Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Nov 14, 2024

By Russell Ernst

As the end of 2024 approaches, rate case decisions are expected to be issued in a slate of key rate proceedings. Important developments are also likely in various other pending rate proceedings, and the upcoming general election could alter the composition of several utility commissions.

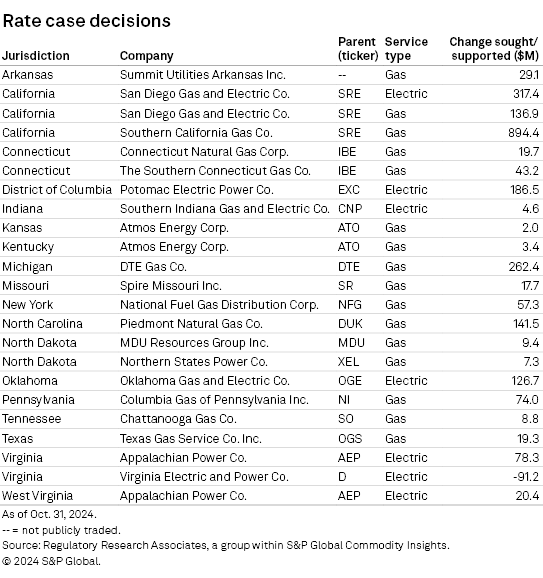

➤ Decisions could be issued during November in 23 pending rate cases across 18 jurisdictions, according to data compiled by Regulatory Research Associates. Most of these proceedings are traditional base rate cases, but six are limited-issue riders, and one involves a multiyear rate plan. The utilities are seeking a total of $2.3 billion in rate increases in these cases.

➤ Administrative law judges or hearing examiners are expected to issue recommended decisions in three proceedings, including substantial rate cases for utilities in California and Oklahoma and an earnings review for one of the major Virginia utilities.

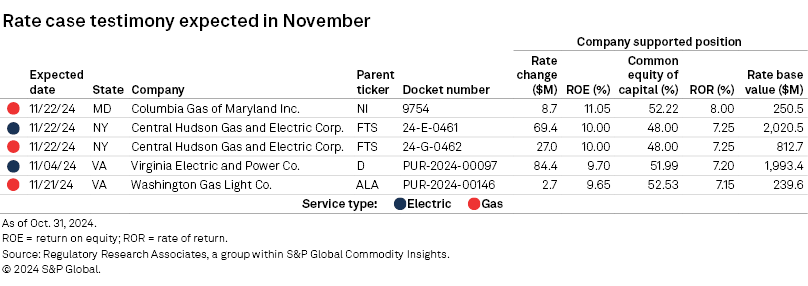

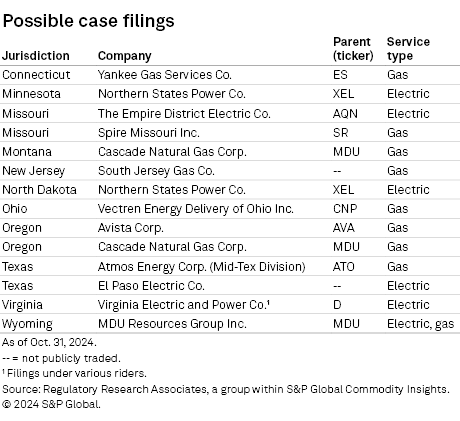

➤ Stakeholders and consumer groups are to file testimony in five other pending proceedings, while developments could occur regarding ongoing settlement negotiations in six pending rate cases. Also, 15 new rate cases could be filed in November.

➤ While only one commissioner term expires in the US during November, several commissioners continue to serve pending reappointment/replacement or pending confirmation. There are also vacancies in five state-level regulatory bodies. Action could occur regarding some of these commissioner seats in the coming weeks.

➤ Nine states are poised to hold utility commission elections for 14 seats, and 11 states will hold gubernatorial elections.

