Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Apr 06, 2023

By Fran Hagarty

Following the deceleration in growth that occurred over the course of 2022, state tax-collection gains will likely remain modest in the near term as rising interest rates and persistently high inflation slow economic activity considerably. In addition to the downward pressure created by macroeconomic conditions, 31 states have enacted changes that will lead to a net decrease of $16.2 billion in revenue (1.4% of forecast general fund revenues) in fiscal 2023, per the National Association of State Budget Officers (NASBO). These reductions include both one-time tax-relief measures and permanent rate reductions, and it is important to note that single state measures can have an outsize impact on national figures. For example, tax-relief measures across several categories in California account for more than 25% of the total net decrease projected nationwide in 2023. In addition, of the 26 states reducing income taxes in 2023, a tax credit in North Dakota and broad-based personal rate reductions in Arkansas and Idaho will account for the most considerable net decreases as shares of forecast state revenues. Among states cutting sales taxes, a fuel tax holiday in New York measures among the largest one-time tax reductions nominally, while the elimination of state taxes on groceries in Virginia (local jurisdictions can continue to impose a 1% tax) will also impact revenues considerably.

Continued inflationary challenges and the exhaustion of federal stimulus will limit rainy day fund growth in the near term. Furthermore, a heightened recession risk, or at the very least slower economic growth over the near term, combined with widespread tax cuts could present headwinds that require states to dip into their reserves, but this is exactly why these reserves exist. Going into the 2001 recession, the median state rainy day fund balance stood at 4.6% of spending, but it fell to 0.7% in the aftermath. The Great Recession saw a lesser decline, from 4.8% to 1.8% of expenditures, in part because of the emergence of the fracking boom during that period, which heavily boosted government savings in mining states. With reserve balances currently much higher than what they were going into the last three downturns, state government funds are largely on a solid footing to weather a near-term decline.

Look at the numbers

Three years after the COVID-19 pandemic caused a historic plunge in state tax revenues, state coffers are in their best shape in decades. A healthy labor market and strong consumer spending over that past two years propelled tax collections well above pre-pandemic levels in nearly all states. That windfall, combined with the considerable influx of pandemic-related federal funding, has enabled states to fortify their budget reserves; indeed, state rainy day funds reached a record $134.5 billion as of late 2022, per the NASBO. The median state rainy day fund balance is able to cover 11.9% of budgeted expenditures for fiscal 2023, up from a median of 7.9% in fiscal 2019, prior to the onset of the pandemic.

States that saw the largest runup in tax revenue over 2020-22 generally boast the most well-funded rainy day accounts.

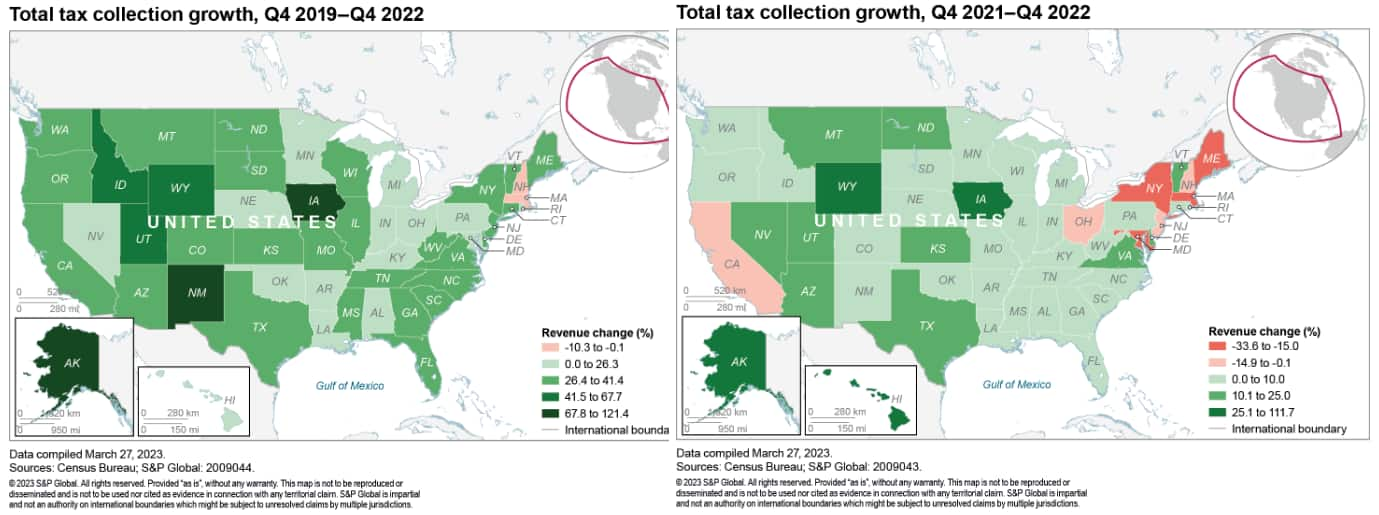

Total state tax collections in the fourth quarter of 2022 were 31% higher than the same quarter of 2019, with the West experiencing the largest gain, of nearly 40%. Median state revenue increased 29.1% in the fourth quarter of 2022, led by Alaska and New Mexico, which saw revenues more than double compared with the same quarter in 2019 thanks to a sustained surge in severance taxes. Fellow energy-dependent state Wyoming also experienced impressive growth over the three years ending in the fourth quarter of 2022, expanding tax collections by nearly 60%. These three states—Alaska, New Mexico, and Wyoming—also possess the highest level of rainy day funds, with reserves able to cover an average of 65.4% of their anticipated budget expenditures in 2023. Oklahoma, Texas, and West Virginia similarly took advantage of the increase in severance taxes to build up their savings, with surplus reserves now available to cover more than 17% of budgeted spending in each state for 2023. Idaho's strong reserve balance could pay for nearly 24% of the state's expected 2023 expenditures, following a more than 50% surge in tax revenue between late 2019 and 2022.

In contrast, Hawaii, Louisiana, and Nevada, states that are highly dependent on tourist industries that were decimated by the pandemic, saw below-average increases in tax collections over 2020-22. That said, budget reserves in these tourism-heavy states are on a solid footing when compared with previous years. With funding able to cover an average of 7.7% of their expenditures for 2023, the rainy day fund balances in these states are in range of the median figure for 2019. At the very bottom of the pack are New Jersey, Washington, and Illinois; the latter two possess very modest surplus balances, while New Jersey's Surplus Revenue Fund is now at zero following a full transfer to its General Fund in fiscal 2022. These states did benefit from the stimulus measures and favorable tax-collection climate of recent years, and are in better fiscal shape because of it, though they have less of a buffer if economic conditions sour.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.