Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Jan 30, 2025

By Husain Rupawala and Tim Zawacki

The success of The Progressive Corp. in taking the US private and commercial auto businesses by storm during the past 25 years both sets a foundation for the company's fledgling individual life business and creates the potential that the startup venture can grow significantly from its current very modest base.

Progressive sent marketing emails to existing private auto customers in select states in January pitching term life coverage written by Progressive Life Insurance Co., a distinct difference from previous outreach that indicated customers would be referred by an agency subsidiary to third-party distributor Efinancial Llc for the placement of coverage with a third-party life insurance company.

Statutory data for Progressive Life indicates that the company's presence remains very limited in terms of both geographical breadth and depth of customer penetration. But we believe a company best known for its private passenger auto products will be increasingly motivated to ramp up the cross-selling of ancillary products and services, including those manufactured in-house, as competition in its core business is due to accelerate significantly.

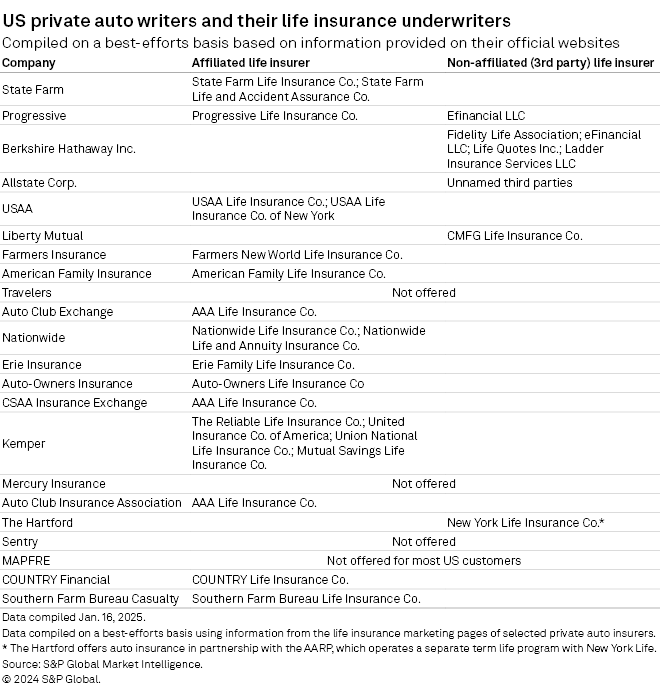

Our analysis of the approach to the individual life business by Progressive's private auto-focused peers includes their reliance on internal production, external partnerships and a combination of the two, depending on geography and product type.

Progressive's recent growth in private auto policies in force is remarkable, but it is unsustainable at current levels given the company's already sizable market position and evidence that at least some of its traditional rivals have ramped up new business acquisition efforts amid dramatically improving underwriting results in the business line. Additionally, while Progressive has increasingly focused in recent years on attracting customers looking to bundle their homeowners and private auto policies, the company continues to refine its risk appetite for property business amid the omnipresent threat of natural catastrophes.

In November 2024, for example, Progressive's personal auto policies in force surged by 21.2% as the company continued to increase its spending on multimedia advertisements. That marked the fastest year-over-year pace of expansion in that business since July 2003, when the book was less than one-quarter of its current size. We assume that the company's private auto growth is at or near a historical peak and, as the expansion inevitably slows, a greater focus will shine on policy life expectancy, a key measure of customer retention.

Prior to the unprecedented disruption triggered by the COVID-19 pandemic and amid a softening private auto rate environment, Progressive in November 2019 had identified life insurance, which it had been offering on an agency basis for a number of years, as a key aspect of its "Horizon 3" strategy. The company's "Horizon 2" strategy involved the investment in new products that leverage core competencies, which included an expansion into the ridesharing market in commercial auto and the launch of business owner's policies for small businesses. For "Horizon 3," Progressive sought to explore new areas to solidify the endurance of its franchise through strategic alliances and investments with third-party vendors. That included the company's agency relationship with eFinancial, an affiliate of Fidelity Life Association, which are now both part of iA Financial Corporation Inc.

