Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Oct 05, 2022

By David Owen

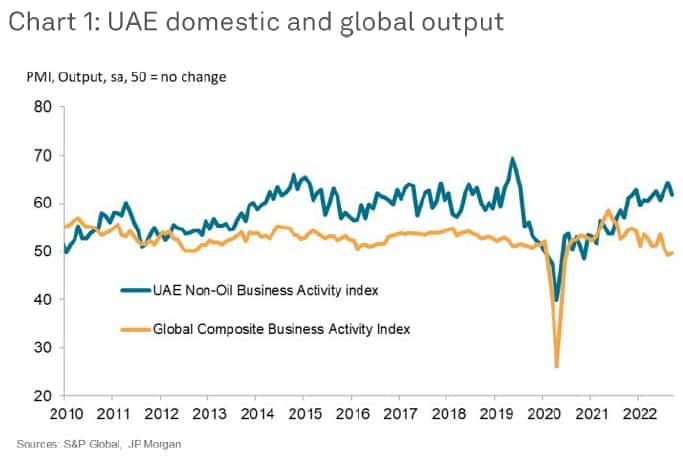

The United Arab Emirates non-oil economy has appeared immune to some of the drags on output observed in the global economy in the third quarter of 2022, in fact recording some of the fastest rates of expansion seen over the past three years. Robust demand and relatively soft price pressures by international standards have helped firms to boost their activity and employment, in stark contrast to the worldwide picture of an economic slowdown.

The UAE non-oil sector has seen a robust acceleration in business activity growth since the height of the COVID-19 pandemic. Trending upwards since early-2021, the rate of expansion reached its strongest in over three years during August, with around 32% of survey respondents noting an upturn in output from the previous survey period. While the expansion slowed in September, it was still marked overall, as firms reported that strong demand levels often encouraged them to raise their activity further.

The strength of the upturn over the course of 2022 so far is notable for two reasons. First, recent growth comes off the back of the Expo 2020 - between October 2021 and March 2022 - which had a considerable impact on tourism and new business. The sustained pick-up suggests that firms are still benefiting from increased investment and higher economic activity.

Second, growth in the non-oil sector contrasts with a faltering global economy, which saw output contract in August amid headwinds from inflation, the war in Ukraine and zero-COVID policies in mainland China. After trending more closely to global figures in 2021, the UAE business activity index has clearly outperformed in 2022, suggesting that the domestic non-oil sector has been more resilient to external shocks than most other countries.

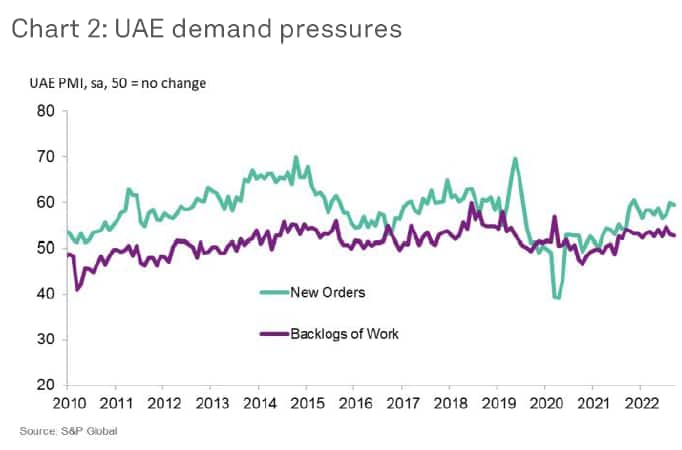

The improvement in business conditions over September was marked by another robust increase in new business volumes. Despite ticking down slightly from August's nine-month high, the rate of new orders growth was sharp and faster than the trend observed since the survey began in August 2009. Surveyed businesses commented on improving market conditions as well as a boost to sales from efforts to keep prices affordable for customers.

