Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Mar 07, 2023

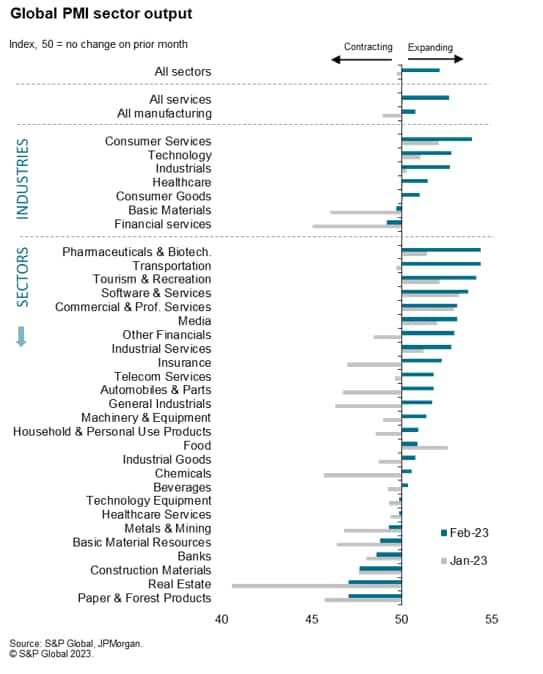

Detailed sector Purchasing Managers' Index (PMI) from S&P Global provide a unique deep-dive analysis of worldwide economic trends. The latest data showed a revival in global economic growth being driven by rising expenditure on consumer services activities, notably for tourism, recreation and travel. There are several areas of concern, however, which raise questions over the sustainability of this expansion.

Global business activity rose in February at the fastest rate for eight months, according to the JPMorgan Global PMI - compiled by S&P Global - marking a further step in the global recovery from a contraction which now appears to have peaked last October. The improvement has help allay global recession fears, and came as a positive surprise to the markets, which are now betting on more aggressive interest rate hike trajectories for the major central banks (and, in particular, reduce risks of a pivot by the US Fed later in 2023).

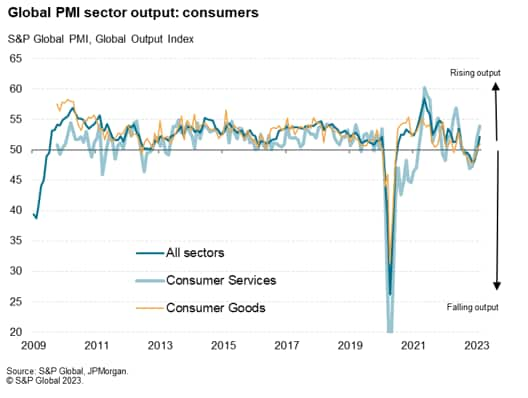

Perhaps the most surprising element of the February PMI surveys was the role of the consumer, with demand for consumer services surging globally at its fastest rate for nine months, reviving from decline in the closing three months of 2022. Consumer services consequently outperformed all other major industries to drive the economic expansion in February. At the same time, new orders for consumer goods rose at the fastest pace in nine months. Although the rise was far more muted that that seen for services, driving a commensurately more muted rise in production, the improved picture for consumers painted by the PMI data for both goods and services comes despite interest rates in the major developed economies rising to their highest levels since prior to the Great Recession and amid a global cost of living crisis.

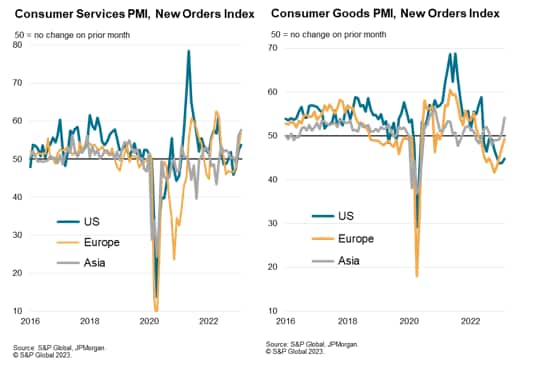

With interest rates having been hiked higher in the US than in Europe and Asia, it should be no real surprise to see consumer spending on goods and services lagging somewhat in the US, though even here a resurgence of demand for consumer services was recorded in February.

In Europe, strong inflows of new business were also reported into consumer services companies, accompanied by a near stabilisation of orders for consumer goods.

However, it was Asia that saw the strongest gains, both in terms of rising demand for consumer services and new orders placed for consumer goods.

Although February also saw growth accelerating (or downturns easing) for all other broad industries, the performance of the consumer comes under particular scrutiny as sustained spending will be required to drive economic growth in the coming months.

In this respect, a closer dive into the survey data reveal some areas of concern.

First, the growth surge in Asia can be largely traced to a reopening of the Chinese mainland economy after COVID-19 restrictions were relaxed. These looser restrictions not only facilitated higher consumer activity in China, but could be seen to have also boost travel and tourism abroad. As our charts illustrate, prior relaxations of COVID-19 restrictions around the world led to a marked improvement that soon faded.

Second, travel and tourism has also benefitted in 2023 from pent-up demand for holidays and travel. Note that two of the top three sub-sectors in February were transportation and tourism & recreation. Such a rise in demand may of course prove temporary unless the economic fundamentals improve further.

Third, recreation activity has been boosted in some countries, notably in the US and Europe, by milder than usual weather for the time of year in both January and February. This may simply have brought forward spending from the spring.

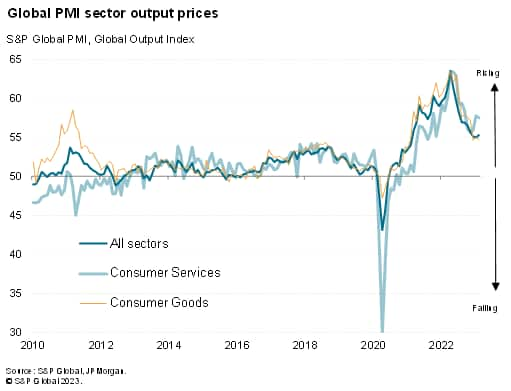

Fourth, while it is true that unemployment generally remains very low, meaning a strong labour market can supporting rising consumer spending, survey price gauges remain elevated, suggesting that inflationary pressures may have peaked but that prices generally continue to rise and will add further to the global cost of living squeeze. Note that, although down from last year's peaks, the rate of increase for both consumer goods and consumer services remain very elevated by historical standards of the PMI surveys.

All of these factors suggest that the consumer may play less of a role in the economic upturn in coming months, being somewhat temporary in nature to some degree or not being driven by improving economic fundamentals.

A further cause for concern is the very revival of consumer spending itself. While PMI survey data showed business and consumer confidence improving on the back of reduced recession fears, and therefore expectations of less aggressive interest rate hikes than had previously been anticipated, this picture is now changing. Markets are now pricing in higher interest rates after the stronger than expected PMI data, which is feeding through to higher long-term borrowing and increased mortgage costs.

The improvement in household demand signalled by the PMI surveys globally may therefore likely play a role in reducing longer term prospects.

It will therefore be crucial to watch the detailed sector PMI data in the coming months to better understand the changing dynamics, and in particular to assess the degree to which short-term factors are supporting the global economy.

Access the global PMI press release here

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.