Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Feb 26, 2021

By Rahul Kapoor and Rajiv Biswas

APAC Special Focus

APAC exports are forecast to show a strong rebound of 11.5% in 2021, after contracting by 5.1% in 2020. IHS Markit estimates that global trade volume contracted by an estimated -11.2% in 2020. A recovery is forecast in 2021 and 2022, with global trade volume to recover by 7.5% and 4.1%, respectively.

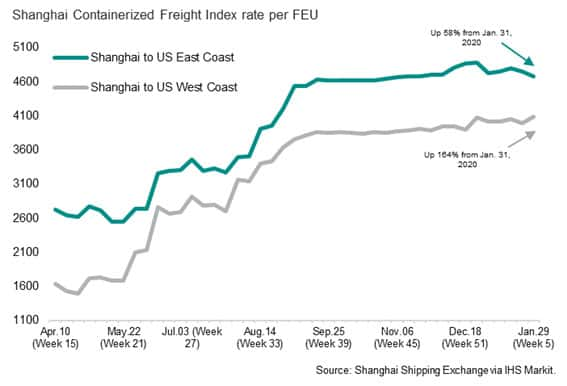

Surging Asia-Pacific exports have created shipping container shortages, with the price of containers on Asia-US and Asia-EU shipping routes having soared since mid-2020. Meanwhile, the strong rebound in global electronics demand has also created supply bottlenecks for electronics manufacturing firms, with shortages of semiconductors having already resulted in disruptions to auto production for some major auto manufacturers during the first quarter of 2021.

Recovery in APAC Exports

The Asia-Pacific (APAC) region experienced a severe recession in 2020 due to the COVID-19 pandemic, with APAC GDP contracting by an estimated 1.2% year-on-year (y/y). Pandemic-related lockdowns and travel bans had a severe negative impact on the economies of most APAC nations during the first half of 2020. However, during the second half of 2020, many Asia-Pacific economies had shown a significant recovery in economic momentum. This upturn was driven both by strengthening global export demand as well as the rebound in domestic consumption spending as a result of the easing of pandemic-related restrictions in many countries.

A strong economic recovery is expected in 2021, with APAC GDP growth forecast at 5.8%, based on expectations that the progressive rollout of COVID-19 vaccines during 2021 will help the gradual recovery of economic activity in many OECD and APAC economies.

A key factor underpinning the strong economic rebound in the APAC region is expected to be buoyant economic growth in China, which is forecast to grow at 7.6% in 2021. The Asia-Pacific recovery is expected to be broad-based, with most major Asia-Pacific economies forecast to show rapid growth in 2021.

Exports from many Asian economies have already shown a strong rebound since mid-2020 as consumer demand in the US and EU has strengthened. China's exports rose by 18.1% year-on-year in December 2020, while Japan's exports rose by 6.4% y/y, South Korean exports were up 11.4% y/y and Singapore's exports were up 12.8% y/y in January 2021.