However, strong client demand and project backlogs meant that businesses continued to face strains on their capacity, leading to a moderate uptick in outstanding orders. Capacity constraints have now been observed in each of the last 15 months, signalling that firms are struggling to match demand with output levels.

One positive consequence of this strain on capacity has been greater hiring activity. August and September data indicated two of the fastest rises in employment at UAE non-oil firms for over five years, pointing to a desire among businesses to rebuild workforces as new work intakes rise.

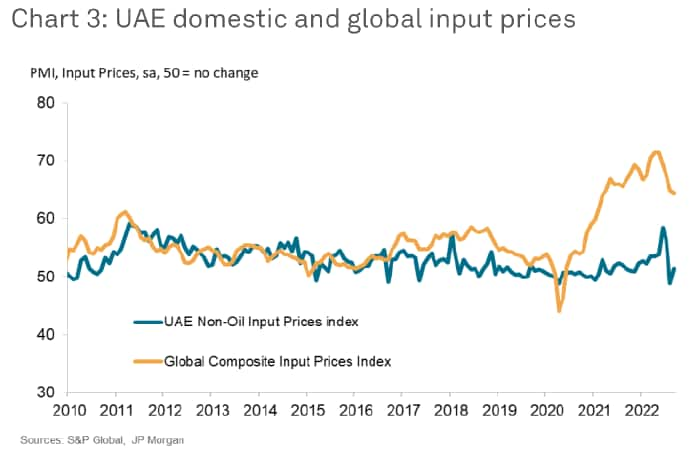

Survey indicators on price pressures also point to a far calmer situation at UAE businesses compared to global trends. Chart 3 shows the Input Prices Indices both domestically and worldwide, signalling that input cost inflation in the UAE non-oil sector has remained softer than the global average throughout 2021 and 2022 so far. Indeed, August data indicated a renewed drop in business expenses, helped by a softening of fuel prices, while September data pointed to only a modest rise in costs.

The relatively mild rate of input price inflation has assisted companies aiming to keep selling prices low - in fact, charges in the UAE have decreased in 13 of the past 14 months according to the PMI - which has in turn encouraged stronger demand. These findings suggest that UAE firms' ability to escape marked cost pressures on materials, energy and labour has in part enabled the robust rate of activity growth observed this year.

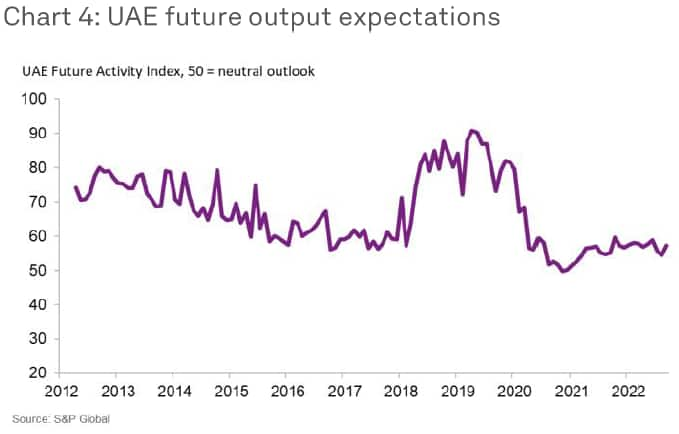

That said, the sector may still be exposed to wider demand shocks and thereby face weaker sales growth in the coming months if global conditions worsen. These concerns are reflected in firms' responses concerning future output predictions. Chart 4 shows that business confidence has remained subdued in the period following the start of the COVID-19 pandemic, despite activity growth recovering to a normal speed, with fewer respondents giving predictions of a rise in output over the next 12 months compared to the long run average. Moreover, sentiment dropped to a 17-month low in August, as some firms displayed concerns that global weakness could spread into the domestic economy.

David Owen, Economist, S&P Global Market Intelligence

Tel: +44 2070 646 237

david.owen@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.