Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Sep 05, 2022

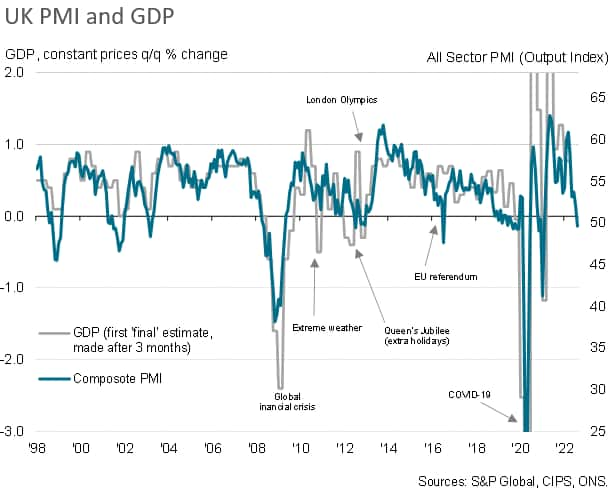

The S&P Global/CIPS UK Composite PMI fell below the crucial 50.0 no-change mark during August for the first time in 18 months. A severe and accelerated drop in UK manufacturing output was joined by a near-stalled service sector.

Although the survey data are currently consistent with the economy contracting at a modest quarterly rate of 0.1%, deteriorating trends in order books and future expectations suggest the risk of a recession has risen.

However, the survey data also suggest the incoming prime minister will not only be dealing with an economy that is facing a heightened risk of recession, but also a deteriorating labour market and persistent elevated price pressures linked to the soaring cost of energy.

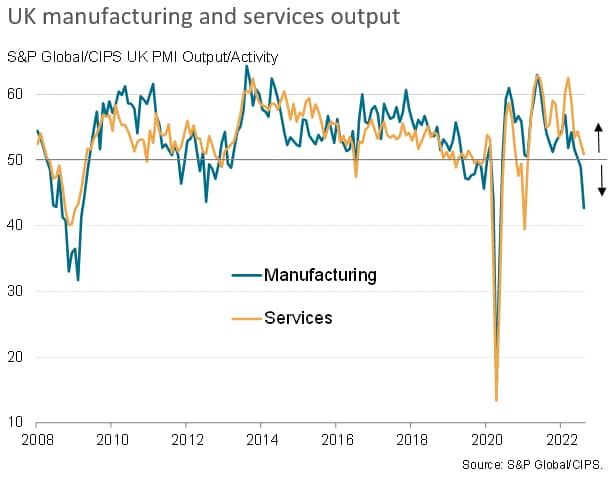

The latest PMI survey data show UK private sector business activity falling for the first time in a year-and-a-half in August as an increasingly severe downturn in manufacturing was accompanied by a near-stalling of the vast services sector. Posting 49.6, down from 52.1 in July, the S&P Global/CIPS UK Composite PMI hit its lowest since the COVID-19 lockdowns of February 2021.

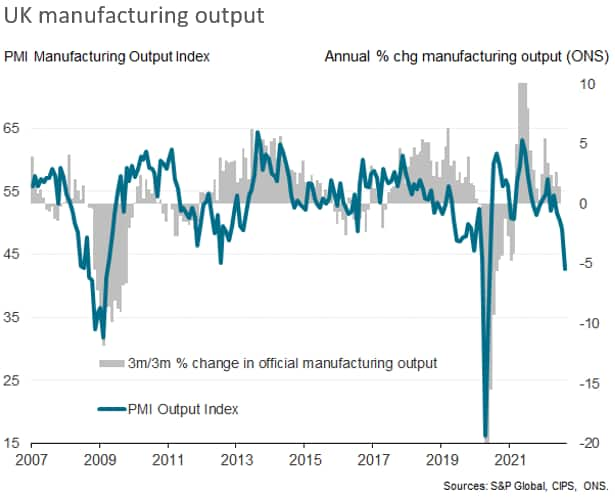

Although merely consistent with GDP contracting at a quarterly rate of 0.1%, the manufacturing decline is gathering pace to a worrying degree. The severity of the manufacturing decline is such that, barring pandemic lockdown months, August's falling production was the steepest seen since the height of the global financial crisis in March 2009.

Demand for consumer-facing services such as restaurants, hotels, travel and other recreational activities is meanwhile collapsing under the weight of the cost-of-living crisis, with demand for business services also coming under pressure amid concerns over rising costs and the darkening economic outlook. Financial services firms are meanwhile reporting subdued trading amid the recent hikes in interest rates, adding to an increasingly broad-based malaise across the economy.

