Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Dec, 2015 | 09:00

By Robin Flynn

While the FCC Incentive Spectrum auction, in which TV station owners voluntarily tender their spectrum to be auctioned to wireless carriers, is expected to begin as planned in March 2016, a delay could still materialize in one of the most complex auction processes ever contemplated on a national scale.

For example, the date could be pushed back to the summer over a need for additional time to test the auction software or other matters. With FCC Chairman Tom Wheeler making the auction a key element of his legacy, however, the Commission is expected to go to every effort to complete the bidding in 2016.

Bidding in the auction is slated to begin on March 29, 2016, which is the deadline for reverse auction applicants (the stations) to commit to an initial bid option of license relinquishment, channel sharing or moving to high or low VHF. The actual reverse auction bidding process is expected to start in May, and it could take as much as two months to complete the reverse auction, with station proceeds potentially distributed in the fourth quarter of 2016.

The larger station groups continue to study the auction and estimate station values and reserve prices, as well as in many cases pursue channel-sharing agreements. Major owners with a large number of duopoly markets, such as Comcast/NBC, CBS, Univision, Tribune and Sinclair, are publicly acknowledging that they are scrutinizing participation as a way to monetize spectrum, while in most cases emphasizing that they plan to continue to continue in the in the broadcasting business in largely the same way via channel sharing and signal compression.

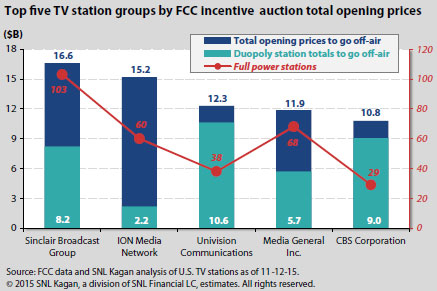

The trick is deciding what stations are worth, since as Tribune Media Co. President and CEO Peter Liguori said on Nov. 11, "Opening bid prices in this kind of an auction are irrelevant," referring to the descending clock format. Our chart shows the total opening prices for the top 5 station owners by opening price totals, with the total opening price totals for duopoly stations (the ones more likely to be tendered) also shown.

While nobody expects large owners to get anywhere near this level of proceeds, because all stations will not be needed in all markets and the winning station prices are expected to fall far below these figures, it is still a sign of how relatively robustly certain groups could participate.

Sinclair has previously referred to its potential proceeds of $2 billion from the auction with just a 3% hit on broadcast cash flow, and reiterated those numbers in its Nov. 4 call. Other owners such as 21st Century Fox Inc. also have a large number of duopoly stations.