➤ There could also be action at the Federal Energy Regulatory Commission regarding certain key proceedings RRA is following: a large gas pipeline rate case; an electric transmission rate case; a formula rate plan proceeding for a large California utility; a case addressing issues related to the colocation of large loads at generating facilities; and a proceeding pertaining to cross-jurisdictional issues relevant to FERC and state utility commissions.

As of Oct. 30, 124 electric and gas rate cases were pending across 40 states and the District of Columbia. The rate changes sought in these pending proceedings aggregate to a $18.7 billion net rate increase, excluding some of the later-year steps of multiyear rate requests.

RRA has observed that the fourth quarter is generally the most active time of the year for rate case decisions, with December being the busiest month, on average, as regulators try to clear their slates before the new year begins. By contrast, filing activity tends to taper off toward year-end.

The busiest time for rate case filings is usually late spring or early summer, with the least activity in fall.

A list of expected events for November and beyond is available in the Regulatory Research Associates Events Calendar.

Expected decisions

Arkansas — Summit Utilities Arkansas Inc. — A decision is expected to be issued Nov. 25 in Summit Utilities Arkansas' gas distribution rate proceeding (Docket 23-079-U). The Summit Utilities subsidiary recently signed a settlement that calls for an $87.7 million rate increase based on a 9.85% return on equity (41.07% of a regulatory capital structure) and a 6.17% return on a $1.205 billion rate base.

California — San Diego Gas & Electric Co./Southern California Gas Co. — A decision could be rendered in a pending rate case (Application 22-05-016) for Sempra subsidiaries San Diego Gas & Electric and Southern California Gas. San Diego Gas & Electric supports $317.4 million electric and $136.9 million gas rate increases for the 2024 test year. The company also proposes incremental, post-test-year combined electric and gas rate increases of $345.6 million in 2025, $332.2 million in 2026 and $303.2 million in 2027. Southern California Gas requests an $894.4 million increase in gas rates for the 2024 test year and incremental, post-test-year rate increases of $291.9 million in 2025, $261.1 million in 2026 and $380.6 million in 2027.

Connecticut — Connecticut Natural Gas Corp./The Southern Connecticut Gas Co. — A decision is expected to be issued Nov. 18 in pending rate proceedings for Connecticut Natural Gas and Southern Connecticut Gas. Connecticut Natural Gas is seeking a $19.7 million rate increase premised upon a 10.20% return on equity (55.00% of capital) and a 7.95% return on a rate base valued at $602.3 million. Southern Connecticut Gas is seeking a $43.2 million rate increase premised upon a 10.20% return on equity (53.00% of capital) and a 7.70% return on a rate base valued at $876.9 million. The Connecticut Public Utilities Regulatory Authority recently issued a draft decision specifying a $38.8 million gas rate reduction premised upon a 9.20% return on equity (53% of capital) and a 7.154% return on a rate base valued at $529.9 million for Connecticut Natural Gas and a $36.6 million gas rate reduction premised upon a 9.20% return on equity (53% of capital) and a 7.008% return on a rate base valued at $767.9 million for Southern Connecticut Gas. The companies are subsidiaries of Avangrid Inc., the ultimate parent of which is Iberdrola SA.

District of Columbia — Potomac Electric Power Co. — A decision may be rendered in Exelon Corp. subsidiary Potomac Electric Power's proposed multiyear rate plan in Formal Case 1176. The three-year plan includes a first-year rate increase of $116.3 million based on a 10.50% return on equity (50.50% of capital) and a 7.77% return on a rate base valued at $3.007 billion. An incremental rate increase of $34.5 million would be implemented in the second year, reflecting a 10.50% return on equity (50.50% of capital) and a 7.78% return on a $3.224 billion rate base. The final incremental increase of $35.7 million that would go into effect in the third year would be premised upon a 10.50% return on equity (50.50% of capital) and a 7.79% return on a $3.392 billion rate base.

Indiana — Southern Indiana Gas and Electric Co. — A decision may be issued in Southern Indiana Gas and Electric's transmission, distribution and storage system improvement charge rider proceeding (Cause 45894-TDSIC-1) for its electric operations. The CenterPoint Energy Inc. subsidiary proposes a $4.6 million rate increase under the rider based on a 10.40% return on equity (47.62% of a regulatory capital structure) and a 6.65% return on a $460.7 million rate base.

