Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — May 5, 2025

By Francesca Price

On April 15, 2025, The Trump administration initiated a Section 232 investigation into imports of processed critical minerals and their derivate products. The investigation is aimed at evaluating national security risks posed by import reliance and assess domestic refining capabilities in the latest move to address the country's supply chain vulnerabilities and reduce dependence on China. The investigation, due within 270 days, will also examine the market-distorting effects of predatory pricing, export controls and state-backed overcapacity — trade practices that the US has previously accused China of using.

"Processed critical minerals" refer to the commodity's state after extraction, once the raw material has undergone further processing into a form such as metal, oxide or salt. "Derivate products" refers to all goods that incorporate these processed minerals as inputs, ranging from components such as semiconductor wafers, anodes and cathodes to finished goods such as electric vehicles and wind turbines.

Refining and processing to produce industry-grade material adds significant value to the critical mineral supply chain. The International Renewable Energy Agency (IRENA) estimates the combined value of mining nickel, lithium and cobalt to reach $11 billion in 2025, increasing to $44 billion once refined. For the EV supply chain, this value is estimated to jump up significantly again for precursor production ($271 billion), cell production ($387 billion) and cell assembly ($1.2 trillion). The Section 232 investigation, in addition to the March 30 executive order titled "Immediate Measures to Increase American Mineral Production," reflects the Trump administration's ambition to develop fully integrated supply chains in the US. Pursuant to instructions set out in the March 30 executive order, on April 18 the US government released a list of 10 US critical mineral projects that have been granted FAST-41 status, a federal initiative to streamline approvals of critical infrastructure projects. These projects include the Resolution copper project in Arizona, the Stibnite gold and antimony mine in Idaho, and the Silver Peak lithium mine in Nevada.

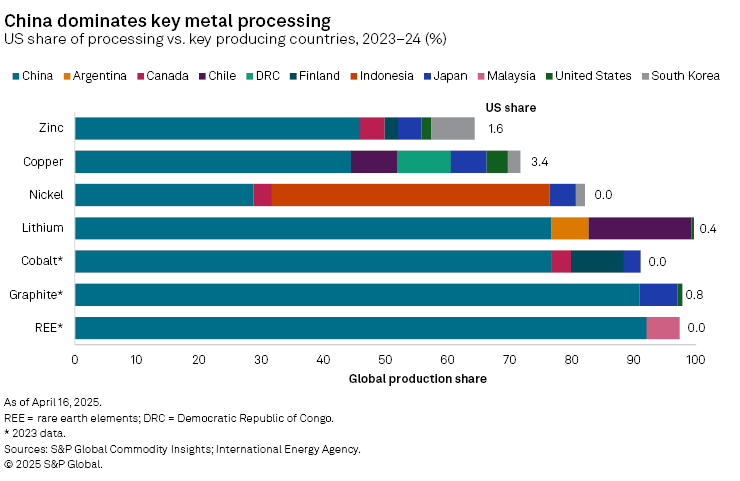

The US is heavily reliant on overseas sources of processed materials owing to limited domestic refining capacity. In 2024, the US production for refined copper amounted to 3.4% of global output, while it was about 1.6% for refined zinc and less than 1% each for refined lithium and graphite. The US lacks active industrial-scale refining capacity for rare earth elements (REE), cobalt and nickel.

Trump's Section 232 notice followed an April 4 announcement from China's Ministry of Commerce, introducing export controls on a range of REEs and magnets. The export controls were issued in parallel to the announcement that US-origin goods would be subject to a 34% additional tariff in retaliation to Trump's April 2 announcement of reciprocal tariffs on Chinese imports.

China's REE export restrictions, effective immediately, mirror controls already in place for other critical minerals, such as tungsten (February 2025), antimony (September 2024), graphite (December 2023), and germanium and gallium (August 2023). To protect its domestic REE industry, China also banned the export of rare earth magnet manufacturing technologies in December 2023, adding to an existing ban on extraction and separation technologies. In December 2024, China banned the export of gallium, germanium, antimony and superhard materials to the US in retaliation to restrictions against China's semiconductor sector.

