Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Jun, 2016 | 09:00

Highlights

First-quarter earnings at major Chinese insurers point to an industry that is growing more vulnerable to investment risks that could end years of rapid profit growth.

First-quarter earnings at major Chinese insurers point to an industry that is growing more vulnerable to investment risks that could end years of rapid profit growth.

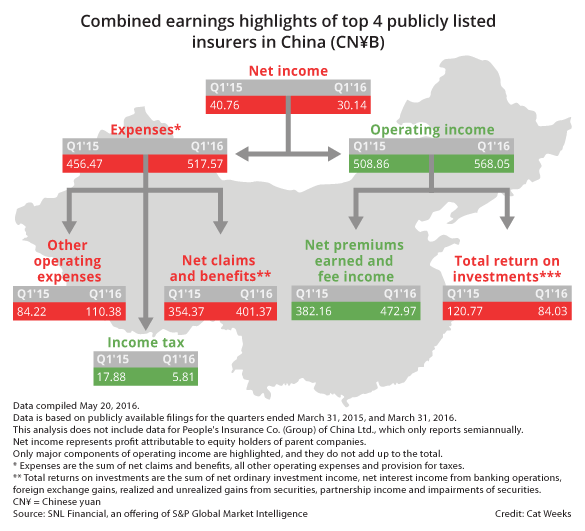

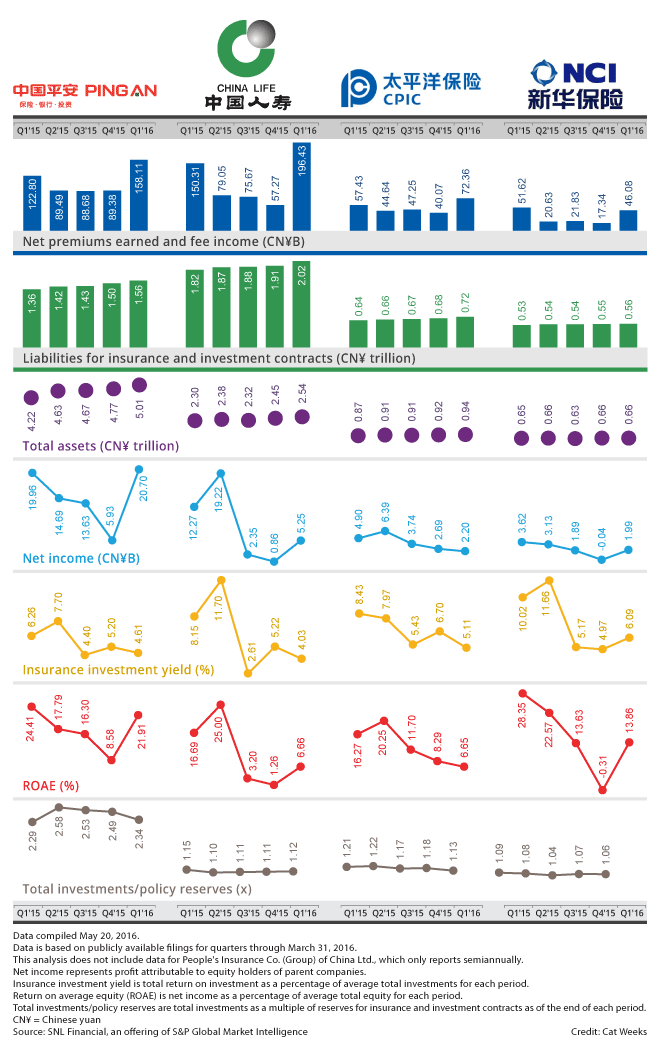

Among the top five listed Chinese insurers by assets, aggregate net profit at Ping An Insurance (Group) Co. of China Ltd., China Life Insurance Co. Ltd., China Pacific Insurance (Group) Co. Ltd. and New China Life Insurance Co. Ltd., or NCI, dropped to 30.14 billion yuan in the three months to March from 40.76 billion yuan a year earlier. Among them, only Ping An managed to avert a decline in earnings, which edged up to 20.70 billion yuan from 19.96 billion yuan..

People's Insurance Co. (Group) of China Ltd., or PICC, was excluded because it only reports semiannually.

Total investment gains at the four companies shrank to 84.03 billion yuan in the first quarter from 120.77 billion yuan a year earlier, eating into a 90.81 billion yuan increase in net premiums earned and fee income. Investment yields — investment returns relative to total investments — declined year over year across the board, most profoundly at China Life Insurance, where the gauge more than halved to 4.03% from 8.15%.