Kansas — Atmos Energy Corp. — An order could be issued in Atmos Energy's gas system reliability surcharge rider case (Docket 25-ATMG-133-TAR). The company seeks a $2.0 million rate increase that reflects a $38.9 million rate base. The calculated pretax rate of return is 8.70%, as per the commission's decision in a separate proceeding.

Kentucky — Atmos Energy — A decision is possible in Atmos Energy's pipe replacement program rider proceeding (Case 2024-00226). The company proposes a $3.4 million rate increase that reflects a $69.3 million rate base. The company used the 9.45% return on equity (54.50% of capital) and the 6.94% overall return specified in its previous base rate proceeding (Case 2022-00222) to calculate the revenue deficiency in the instant case.

Michigan — DTE Gas Co. — A decision is expected in DTE Gas' base rate proceeding (Case U-21291). The DTE Energy Co. subsidiary supports a $262.4 million rate increase premised upon a 10.25% return on equity (40.78% of a regulatory capital structure) and a 6.04% return on a $6.940 billion rate base.

Missouri — Spire Missouri Inc. — A decision could be issued in Spire Missouri's infrastructure system replacement surcharge rider proceeding (Case GR-2025-0026). The Spire Inc. subsidiary seeks a $17.7 million rate increase premised upon an 8.25% pretax return, as authorized in a separate case, and a $146.2 million rate base.

New York — National Fuel Gas Distribution Corp. — A decision may be issued in the second half of November in National Fuel Gas Distribution's rate proceeding (Case 23-G-0627). The National Fuel Gas Co. subsidiary recently signed onto a joint proposal that calls for the implementation of a three-year rate plan covering Oct. 1, 2024, through Sept. 30, 2027. The first-year increase would be $57.3 million based on a 9.70% return on equity (48.00% of capital) and a 7.30% return on a $1.044 billion rate base.

North Carolina — Piedmont Natural Gas Co. Inc. — A decision may be issued in Piedmont Natural Gas' rate proceeding (Docket G-9, Sub 837). The Duke Energy subsidiary has signed a settlement that calls for a $141.5 million rate increase premised upon a 9.80% return on equity (52.30% of capital) and a 7.16% return on a $6.399 billion rate base.

North Dakota — MDU Resources Group Inc. — A decision may be issued in MDU Resources' gas distribution rate proceeding (Case PU-23-341). The utility is a signatory to a unanimous settlement that calls for a $9.4 million rate increase reflecting a 9.90% return on equity (50.19% of capital) and a 7.26% return on a $215.4 million rate base.

North Dakota — Northern States Power Co. — A decision may be issued in Northern States Power's gas rate proceeding (Case PU-23-367). The Xcel Energy Inc. subsidiary is a signatory to a settlement that calls for a $7.3 million rate hike premised upon a 9.90% return on equity (52.50% of capital). The settlement does not specify a rate base value or the overall return; however, RRA estimates that using the agreed-upon ROE in conjunction with the company-proposed capital structure would result in an overall return of 7.36%.

Oklahoma — Oklahoma Gas and Electric Co. — A decision could be rendered in OGE Energy Corp. subsidiary Oklahoma Gas and Electric's rate proceeding (Cause PUD2023-000087). The company recently signed onto a settlement that calls for a $126.7 million base rate increase premised upon a 9.50% return on equity (53.50% of capital). The settlement does not specify a rate base value or the overall return.

Pennsylvania — Columbia Gas of Pennsylvania Inc. — A decision could be rendered in November in Columbia Gas of Pennsylvania's rate case (Docket R-2024-3046519). The NiSource Inc. subsidiary is a signatory to a settlement that calls for a $74.0 million rate increase. The settlement is silent regarding traditional rate case parameters but calls for the company to use the return on equity set by the commission through its quarterly earnings review process to calculate future revenue requirement updates under the company's DSIC and for other purposes.