Progressive had scored the life insurance market as having "medium to low attractiveness," but Chief Strategy Officer Andrew Quigg said during a November 2019 conference call that the company's "ability to win" in that business was relatively higher based on an ability to leverage its core strategic pillars and the strength of its brand. The company also touted — and continues to offer — a range of other ancillary consumer products and services largely through arrangements with third parties, including vehicle loan refinancing and personal loans through Upstart Holdings Inc., pet insurance through Pets Best Insurance Services LLC and Companion Protect, LLC, residential mortgages through Nationstar Mortgage LLC, debit cards for children through Till Financial Inc., and dental and vision insurance through eHealth Inc.

The transition to an in-house life insurer from agency referrals has been measured to this point. Progressive Life was incorporated in 2020 and began writing only in Ohio in 2022. The company expanded to Arizona, Indiana, Louisiana, Michigan, Missouri, Ohio, Pennsylvania and Virginia in 2023. It is also licensed to write in Georgia, Maryland, Mississippi, Tennessee, Texas, Utah and Wisconsin, and it wrote business in all but the latter two states during the first nine months of 2024.

"The focus in the early phase of operation will be to gauge product-market fit and assess demand," Progressive Life said in its 2023 annual statement. From the first quarter of 2022 through the third quarter of 2024, Progressive Life's cumulative premium volume totaled a mere $658,000 though nearly a third of that tally hit the books in the most recent reporting period.

Strategies for writing life insurance cross-sold to private auto customers vary widely around the industry. Among the largest US private auto groups, according to our analysis, State Farm Mutual Automobile Insurance Co., United Services Automobile Association, Farmers Insurance Group of Cos., American Family Mutual Insurance Co. SI, Nationwide Mutual Insurance Co. and Auto Club Exchange Group (and the two other major American Automobile Association-linked groups) sell life insurance written on the paper of affiliates or subsidiaries. Meanwhile, Geico Corp. maintains agency relationships with third parties such as eFinancial, Liberty Mutual Holding Co. Inc. with CMFG Life Insurance Co. operating as TruStage Financial Group Inc., and The Allstate Corp. pitches life products issued by third parties, according to their respective websites. Certain independent agency-focused companies such as The Travelers Cos. Inc., Mercury General Corp. and Sentry Insurance Co.'s Dairyland-branded business do not make reference to term life policies on their personal lines websites.

Allstate previously sold life products through wholly owned subsidiaries Allstate Life Insurance Co. and Allstate Life Insurance Co. of New York, among others, but has engaged in a series of divestitures of its life and health businesses in recent years.

Though it may have gone the partnership route, comments years ago by Allstate executives offer context as to the potential associated with the marketing of life insurance products by a personal lines insurer. During an investor day in 2011, when the company was looking to drive the internal cross-sale of life products through the introduction of a multiline discount and integrating life products in the property and casualty quoting process, Allstate put its life insurance penetration rate at about 6% of households as compared with an "industry average" of between 10% and 12% and a "best-in-class" result in the high-teens.

The level of penetration of life products marketed under the Progressive name but underwritten externally among the company's private auto customers is not known, but its internal penetration rate has nowhere to go but up. Progressive Life reported just 276 policies in force at year-end 2023 with an associated amount of coverage of less than $91.7 million in the aggregate. The Progressive personal auto business amassed more than 19.5 million policies in force at that time, and that number grew to nearly 23.6 million by the end of November 2024.

If the company were to hypothetically match Allstate's 2011 penetration rate, it would mean more than 1.4 million life policies in force, and assuming an amount of insurance per life policy in force consistent with Progressive Life's 2023 tally of approximately $332,000, that would yield a total coverage amount of more than $469 billion. This hypothetical scenario would rank Progressive among the top 20 US term life groups. For comparison purposes, at year-end 2023, State Farm's life companies had more than 3.3 million in term life policies with an associated in-force coverage amount of $891.58 billion; the USAA life companies had fewer than 1 million term life policies with an aggregate coverage amount of $454.85 billion.

Progressive's opportunity in the space is even clearer today than it was when management was talking up the business in November 2019 as its personal auto policy count soared by 58.9% in the subsequent five years. And the need to pull levers to drive customer retention, which management has identified as one of Progressive's "most important priorities," will become more critical as 2025 proceeds and competitive dynamics in the private auto business evolve.

Whether there are a sufficient amount of operational efficiencies to be harvested by more fully migrating to an in-house model from a white-label agency approach remains to be seen, especially given that Progressive already associates its brand with the latter category of policies..

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.