Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Oct 21, 2021

By Sara Johnson

The COVID-19 pandemic, the energy transition from hydrocarbons to renewables, and related government interventions are disrupting markets around the world. Major shifts in household spending patterns, working from home, fiscal and monetary stimuli, and industry consolidation are contributing to market imbalances. With demand persistently outpacing disrupted supply, prices are rising to rebalance markets. Thus, the IHS Markit October global forecast is characterized by lower near-term output growth, higher price inflation, and earlier interest rate increases compared with the September forecast.

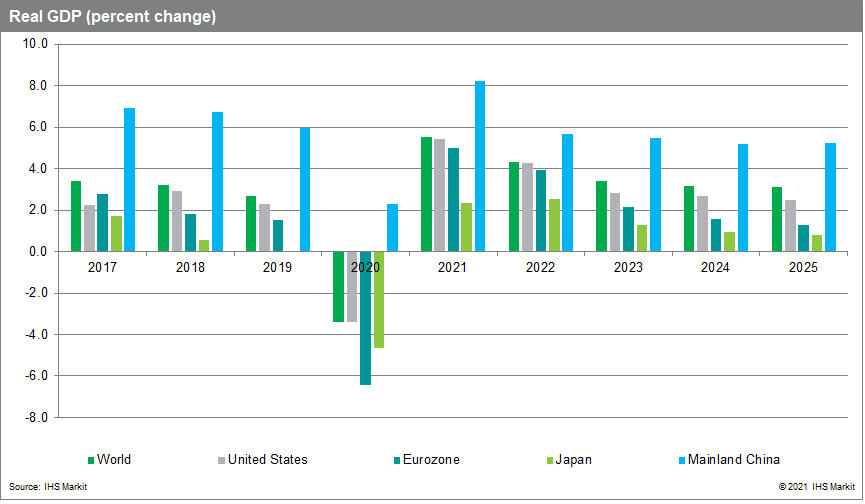

After a 3.4% decline in 2020, world real GDP is projected to increase 5.5% in 2021 and 4.3% in 2022, led by recoveries in consumer spending and business investment. This forecast was revised down by 0.1 percentage point in 2021 and 0.2 percentage point in 2022, reflecting weaker outlooks for North America, Western Europe, mainland China, and Japan. Global growth will settle to 3.4% in 2023 and 3.2% in 2024 as pent-up demand is satisfied, major economies reach full employment, and fiscal and monetary policies tighten.

With some critical supply shortages and shipping bottlenecks persisting well into 2022, inflation pressures will remain elevated for several months and subside more gradually than previously expected. Global consumer price inflation is projected to pick up from 2.2% in 2020 to 3.7% this year, its highest rate since a 5.0% advance in 2008. As agricultural and industrial commodity prices retreat, consumer price inflation will ease to 3.2% in 2022 and 2.7% in 2023 and 2024. This month's inflation forecast was revised up by 0.1 percentage point this year and 0.3 percentage point in 2022

COVID-19 concerns and worsening supply shortages will delay some US growth beyond 2021.

The forecast of real GDP growth was lowered 0.3 percentage point, to 5.4%, in 2021, and 0.2 percentage point, to 4.3%, in 2022. The revisions reflect more cautious consumer spending, fewer light vehicle assemblies, and weak third-quarter exports. On the positive side, a healthy report on retail sales in September indicates resilience in spending as COVID-19 virus infections decline. The forecast assumes passage of the Infrastructure Investment and Jobs Act, but not the Build Back Better reconciliation bill with substantial increases in social spending and taxes. With sustained growth in consumer spending on services, business investment, and exports, real GDP is projected to increase 2.8% in 2023 and 2.7% in 2024.

US labor supply is an emerging constraint on economic growth.

Despite rising wages and record job openings, the labor participation rate in September stood at 61.6%, well below its pre-pandemic level of 63.3%. Workers have been slow to return for a variety of reasons, including safety concerns, lack of childcare availability, generous unemployment benefits, accumulated savings, and early retirement. In the IHS Markit forecast, the US unemployment rate falls from 4.8% in September to a low of 3.6% in 2023-24, putting upward pressure on wage rates. With the upward revision to the inflation forecast, the Federal Reserve's "lift-off" of the federal funds rate is moved forward six months to March 2023.

Western Europe's mid-2021 growth spurt is fading, and input shortages are constraining production.

With the easing of pandemic-related restrictions, real GDP likely posted another strong growth rate in the third quarter, led by consumer spending. However, the IHS Markit PMI™ surveys indicate that shortages of electronic components and raw materials are limiting production. Meanwhile, demand is cooling as rising inflation squeezes household real incomes. After a 6.4% decline in 2020, eurozone real GDP should increase 5.0% in 2021, 4.0% in 2022, and 2.2% in 2023. While Emerging Europe's growth prospects are a bit stronger, near-term growth is threatened by new waves of COVID-19 cases in several economies, including Russia, Romania, and the Baltic States.

The acceleration in European consumer price inflation will continue in the closing months of 2021.

The region's natural gas prices have soared, contributing to increases in other energy prices. With inflation proving more elevated and persistent than anticipated, the risk of second-round effects on wages and unit labor costs has risen. Labor and skills shortages are appearing in some countries, including the United Kingdom, where Brexit has reduced immigration. In response to inflation concerns, the Bank of England will likely become the first major central bank to raise interest rates, by February 2022 at the latest. The European Central Bank will be more cautious, as inflation expectations remain below 2%; its first interest rate increase is expected in 2024.

Mainland China faces headwinds from the real estate downturn and power shortages.

Real GDP growth slowed from 7.9% year on year (y/y) in the second quarter to 4.9% in the third quarter, as containment of COVID-19 outbreaks in August took a toll on retail sales. A further deceleration in real GDP is expected in the fourth quarter. Industrial production growth subsided to 3.1% y/y in September from 5.3% in August, with energy-intensive goods such as metals, chemicals, and construction materials hit hardest by power restrictions. Coal-based thermal power, which accounts for 70% of the country's electricity generation, has been constrained by Beijing's decarbonization policies and cessation of coal imports from Australia in 2021. Meanwhile, the government's deleveraging campaign targeting property developers is deflating real estate and construction activity. Mainland China's real GDP growth is projected to slow from 8.2% in 2021 to 5.7% in 2022 and 5.5% in 2023.

Asia Pacific economies are rebounding from third-quarter setbacks.

IHS Markit economists estimate that real GDP contracted quarter on quarter during the third quarter in Australia, Indonesia, Malaysia, the Philippines, Thailand, and Vietnam. With new COVID-19 cases diving from recent peaks, helped by rapidly rising vaccination rates, Asia Pacific is poised for a strong rebound in late 2021 and early 2022. The recovery of manufacturing production will help to gradually ease global supply-chain disruptions. After a 1.0% decline in 2020, the region's real GDP is projected to increase 6.0% in 2021 and 4.8% in 2022.

Pandemic-related supply shortages, shipping delays, and the first storm of the energy transition are driving up prices and constraining global economic growth. Some of these disruptions will persist through 2022. Investment in new capacity is a medium- or long-term solution to supply shortages, but in the near term a cooling of demand growth will be necessary to bring markets into balance. With inflation continuing to surprise on the upside, the global economic expansion will proceed at a diminishing pace in 2022-23.