Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Sep 13, 2023

By Laura Denman

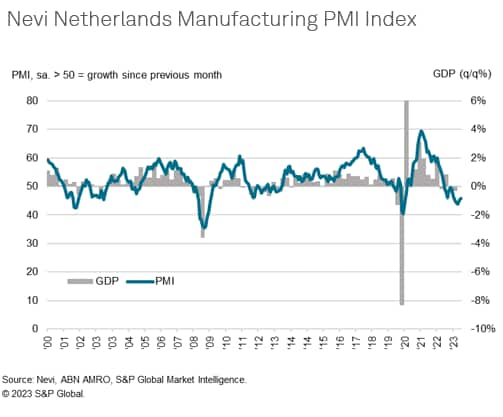

The Netherlands followed its neighbour, Germany, into a technical recession in the second quarter of 2023, with GDP shrinking by 0.3%, as per the initial estimate published by Statistics Netherlands last month. This contraction comes on the heels of a 0.4% quarterly decline in the first quarter of the year and marks the Dutch economy's first recession, albeit a mild one, since the initial onset of the pandemic.

Since the start of the year, Nevi Netherlands Manufacturing PMI data has pointed towards weakening trends across the sector with firms often reporting having scaled back production due to deteriorating demand conditions, particularly at some of the nations' key trading partners. However, the figures for August show early signs of the downturn stabilizing and offer a glimmer of hope for the Dutch economy in the near future.

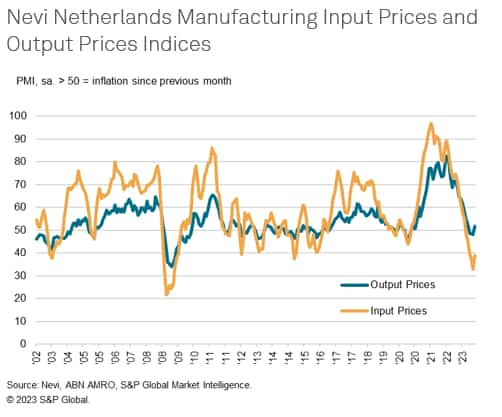

August PMI data continued to highlight weakness within the Dutch manufacturing sector. At 45.9, the headline PMI figure marked a year-long sequence of decline in the overall health of the Dutch manufacturing sector. The ongoing contraction in the goods-producing economy remained driven by a lacklustre demand within the sector. Over the past few months, new orders have experienced substantial declines, with the sharp decrease recorded in the June just gone ranking among the most sizeable in survey history. Official data was harmonious with PMI data with Statistics Netherlands estimating consumer spending to have fallen 1.6% on the quarter. According to panel members, recent inflationary pressures and the associated interest rate hikes have been the primary factors weighing on demand.

Given that exports make up approximately 29% of Dutch GDP, the sustained reduction in new export inflows has likely exerted significant pressure on the sector. New export orders received by Dutch manufacturing firms fell rapidly during August, marking the thirteenth decrease in successive months. Around 70% of these exports are destined for other EU countries, rendering the Netherlands particularly vulnerable to the demand fragility currently plaguing this region.

With machinery & transport equipment accounting for 28%, and mineral fuels making up 23% of the nation's total exports, the worrying trends revealed in the latest S&P Global Europe Sector PMI data are particularly alarming for the Dutch manufacturing sector. August survey data revealed that Machinery & Equipment saw the sharpest fall in new orders of the 20 monitored industries while the downturn in European demand for Chemicals was considerable and the most pronounced since May.

Other indices also reveal a bleak landscape for Netherland's manufacturing sector at present. The resilience of good producers with regards to their hiring has finally waned, leading them to initiate workforce reductions in a bid to curtail expenses. The level of Dutch manufacturing employment fell for the third straight month and at the fastest pace in close to three years during August.

Elsewhere, manufacturers reportedly looked to continue winding down purchasing to mirror subdued demand trends. Input buying declined for the twelfth month in a row and at a strong pace. Pre-production inventory levels contracted at the strongest rate since November 2011.

Inflationary pressures and the associated interest rate rises have been factors weighing on Dutch domestic spending habits. However, the latest PMI data has been indicative of some signs of improvement in this area. Input prices fell for the sixth month in a row during August and at considerable pace.

However, lagged effects of the previous interest rate hikes by the ECB are expected to persist in the short term, given the current base rate of 4.25%. Moreover, with the Eurozone still grappling with stubborn inflationary pressures, it is unlikely that the central bank will entertain any interest rate cuts until mid-2024. Consequently, the ongoing downward pressure on domestic spending patterns that stems from this source is likely to continue in the near-term.

Despite the prevailing negative trends encapsulated by both the PMI survey and official data releases, manufacturing firms and economic forecasters express a relatively optimistic outlook for the year-ahead. During August, the Future Output Index registered above the neutral 50.0 threshold to signal that Dutch goods producers expect to see an increase in activity levels in the coming 12 months. Opportunities expected to support growth include forecasts of enhanced demand conditions, planned investments, new product development initiatives, and the commencement of fresh projects.

Meanwhile, S&P Global Market forecasters expect to see modest growth of 0.5% over the course of 2023, followed by an improvement to 0.9% annual expansion in GDP in 2024. While these figures represent slight downward revisions compared to previous forecasts (0.7% and 1.0% for 2023 and 2024 respectively), they nonetheless signal a positive trajectory for economic recovery in the latter part of the year.

Having reached a three-month high during August, the headline PMI displays some encouraging signs for the future. Therefore, the forthcoming PMI data will likely offer further insights into the unfolding economic landscape and provide early indicators of what lies ahead. Next PMI data release scheduled for October 2nd, 2023.

Access the Netherlands Manufacturing PMI press release here.

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.