Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 May, 2017 | 13:30

Highlights

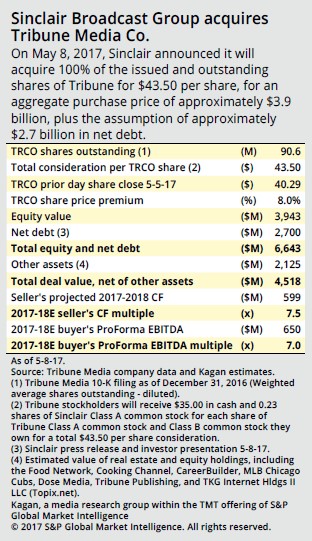

Sinclair's winning bid of $43.50 per share for Tribune Media on May 8 is valued at 7.5x 2017-18 cash flow on the seller's side and 7.0x on the buyer's side with expected synergies.

The following post comes from Kagan, a media research group within S&P Global Market Intelligence. To learn more about this research, please request a call.

Based on estimates from Kagan, a media research group within S&P Global Market Intelligence, the $43.50 per share deal for Tribune Media Co. by Sinclair Broadcast Group Inc. is valued on the lower end of recent TV station deals at 7.5x 2017-18 average cash flow on the seller's side and 7.0x on the buyer's side based on company guidance of $650 million in 2017-18 average pro forma EBITDA, including expected synergies.

Despite a rumored bid by 21st Century Fox Inc. and Blackstone Group LP to fund a potential TV station group joint venture offer with Tribune Media and other potential buyers including Nexstar Media Group Inc., Sinclair came out on top in a deal that values the broadcast assets and WGN America at an estimated $4.5 billion and the minority interests in Food Network, Cooking Channel, CareerBuilder LLC, real estate and other assets at $2.1 billion.

Sinclair's deal price for Tribune Media breaks down to $35.00 in cash and 0.23 share of Sinclair class A common stock for each share of Tribune class A common stock and class B common stock for a total consideration price of $43.50. Sinclair has secured $5.6 billion in financing from JPMorgan, Royal Bank of Canada and Deutsche Bank, including $785 million in a bridge loan that would represent 5.0x debt leverage on a blended 2016-17 average pro forma EBITDA, including expected synergies.

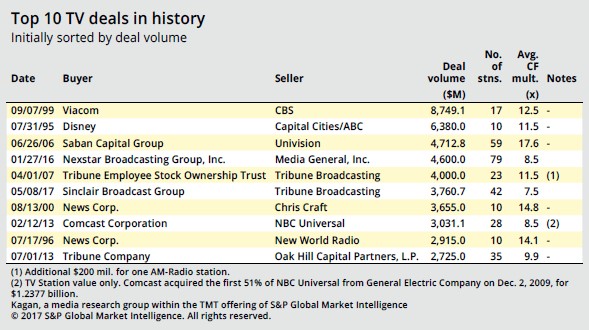

Our deal valuation by business segment estimates the Tribune Media TV station group at $3.76 billion, or 57% of Tribune Media's total deal value. Of the top 10 TV station deals in history, this deal ranks sixth overall and second since the Great Recession behind Nexstar's $4.60 billion deal for Media General in January 2016.

Including Tribune Media's radio station WGN-AM in Chicago valued at $52 million, cable network WGN America valued at $628 million, or approximately $8 per sub, the digital multicast networks Antenna TV, THIS TV and Zap2it.com, we valued the Tribune Media television and entertainment segment at $4.5 billion at an average 7.5x CF, or 68.0% of the total Tribune Media deal value of $6.6 billion.

In analyzing the overlap of Sinclair and Tribune markets, based on 10-K filings including joint sales agreement/shared services agreement stations and pending station deals, the 233 owned and/or operated TV stations located in 108 markets and would be the largest ABC, FOX, The CW and My TV affiliate group and the second-largest CBS and the third-largest NBC affiliate group by a number of stations.

On a pro forma basis excluding potential divestitures, the combined group would cover 72% of U.S. TV homes and 45% on a 50% UHF-discounted TVHH basis, which would be over the current 39% FCC ownership cap. Sinclair's President and CEO Chris Ripley said in the investor call that he hopes that the regulators agree that the 14 overlapping markets "have no impact on overall competition" and will not have to sell any of them.

Based on Kagan estimates, the combined Sinclair and Tribune would be by far the largest TV station group, with 2017-18 average net ad revenue of $2.9 billion and gross retrans revenue of $1.4 billion for a total of $4.3 billion. However, that is before expected synergies with Sinclair, which would seek to step-up retrans per sub rates for Tribune stations in the next round of renewals.

This is a transformative deal and, if given shareholder and regulatory approval, could set a precedent for more large-scale deals that will reshape the broadcast TV landscape.