Tennessee — Chattanooga Gas Co. — A decision is expected in Chattanooga Gas' rate case (Docket 24-00024). The company supports an $8.8 million rate increase based on a 9.80% return on equity (49.23% of a regulatory capital structure) and a 7.12% return on a $275.7 million rate base. The equity return and the capital structure equity component were determined pursuant to a previous base rate update case. Chattanooga Gas is a subsidiary of Southern Co.

Texas — Texas Gas Service Co. Inc. — A decision could be issued Nov. 19 in Texas Gas Service's pending rate case (Docket OS-24-00017471) before the Railroad Commission of Texas. A recent settlement calls for the One Gas Inc. subsidiary to implement a $19.3 million rate increase premised upon a 9.70% return on equity (59.58% of capital) and a 7.55% overall return. A rate base value was not specified.

Virginia — Appalachian Power Co. — A decision is expected to be issued Nov. 20 in Appalachian Power's earnings review proceeding (Case PUR-2024-00024). The American Electric Power Co. Inc. subsidiary supports a $78.3 million rate increase premised upon a 10.80% return on equity (48.71% of capital) and a 7.80% return on a $3.229 billion rate base.

Virginia — Virginia Electric and Power Co. — A decision is expected to be issued in November in Virginia Electric and Power's Rider CCR proceeding (Case PUR-2024-00029). The Dominion Energy Inc. subsidiary proposes to implement a $91.2 million rate reduction under the rider premised upon a 9.70% return on equity (52.10% of capital) and a 7.05% overall return. Rider CCR pertains to the recovery of costs incurred to comply with state and environmental laws and regulations.

West Virginia — Appalachian Power — A decision is expected to be issued in Appalachian Power's expanded net energy cost proceeding (Case 24-0413-E-ENEC). The company proposes a $20.4 million net rate increase.

Administrative law judges' recommendations

California — Southern California Edison Co. — An administrative law judge's proposed decision is expected in Edison International subsidiary Southern California Edison's rate case (Application 23-05-010). The company supports a $4.049 billion multiyear electric rate increase. Specifically, the company is backing a $1.90 billion increase in 2025, a $668.1 million increase in 2026, a $748.6 million increase in 2027 and a $732.3 million increase in 2028.

Oklahoma — Public Service Co. of Oklahoma — An administrative law judge's report will likely be issued in American Electric Power subsidiary Public Service Co. of Oklahoma's electric rate proceeding (Cause PUD2023-000086). The company is a signatory to a settlement that calls for a $119.5 million base rate increase premised upon a 9.50% return on equity (51.12% of capital) and a 6.98% overall return. A rate base value was not specified.

Virginia — Appalachian Power — A hearing examiner's proposed order will likely be issued in early November in Appalachian Power's earnings review proceeding (Case PUR-2024-00024). The company supports a $78.3 million rate increase premised upon a 10.80% return on equity (48.71% of capital) and a 7.80% return on a $3.229 billion rate base.

Settlements

Iowa — Black Hills Iowa Gas Utility Co. LLC — A settlement, if one is ultimately reached in Black Hills Corp. subsidiary Black Hills Iowa Gas Utility's rate case (Docket RPU-2024-0001), is to be filed by Nov. 15. The company proposes a $20.7 million rate hike based on a 10.50% return on equity (51.38% of capital) and a 7.65% return on a $397.7 million rate base.

Nebraska — NorthWestern Energy Group Inc. — The deadline for settlement negotiations in NorthWestern Energy Group's Nebraska-jurisdictional gas rate case (Docket NG-0122) is Nov. 4. The company proposes a $3.6 million permanent rate hike based on a 10.70% return on equity (53.13% of capital) and a 7.75% return on a $47.4 million rate base.

New Jersey — New Jersey Natural Gas Co. — Settlement discussions are ongoing in New Jersey Natural Gas' pending base rate case (Docket GR24010071), and an agreement may be announced at any time. The New Jersey Resources Corp. subsidiary is seeking a $219.9 million rate increase that reflects a 10.42% return on equity (54.08% of capital) and a 7.52% return on a rate base valued at $3.346 billion.