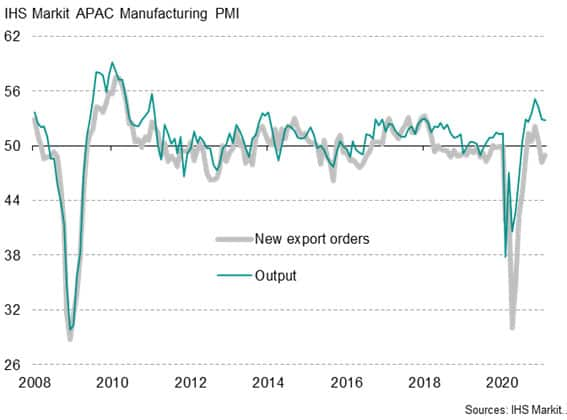

APAC manufacturing output and new export orders

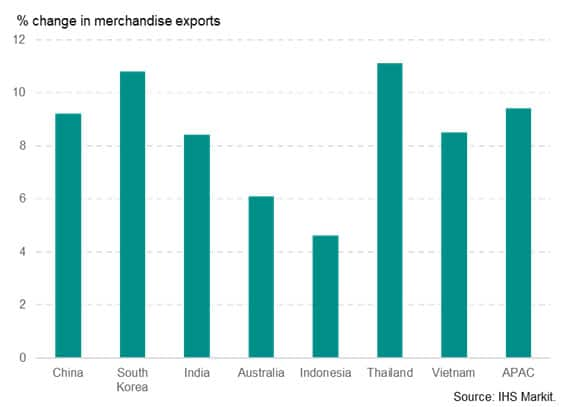

APAC export growth forecast, 2021

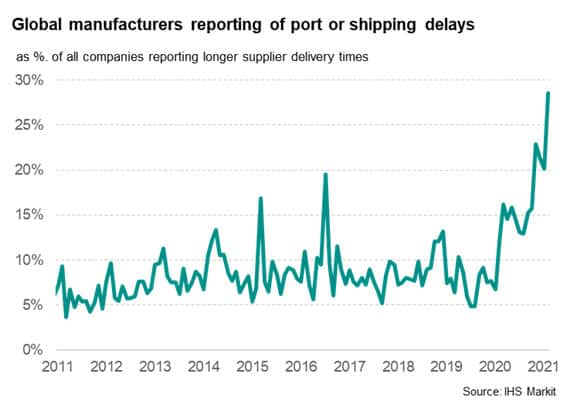

APAC shipping container shortages escalate

The current state of the container shipping market can best be explained by consumers in locked down countries in North America and Western Europe with money to spend embarking on a spending spree for Asian produced consumer goods. This has created logistical problems, resulting in supply chain bottlenecks and empty shipping containers in the wrong locations.

What was different this time round is that container shipping industry was, for the first time in years, in a much better position to ride out a crisis and weathered the COVID-19 hit far better than during the Global Financial Crisis. Industry consolidation over the last few years drove a newfound resolve by the shipping companies to exercise exceptional capacity discipline. Industry's pricing power, which has long been elusive, came back ferociously once demand started recovering. Demand destruction was short lived, recovery has been swift and exceeded expectations amid consumer demand shifts.

This demand surge has come at a time when container supply was scaled back, container positioning was all over the place and large bottlenecks have emerged.

Particularly, In the second half of 2020, a shortage of empty containers in key exporting hubs in Asia and a delay in the return of containers to the quayside in the US have led to equipment shortages in key exporting regions and one of the key reasons for spot rates to scale record highs. Amid surging consumer demand, equipment imbalances and tight supply is driving record freight rates.

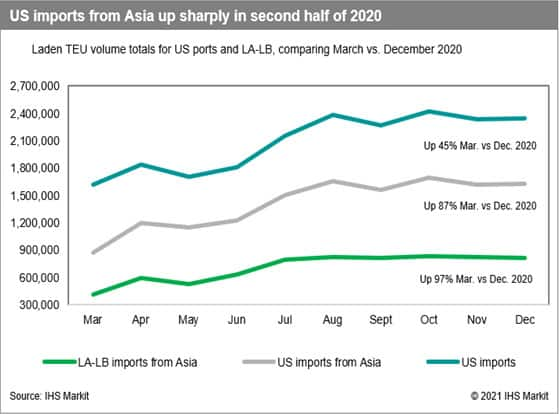

Container demand recovery is benefiting from stay-at-home consumer goods imports, which are getting higher wallet share amid consumer demand shifts. US imports during 2020 have been a tale of two halves. US imports from Asia declined 10.7% in the first half of 2020 from the same period in 2019, according to the IHS Markit PIERS database. US imports from Asia in the second half of 2020 were up 16.9% from the second half of 2019; imports for the calendar year ended up 4.1% higher. Asia-US container volume growth has far outpaced Asia-Europe and Intra-Asia demand.

There has been relentless growth in consumer demand and its positively impacting container demand. This is likely to sustain in H1 2021 and roll over in H2 2021. The data from the IHS Markit PIERS database, looking at some of the specific HS codes the US TEU imports have hit record, for stay-at-home goods, such as furniture, home improvements and consumer electronics. With another round of fiscal stimulus being implemented in the US by the incoming Biden Administration, consumer spending and container demand will remain strong.

US monthly container imports (TEU) - Electric, TV, Sound Equipment

The biggest and most positive impact of record high spot rates will be on the annual contract freight rate increases which as could be as high as 40-50% this year. However, we expect demand growth should start to temper after the peak in H1 2021. Temporal dislocation of container boxes and high congestion will eventually be resolved but not before H2 2021 and spot rates should start peaking well before the industry fundamentals soften.

APAC Electronics Supply Chain Disruptions

In addition to the severe logistical problems to APAC shipping created by container shortages, the global electronics industry has also suffered from supply chain disruptions during late 2020 and early 2021.

