen across the two sectors.

The weakened performance in the service sector represents a particularly severe contrast to the impressive growth seen in prior months, in part reflecting a waning of demand as the boost from the reopening of the economy fades, but also reflecting reduced spending by businesses and households amid the cost-of-living squeeze, prospects of high interest rates and concerns over the economic outlook. While spending on consumer services remained the strongest driver of growth, the rate of increase has moderated considerably since March's peak. Meanwhile, business spending on services almost stagnated in May and financial services activity slowed sharply.

In manufacturing, supply chain constraints remained a widely reported complaint, with the incidence of delays down to the lowest since October 2020 but still running above anything ever seen prior to the pandemic thanks in part to lockdowns in mainland China. However, new orders received by manufacturers have also slowed to a near-stall, amid reports of reduced spending and greater caution in relation to purchasing among customers as well as slumping exports, in part blamed on Brexit.

Export orders for manufactured goods fell for the eighth time in the past nine months. Barring the global shutdowns of early 2020, the latest export drop was the quickest recorded since August 2019 and among the steepest seen since the global financial crisis.

In a sign of weak activity likely persisting into June, backlogs of work barely rose for a second successive month, notably dropping in manufacturing but rising modestly in services.

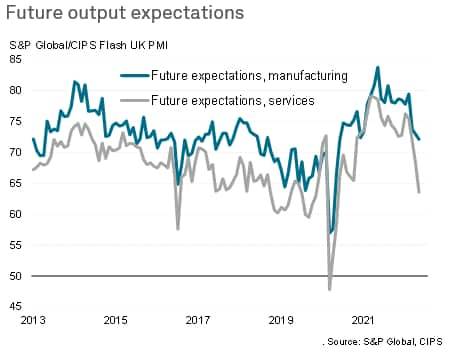

Similarly, expectations of output growth in the coming year deteriorated further, down to the lowest since May 2020 amid declines in both manufacturing and services sentiment, with the latter seeing the most worrying decline.

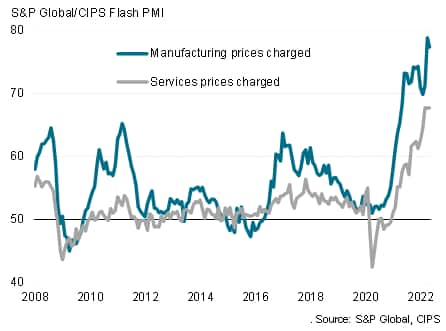

Companies' costs meanwhile rose at the steepest rate yet recorded since comparable data were first available in 1998, breaking a new record for a second successive month. Average prices charged for goods and services rose at a rate only marginally below April's all-time high as higher costs were passed on to customers. the marginal easing in the rate of selling price inflation could be attributed to customers pushing back on price hikes.

The combination of slower order book growth, rising costs and gloomier outlooks led to a pull-back in hiring. Although May saw another month of robust employment growth, the rate of increase was the slowest since April of last year.

Sign up to receive updated commentary in your inbox here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location