Chinese insurers are facing a challenging time in a slowing economy, with falling domestic stock prices making equity investments more difficult at a time when yields on debt holdings are also in decline amid monetary easing. Their fortunes are increasingly tied to swings in share prices as they snap up riskier assets to boost returns.

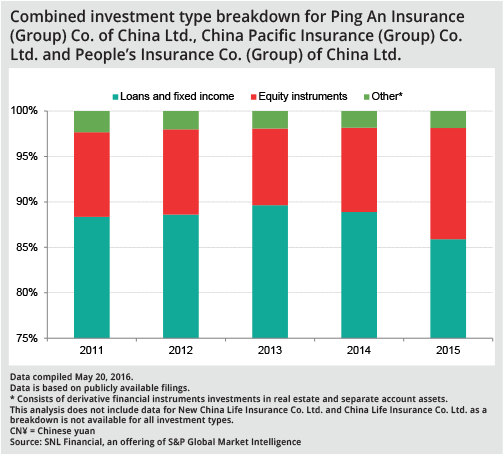

At Ping An, China Pacific Insurance and PICC, proportions of stock holdings in their total investment portfolios grew to a combined 12.20% at the end of 2015 from 9.30% three years earlier, according to SNL Financial data based on company disclosures.

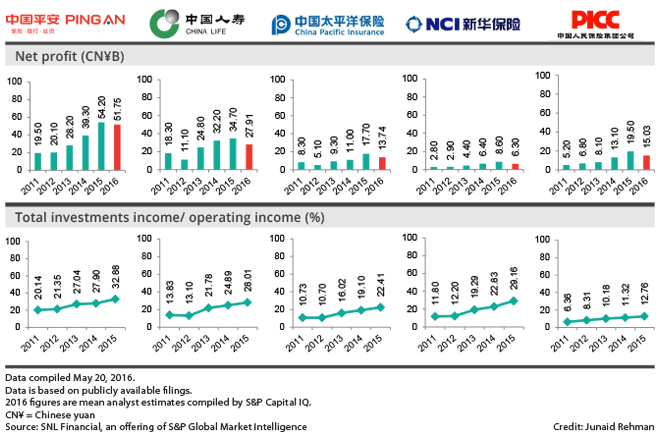

Until last year, that shift paid off. Investment gains in 2015 propelled net profit higher at the top five listed insurers in China, rising to almost to a third of operating income at Ping An, which relies most on returns from asset purchases among them.

Now, with the Shanghai Stock Exchange Composite Index down more than 40% as of May 23 from a June 2015 high that preceded a market collapse, a growing exposure to equities is backfiring on Chinese insurers. Not only that, last year they bought more wealth management products, according to S&P Global Ratings. Those opaque, and often risky, investment schemes offer high yields by channeling funds into everything from bonds to real estate.

"The higher asset risks will pressurize capital positions of Chinese insurers, exposing them to greater volatility in investment markets," said Eunice Tan, director of insurance ratings at S&P Global Ratings. "Profitability for Chinese insurance groups will decline in 2016-2017 reflecting tougher investment conditions."

Annual net profit will likely fall at all five companies in 2016 from the previous year, which would be their first decline in at least four years, according to mean analyst estimates compiled by S&P Capital IQ. In four years through 2015, earnings more than doubled at Ping An and China Pacific, while NCI and PICC saw more-than-threefold profit surges.

Behind the hunt for yield is a rule change that is forcing insurers to boost reserves, in addition to a need to generate guaranteed rates for a popular product type that has helped them boost premium income.

Under new rules that came into effect at the start of 2016, insurers are required to discount liabilities based on 750-day moving averages of government bond rates. As a consequence, companies now need to ramp up reserves when interest rates slide, and estimated values of liabilities fall less. Previously, capital requirements for the industry did not take into account market risks.

As of March 31, policy reserves at Ping An, China Life, China Pacific and NCI all increased from a year earlier.

On the other hand, some Chinese insurers last year drove up sales of so-called single-premium short-term policies that promise certain returns, as well of refunds of premiums during early stages of terms, according to S&P Global Ratings. Those products were particularly in high demand among investors during the market turmoil in the second half of 2015, the rating agency said in a May report.

To honor such terms, insurers have invested heavily in stocks and long-term illiquid instruments, not only exposing themselves to greater investment risks but also creating an asset-liability mismatch. Sales of the schemes, distributed through bank branches, may slow now that regulators have tightened rules for them, Tan said.

That means Chinese insurers may be hit with a double whammy of weakening premium income growth and declining investment returns.