New Jersey — Elizabethtown Gas Co. — A rate case is ongoing for privately held Elizabethtown Gas, and while there have been no formal announcements, settlement discussions are a routine part of New Jersey rate cases, and most cases are resolved via settlements. The company is supporting a $70.3 million rate increase (Docket GR24020158) premised upon a 10.75% return on equity (57.00% of capital) and an 8.33% return on a $1.813 billion rate base. South Jersey Industries Inc., the parent of Elizabethtown Gas, is owned by a private equity concern.

New York — Orange and Rockland Utilities Inc. — A settlement is in the process of being finalized in Orange and Rockland Utilities' pending electric and gas rate proceedings (Cases 24-E-0060 and 24-G-0061, respectively). The Consolidated Edison Inc. subsidiary supports a $10.7 million electric rate hike based on a 10.25% return on equity (50.00% of capital) and a 7.58% return on a $1.305 billion rate base. The company also supports a $17.5 million gas rate increase based on a 10.25% return on equity (50.00% of capital) and a 7.58% return on a $711.2 million rate base.

Other

Texas — CenterPoint Energy Houston Electric LLC — Settlement negotiations were underway in the CenterPoint Energy Inc. subsidiary's mandatory rate case (Docket 56211) when litigation related to outages caused by Hurricane Beryl led the company to withdraw the case. Several intervenors have challenged the withdrawal, and the administrative law judge rejected the motion to withdraw the case. The company has appealed the judge's ruling, but discussions could resume in November if the procedural ruling is upheld. The Texas Public Utility Commission heard oral arguments Oct. 24 and indicated that the commission would rule on the request to withdraw the case at its Nov. 14 open meeting.

Commissioners

Developments are expected in November that will impact the composition of several state commissions.

In November, the term of President Twinkle Andress Cavanaugh of the Alabama Public Service Commission is due to expire. Cavanaugh is running unopposed in the 2024 general election.

The following commissioners are serving beyond the expiration of their terms, pending reappointment or replacement: Chairman Marissa Paslick Gillett of the Connecticut Public Utilities Regulatory Authority (PURA), PURA Vice Chairman John Betkoski III (D), who is expected to retire at the end of 2024, and Michael Caron (R) of the PURA; Harold Gray (D) of the Delaware Public Service Commission; Maida Coleman (D) of the Missouri Public Service Commission; Marian Abdou of the New Jersey Board of Public Utilities; Abigail Anthony of the Rhode Island Public Utilities Commission; Chairman Delton Powers II, Vice Chairman Justin Williams, Florence Belser, Carolee Williams, Headen Thomas and Stephen "Mike" Caston of the Public Service Commission of South Carolina; Vice Chairman John Hie (R) of the Tennessee Public Utility Commission; and Lori Cobos of the Public Utility Commission of Texas.

In several instances, commissioners have been appointed/reappointed and are serving pending confirmation, including Chairman John Espindola and John Springsteen of the Regulatory Commission of Alaska; Matt Baker (D) of the California Public Utilities Commission; Chairman Doug Scott (D) of the Illinois Commerce Commission; Mary Pat Regan and John Will Stacy (D) of the Kentucky Public Service Commission; Hwikwon Ham (I) of the Minnesota Public Utilities Commission; Tennessee PUC Chairman David Jones (R); Chairman Thomas Gleeson and Courtney Hjaltman of the Texas PUC; and Kristy Nieto and Marcus Hawkins of the Public Service Commission of Wisconsin.

On July 25, Connecticut Gov. Ned Lamont (D) appointed David Arconti Jr. (D) to the Connecticut PURA. Arconti's appointment is subject to confirmation by the General Assembly, and he began serving Aug. 5. Additionally, it was announced that Vice Chairman John Betkoski III (D) will resign from PURA at the end of 2024.

In December, a seat on the New Mexico Public Regulation Commission (PRC) will expire. By Nov. 7, the PRC nominating committee must provide the governor with a list of qualified candidates for appointment to a six-year term on the commission.