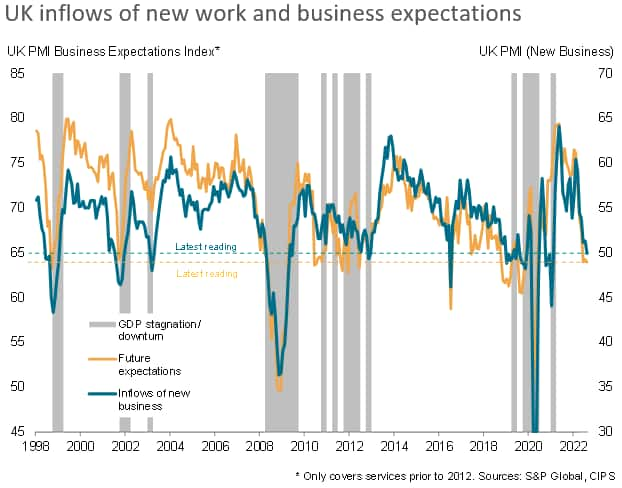

While the composite new orders index also slipped fractionally below the 50.0 no-change mark to signal falling demand for the first time since the early-2021 lockdowns, led by an accelerating rate of decline in new orders for goods and a marked slowing in demand for services, new export sales fared even worse. Overseas sales of goods and services declined to the greatest degree since January 2021 as companies blamed weakening global demand, high prices and Brexit related complications.

Confidence about the future has meanwhile slipped back to a level that matched June's 25-month low. Companies' concerns were focused on the cost-of-living crisis, with businesses worried about their own escalating costs and the adverse spending impact of inflation on both households and businesses. Political uncertainty, rising interest rates and Brexit were also widely cited as causes for concern.

Both the survey's new orders index and business expectations index are now at levels which have generally only been seen in the survey's history prior to periods of economic contraction, and both point to the downturn gaining momentum in September.

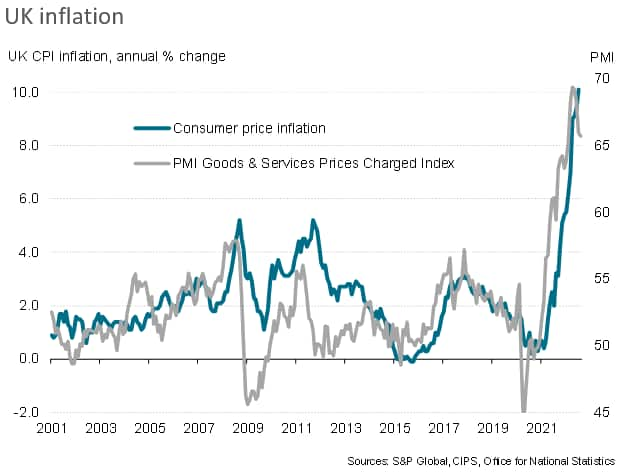

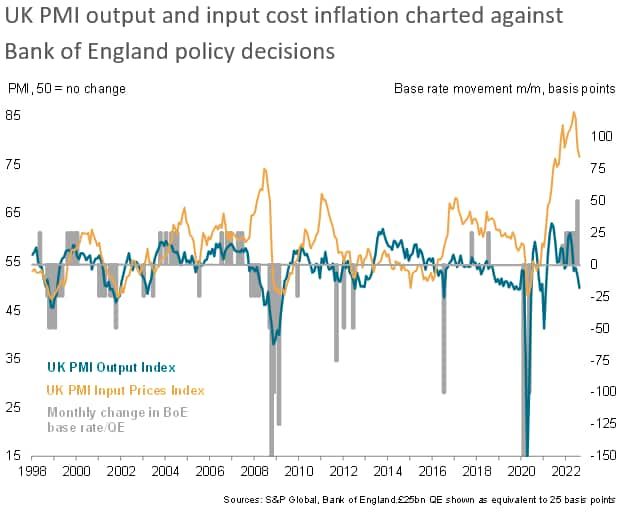

Input costs continued to increase sharply at the aggregate level, though the rate of increase cooled to an 11-month low. Overall output price inflation was, however, little changed compared to July, dropping only slightly to point to persistent elevated CPI readings in the months ahead.

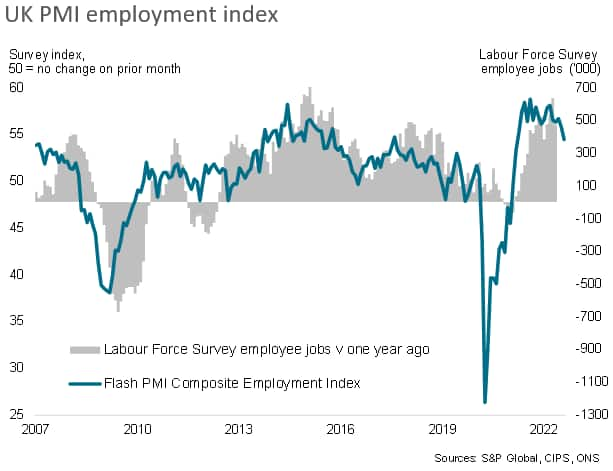

Jobs growth is meanwhile starting to weaken, with August seeing the smallest increase in hiring since March 2021. As hiring tends to lag changes in order books, the recent slump in demand alongside surging energy prices points to a growing reticence to employ staff in coming months.

The latest data therefore reveal a situation whereby the Bank of England is aggressively hiking interest rates (the last meeting saw an unusually hawkish 50bp hike) at a time of contracting economic activity. It is clear that the desire to bring inflation expectations down is coming at an

increasingly high economic cost in terms of growth. Fortunately, inflationary pressures - not withstanding upcoming energy price hikes - are showing signs of moderating, which may fuel speculation that policy may not need to be tightened much further if the cooling core price trend persists.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.