Of the 17 REEs, the April export restrictions apply to seven mostly medium and heavy REEs — samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium. The restrictions apply to specific forms, including compounds, alloys, oxides and target materials, which are integral inputs to industrial and high-tech manufacturing. The inclusion of permanent magnets refers to both finished magnetic materials and magnetic powders, including those used in high-performance neodymium magnet (NdFeB) systems.

The restricted elements, particularly samarium, dysprosium, terbium and scandium, are essential for producing high-performance permanent magnets used in advanced missile systems, fighter jets and directed energy weapons. Samarium-cobalt (SmCo) and NdFeB magnets, enhanced with dysprosium or terbium, are especially critical due to their ability to operate under extreme conditions.

Beyond defense, the controls on gadolinium, lutetium and yttrium could have implications for healthcare and nuclear energy sectors. Gadolinium is used for magnetic resonance imaging (MRI) contrast agents and nuclear reactor shielding; lutetium supports positron emission tomography (PET) imaging and precision optics; and yttrium is used in lasers and high-temperature ceramics.

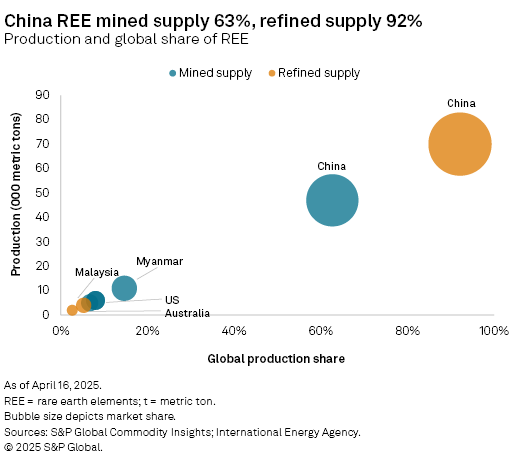

According to the International Energy Agency, China accounts for 63% of the global REE mining capacity and 92% of the global refining capacity. Other minority producers of raw material include Myanmar (15%), the US (8%) and Australia (7%), while Malaysia (5%) is one of the only countries outside of China with industrial-scale refining capacity.

Despite accounting for a small volume of 6,000 metric tons of mined REEs in 2023, the US has no refined production for the specific type of material — medium and heavy REEs — targeted by China's export controls. In an attempt to address this and support the development of a mine-to-magnet supply chain, two companies have received support from the US Department of Defense through the DPA Title III program. MP Materials Corp. is building two separation facilities to process light and heavy REEs at Mountain Pass, California. Lynas Rare Earths Ltd. is also developing two plants for the same in Texas. The projects from both companies are due to become operational toward the end of 2025. MP Materials Corp., which operates the Mountain Pass REE mine, has announced it will cease shipping its REE concentrate to China in response to Beijing's recent export controls and retaliatory tariffs.

Analysis

China's export controls on key medium and heavy REEs pose significant potential risks to US national security, defense manufacturing and high-tech industries. While the restriction applies to all REE exports and does not explicitly target any one country in particular, the US has very limited capacity to refine or process these elements, which leaves it particularly exposed. With China as the dominant global supplier, the new control is likely to trigger temporary material shortages, price volatility and urgent pressure to accelerate domestic and allied sourcing strategies, including investment in recycling, stockpiling and alternative production partnerships.

Trump's latest Section 232 investigation evaluating US dependence on processed critical minerals further confirms the administration's prioritization of minerals security and ambition to onshore as much of the supply chain as possible. With similar executive orders already underway, alongside tightening export restrictions from China, the investigation results threaten to trigger a new wave of tariffs and reciprocal restrictions between the world's two largest economies..

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.