Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — March 10, 2025

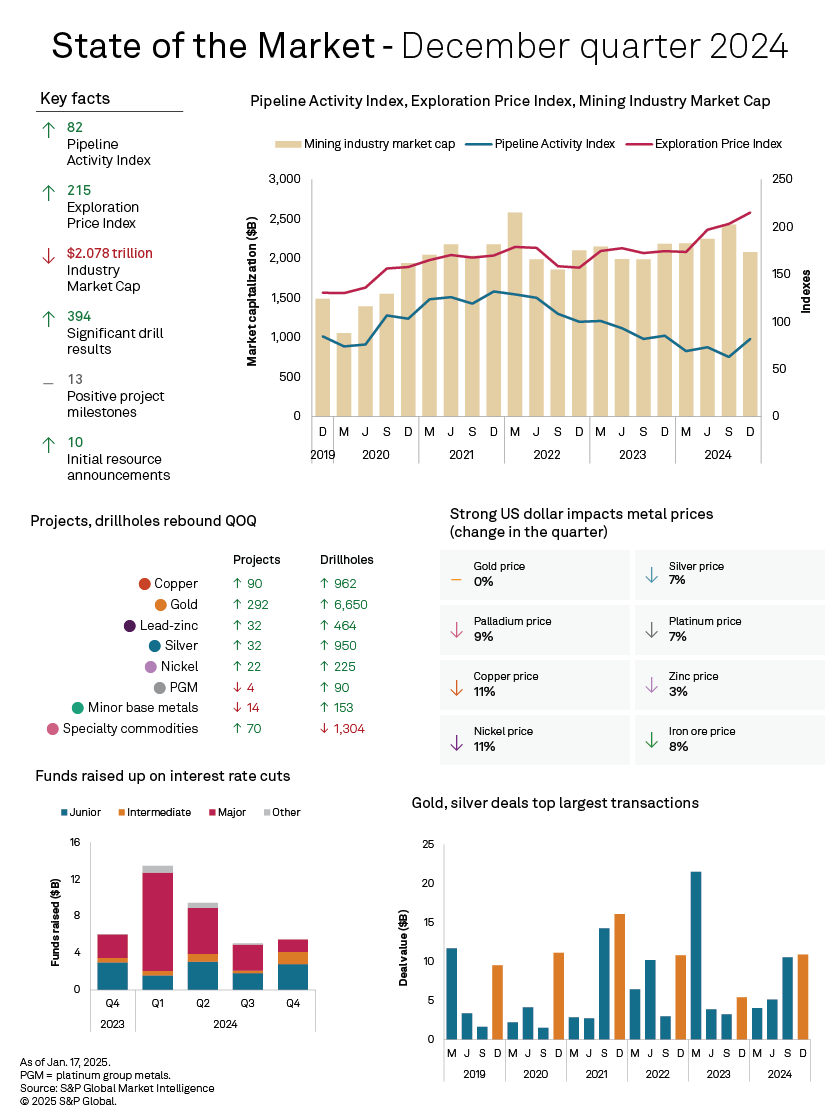

S&P Global Commodity Insights' "State of the Market" quarterly report highlights key trends and activity across the global metals and mining sector during the December quarter of 2024.

Access the full report and databook.

Markets remained optimistic in the December quarter of 2024 despite concerns over the potential effects of the incoming US administration's policies on inflation and the US Federal Reserve's shift toward a more hawkish stance. The S&P 500 rose 3.1% in the fourth quarter, concluding 2024 with a strong performance of 23.3%. These developments, along with the relative strength of the US economy compared to its key counterparts, contributed to a 7.2% appreciation of the US Dollar Index from October to December. The strengthening dollar also led to declining prices for all covered commodities, except graphite, throughout the quarter.

The mining sector improved, with the Pipeline Activity Index (PAI) increasing to 82 from 63 in the December quarter, bolstered by enhancements in fundraising and drilling activities, though it remained near a four-year low. Following two consecutive quarters of decline, mining companies raised $5.46 billion, an 8% quarter-over-quarter increase primarily driven by gains from junior and intermediate companies. The total number of projects and holes drilled also increased to 556 and 10,798, respectively, representing a growth of 21% and 4%.

Looking at the March 2025 quarter

Starting 2025, the S&P 500 Index has faced volatility due to the incoming US administration's inconsistent signals surrounding tariffs on its neighboring countries and China. US economic data indicates that the economy is still robust, highlighted by strong nonfarm payrolls for December. This supports the Fed's careful stance regarding rate cuts and its choice to maintain steady rates during the most recent decision at the end of January. Meanwhile, China's 50.1 manufacturing PMI for January fell short of expectations. In the Middle East, Israel's ceasefires with Hamas and Hezbollah offer a glimmer of hope, although the region continues to be on the edge due to the fragile nature of the truce.

Drilling activity in January had 5,343 reported drillholes, down 3.9% from December and also 3.9% lower year over year. Despite the volatility associated with US tariffs, the markets continue to show an upward trend, with the S&P 500 rising 2.7% and the S&P/TSX Global Mining Index up 6.7% in January.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.