In addition to a vacancy on the Public Service Commission of South Carolina, all current six members are serving beyond the expiration of their terms. The General Assembly elects commission members from each of the state's seven congressional districts. Late this summer, the legislature suspended the screening process of potential applicants for the seven available seats due to a new lawsuit challenging the state's redrawn congressional districts.

There are also vacancies on the Regulatory Commission of Alaska, the Connecticut PURA, the Maryland Public Service Commission and the New Jersey Board of Public Utilities.

FERC

On Nov. 1, the Federal Energy Regulatory Commission will convene a technical conference in Docket AD24-11 to discuss generic issues related to the colocation of large loads at generating facilities. Panelists expected to speak at the technical conference include representatives from the North American Electric Reliability Corporation, Talen Energy Corp., the PJM Interconnection LLC's Independent Market Monitor, and public utility commissioners from Pennsylvania, Indiana and the District of Columbia.

On Nov. 4, FERC will convene a settlement conference in a proceeding (Docket ER24-96) to consider a transmission formula rate filing submitted by PG&E Corp. subsidiary Pacific Gas and Electric Co. (PG&E). In the rate filing, PG&E proposed a 12.37% base ROE plus a 50-basis point ROE adder for the company's continuing participation in the California ISO. On Dec. 29, 2023, the FERC rejected PG&E's request for the 50-basis point adder and set the balance of PG&E's rate filing for hearing and settlement judge procedures.

On Nov. 12, FERC will convene the first public meeting of the Federal and State Current Issues Collaborative in Docket AD24-7 to explore cross-jurisdictional issues relevant to the FERC and state utility commissions. The first overarching topic the collaborative will discuss is gas-electric coordination.

On Nov. 14, FERC will convene a settlement conference in a proceeding (Docket ER24-268) to consider a transmission rate case filed by NextEra Energy Inc. subsidiary Florida Power & Light Co. (FP&L). FP&L proposed to increase the stated rate for transmission service on the company's Peninsular Florida system from $2.56/kW-month to $3.66/kW-month, or more than 43%. FP&L projected a net annual revenue requirement of $1.05 billion, an increase from the company's 2022 revenue requirement of $771.9 million, and a transmission rate base of $8.74 billion, an increase from $6.18 billion in 2022. FP&L based its proposed rates on a 10.80% ROE, a capital structure of 59.60% equity and 40.40% debt and a long-term debt rate of 4.27% based on average costs of both actual and projected long-term debt.

On Nov. 15, FERC will convene settlement conferences in a proceeding (Docket RP24-744) to consider a pipeline rate case filed by Southern Natural Gas Co. LLC (SNG) proposing a systemwide general increase in the pipeline company's rates of approximately 12%. SNG stated the proposed rates reflect a total cost of service of $701.4 million, an increase from $631.5 million in the company's previous rate case in 2009, and a total rate base of $2.10 billion, an increase from $1.97 billion in the 2009 rate case. SNG also stated that it developed its proposed rates with an overall cost of capital of 11.40%, a debt-to-equity ratio of 35.68% to 64.32%, a cost of debt of 6.22% and a 14.27% ROE.

On Nov. 21, FERC will hold its regular monthly agenda open meeting.

Elections

The 2024 general election will take place Nov 5. Nine states will hold utility commission elections for 14 seats, and 11 states will hold gubernatorial elections.

Six of the states holding utility commission elections have one commissioner seat on the ballot in each state: Alabama, Louisiana, North Dakota, Oklahoma, South Dakota and Texas. In Arizona and Montana, three commissioner positions will be on the ballot, while Nebraska will hold two commissioner elections.

Nine of the 11 states holding gubernatorial elections in November allow the governor to appoint members of the state's regulatory bodies and designate the chairs of the regulatory bodies.

Within the first year of the governors' new terms, approximately 11 commissioner seats across nine states will expire. In seven of these states, it is guaranteed that a new governor will make the next appointment or reappointment.

For a more detailed analysis of the gubernatorial candidates and their stances on energy issues, refer to RRA's Topical Special Report "General Elections: A deep dive into the 2024 state-level elections."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

Theme

Location