Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 8 Aug, 2023

By Victor Heng

Highlights

Shrinking advertising revenue is forcing Thai broadcasters to pursue growth via global content distribution, driving premium content production, including with partners outside Thailand.

Lower advertising revenue available for production budgets is impacting the quantity and quality of content produced by broadcasters such as BEC World and One Enterprise, which have operated under tight cost controls in recent years.

Netflix and Viu, a Hong Kong-based regional streamer, are focused on producing films and drama series, respectively, and both are in their second year of producing Thai language originals, signaling the increasing importance of local content that can help reduce the reliance and costs of acquiring premium Korean content.

Netflix and PCCW Media Ltd.-owned Viu announced in 2022 their slate of Thai originals for 2023, boosting local content to drive audience engagement. Thai media conglomerate BEC World Public Co. Ltd., media producer The ONE Enterprise PCL and content distributor and producer JKN Global Group PCL, meanwhile, are pushing for growth in their content export business, inspired by the success of their Korean counterparts.

BEC World and One Enterprise are steadily promoting their artists to drive their TV operations' marketing impact. This practice served them well in the music industry, where Thai members of Korean groups brought attention to Thai content outside Thailand.

Thai content drives global licensing revenue at BEC World

As the TV ratings leader in general entertainment, BEC World produces content for its digital terrestrial TV network, CH3 and digital platform CH3 Plus, and sells locally and internationally to broadcasters and online services. With ad revenue in decline, BEC World kicked off global distribution plans in 2018. The company has since exported 6,200 hours of content to Asia, Latin America and Africa, with Southeast Asia the most active licensee market.

China's Tencent Holdings Ltd. was BEC's first simulcast partner in 2018, with its over-the-top platform streaming BEC-produced "The Crown Princess" in China and other markets. Building on that success, BEC World and Tencent expanded their partnership to distribute more BEC World content in the same markets, in addition to exclusivity on select titles in 2020.

Viu and Netflix adopted a similar strategy to Tencent to quickly establish a foothold in Southeast Asia, licensing content similar to that of BEC World. Viu acquired a mix of rights, including new titles licensed between one to four Southeast Asian markets — Indonesia, Malaysia, the Philippines and Singapore — and back titles for the Southeast Asian region. Netflix took on a broader approach, licensing for all of Southeast Asia.

Meanwhile, BEC World announced a new distribution agreement with Singapore-based I.E. Entertainment in December 2022, aiming to expand beyond Southeast Asia. The announcement also unveiled new deals with PTS in Taiwan and StarTimes in Africa. Moreover, Indian streamer MX Player acquired over 200 hours of BEC World drama content in April 2023 for the Indian subcontinent, dubbing the content in Hindi and showcasing Thai content for the first time in the subcontinent.

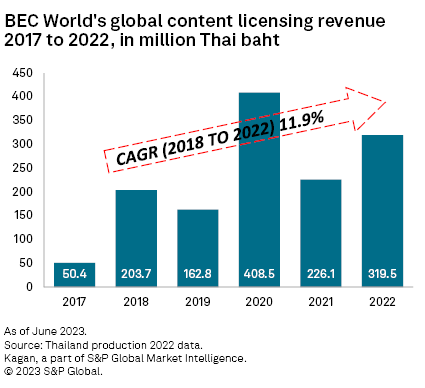

BEC World first reported global content licensing revenue of 50.4 million Thai baht in 2017, peaking at 408.5 million baht in 2020, before almost halving in 2021 as pandemic restrictions hit production output, and rebounding in 2022 by 41.3% on the back of 3,000 hours of content from 50 titles licensed in Asia, including Thailand, across various platforms. Compound annual growth rate from 2018 to 2022 was 11.9%.

BEC World also set up BEC Studios to manage pre- and postproduction operations in June 2022, bringing the whole process in-house. BEC World invested 400 million baht to drive global content exports with BEC Studios equipped to serve internal content needs on all platforms, as well as joint production with third parties. Planned facilities include six soundstage studios with a base capacity of 10 premium drama productions per year, including postproduction and virtual production studios. Soundstage and postproduction studios provide comprehensive indoor filming capabilities, cutting down on production time and halving costs. The next two expansion phases include the building of two additional studios.

Gearing up for more content, BEC World added movie production to its slate in July 2022, via new joint venture Major Joint Film Co. Ltd., with Thailand's leading movie producer and distributor M Pictures Entertainment PCL. BEC World made an initial investment of 19.7 million baht in addition to joint capital of 39.4 million baht. The first film produced was "Buaphan Fan Yap," a joint effort with Raruek Production, released in November 2022. Up to four titles are planned for investment and production in 2023, with two to be released in cinemas.

Research

Research