Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Dec 07, 2023

By Matt Chessum

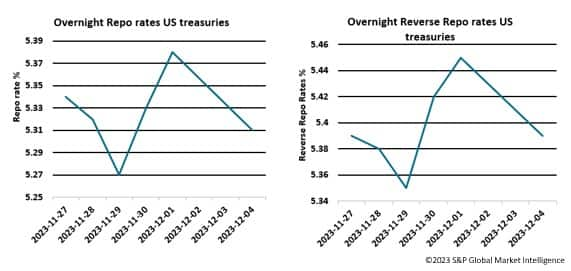

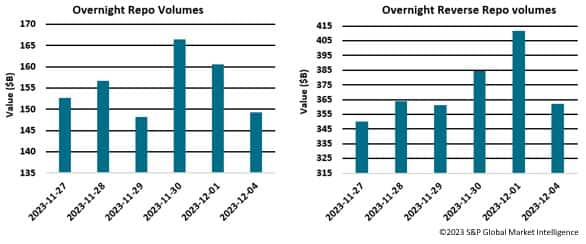

Despite a much quieter year-end period than has been experienced for many years, investors were recently caught off guard as SOFR spiked and demand for cash over November month-end increased significantly. Rates and volumes in both repo and reverse repo markets spiked between November 30th and December 1st as a result, as investors turned to the financing markets to source liquidity.

An increase in Treasury yields throughout the month of October and during the first week of November heightened the attractiveness of holding US treasuries. The growth in returns led to a rally in US government bonds throughout November as investors attempted to lock in the higher yields on offer. As a result, an increase in demand for financing took place via the repo markets. This expansion of financing requirements led to a peak in the Secured Overnight Financing Rate (SOFR) over the November month-end period. SOFR hit 5.39% on December 1st, its highest level since replacing Libor in April 2018. This benchmark high was reflected across both sections of the repo market with financing rates remaining elevated over the first few days of December before slowly declining thereafter. Since month end, overnight rates have stabilized, and the most recent increases appear to be an anomaly rather than the new norm.

A number of factors have been listed for this sudden rise in month end rates. The recent Treasury rally and the demand for financing, the paring back of banks repo market lending over the month end period and the increased volumes of Treasuries in the market as a result of quantitative tightening and new issuance, have all been cited.

Until this recent spike in demand for cash, the year-end positioning period has remained fairly benign. The disappearance of the potential for negative rates, a steepening of the yield curve and cheaper funding in the short end have all led to an orderly and relatively calm year-end period. As asset allocations change and market volatility increases, however, it appears the potential still remains for year-end to be more of a sleigh ride than market participants may have otherwise anticipated.

For more information on how to access this data set, please contact the sales team at:

h-ihsm-global-equitysalesspecialists@spglobal.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.