Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 10 Dec, 2021

By Milan Ringol

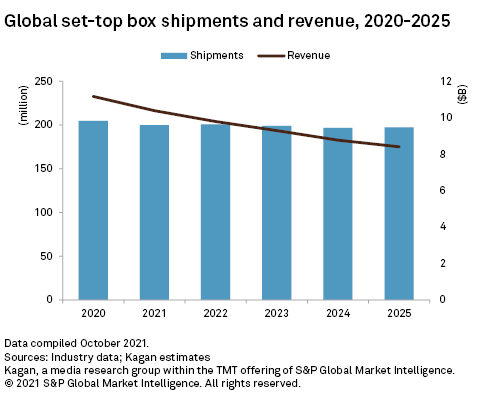

Global set-top box shipments are expected to shrink at a -0.7% CAGR from 2020 through 2025 as pay-TV subscriber growth continues to slow in most of the world, according to Kagan's latest forecast. As subscribers decline and the installed base shrinks, surplus inventory is re-deployed and the need for new boxes decreases. The increasing demand for 4K boxes is driving much of worldwide set-top box shipments, buoying the broader segment from a far faster decline.

Streaming video alternatives continue to entice consumers to cut the cord in mature TV markets and have become common augmentations to the traditional TV experience in many homes worldwide. Streaming service stacking, wherein a household subscribes to multiple OTT services, is becoming more common as consumers deal with the fragmentation of online video content sources, which has been exacerbated by many content owners also offering their own streaming platforms. This stacking trend chips away at the consumer's home entertainment budget and can lead to further cord cutting.

North America is leading the STB shipment decline, with Latin America and the Caribbean as well as Western Europe not far behind as satellite TV operators in those regions are scaling back operations. However, the continued growth of free-to-air satellite TV households across Africa and India are expected to help mitigate the decline in satellite set-top box shipments.

Meanwhile, Cable box shipments are on the decline as the subscriber base shrinks in North America. This is also the case across Western and Eastern Europe as IPTV leeches some of those cable subscribers. IPTV subscribers are growing across all regions except North America but, somewhat paradoxically, global telco set-top box shipments are in fact declining. The influx of IPTV subscribers in 2020 is much lower compared to the rapid growth from 2015 to 2018 that was facilitated by massive fiber buildouts in China. With fewer new customers, demand for new boxes similarly declined.

MI clients can access our full report that breaks out set-top box shipments across regions and supported resolution, as well as individual breakout for the cable, satellite, and IPTV STB markets.