The IHS Markit Global Electronics Purchasing Managers' Index (PMI) has signalled a strong rebound in global electronics orders since mid-2020 as global lockdowns were eased and consumer spending rebounded in many major economies. The IHS Markit Global Electronics PMI new orders index rose from a calendar year-to-date low of 35.0 in May 2020 to a level of 53.4 by January 2021, reflecting a significant recovery in new orders.

IHS Markit Global Electronics PMI

However surging demand for semiconductors has outpaced production, resulting in semiconductors shortages that are impacting on production in key manufacturing industries such as autos.

The South Korean Ministry of Trade, Industry and Energy announced that South Korea's exports of information and communications technology (ICT) goods in December 2020 amounted to USD 18 billion, up 24.9% compared to the same period last year. Exports of semiconductors rose by 30% y/y, while exports of display panels rose by 31% y/y. Exports of mobile phones rose by 48% y/y.

South Korea's Ministry of Trade, Industry and Energy has projected that South Korean semiconductors exports in 2021 will rise by around 10% to USD 109 billion, due to buoyant global demand for electronics products.

With significant shortages of semiconductors having become evident during early 2021, this is expected to further boost South Korean semiconductors exports during 2021.

Taiwan's exports of electronics products surged in January 2021, rising by 47.5% y/y to USD 13.3 billion. Exports of semiconductors rose by 46.3% y/y, while exports of optical devices rose by 53.5% y/y. Due to strong global demand for computers, TVs and auto electronics, a severe shortage of semiconductor chips has developed in recent months.

Chip stockpiling during 2020 due to US government sanctions on certain Chinese technology companies have also contributed to the shortages. Global auto manufacturers as well as smartphone producers are among the industry segments that have been impacted by these shortages. According to IHS Markit Automotive research, vehicle manufacturers are finding increased disruption to the supply of systems using semiconductors in the first quarter of 2021. Many automakers worldwide have reported disruptions to production due to shortages of semiconductors, including Ford, VW Group, GM, Honda and Mazda. (IHS Markit Automotive, 22nd February 2021, "Semiconductor Supply Issue: Light Vehicle Production Tracker").

The extent of the shortages of critical electronics components has become so severe that high level consultations have been held with Taiwan involving key industry bodies as well as government officials from major industrial economies including the US and Germany. On 24th February, US President Biden signed an executive order for a US government review of US supply chain vulnerability for critical materials, including for semiconductors.

The shortage of semiconductors has driven up capital expenditure plans, with Taiwan's TSMC, the world's largest chipmaker, having announced plans to increase capital spending on production and development of advanced chips to a range of USD 25 billion to USD 28 billion in 2021, a 60% increase on 2020. Taiwan's UMC, which also manufactures chips, plans to lift spending on new capital equipment by around 50% in 2021.

Recent power disruptions in Texas due to severe winter weather has added to the supply chain disruptions to global semiconductors output, with Texan semiconductors plants of Samsung, NXP Semiconductors and Infineon Technologies among the semiconductors manufacturers whose production in Texas has been disrupted.

APAC Trade Outlook

The central case global economic scenario for 2021 is positive, with the world economy forecast to show improving momentum through the course of 2021 as COVID-19 vaccination programs are rolled out. Many of the world's largest economies, including the US, EU, Japan, China and India, are expected to be rapidly progressing with vaccination programs during the first half of 2021.

This should allow domestic demand to strengthen in these economies, with gradual easing of lockdown conditions in countries in this grouping that are currently experiencing significant new waves of COVID-19 cases. Consequently, this should help to support the strong rebound in world exports during 2021, which are forecast to grow 12.4% following a severe contraction of 10.3% in 2020.

However, there is increasing evidence that the strong rebound in manufacturing exports has created significant logistical problems, with shipping container costs for Asian shipments to the US and EU having soared. Meanwhile the global electronics industry is suffering from semiconductors shortages that are disrupting production in some industries, notably the automotive sector. However, these disruptions to global supply chains are expected to be temporary, with conditions expected to improve in the second half of 2021.

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

Posted 26 February 2021 by Rahul Kapoor, Vice President & Global Head of Shipping Analytics & Research, S&P Global Commodity Insights and

Rajiv Biswas, Executive Director and Asia-Pacific Chief Economist, S&P Global Market Intelligence

How can our products help you?