Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Jan 17, 2024

By Matt Chessum

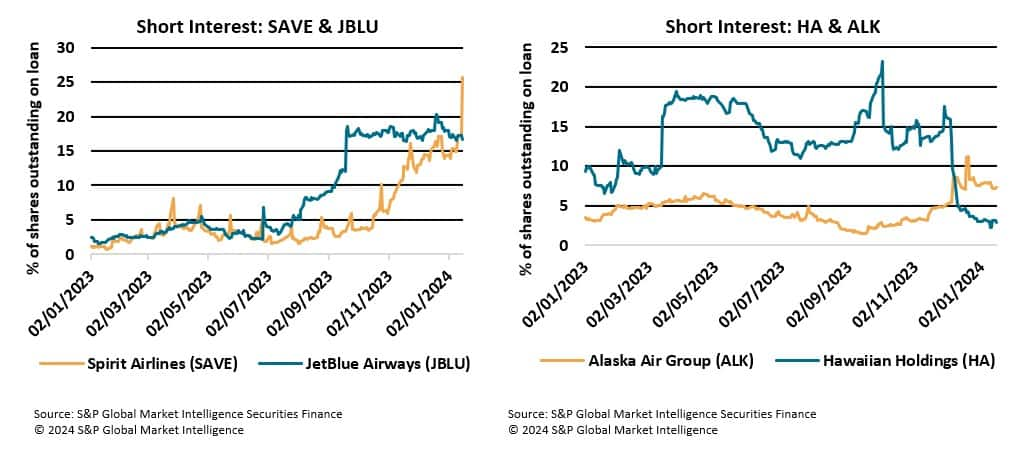

Short interest in Spirit Airlines (SAVE) has recently spiked after a judge blocked the company's proposed merger with JetBlue Airways (JBLU). The news of the decision led to a sharp fall in both companies' share prices, attracting an increase in interest from short sellers. Short interest has been building across both companies since July 2023.

The decision to block the merger has led to increased skepticism that Alaska Air Group Inc's (ALK) proposed $1.9B merger with Hawaiian Holdings Inc (HA) will be approved. Alaska Air Group does intend to keep Hawaiian as a separate subsidiary and the deep discount pricing model used by JetBlue Airways and Spirit Airlines does not exist. The difference in business models is possibly reflected in the lower levels of short interest seen across Hawaiian Holdings Inc, which have recently been in decline, and Alaska Air Group, where short interest has remained relatively low. This may change in the coming weeks as markets digest the news, and the probability of a successful merger is reassessed.

Airline stocks have remained under pressure despite the recovery seen across the industry following the pandemic. Airline share prices continue to trade below their pre-pandemic levels as the recent increase in both interest rates and inflation have hit consumer spending and leisure travel. As the risk of recession remains a possibility, airlines are facing a challenging operating and financial environment. Smaller airlines have continued to struggle as financial headwinds restrain their ability to meaningfully challenge the larger carriers.

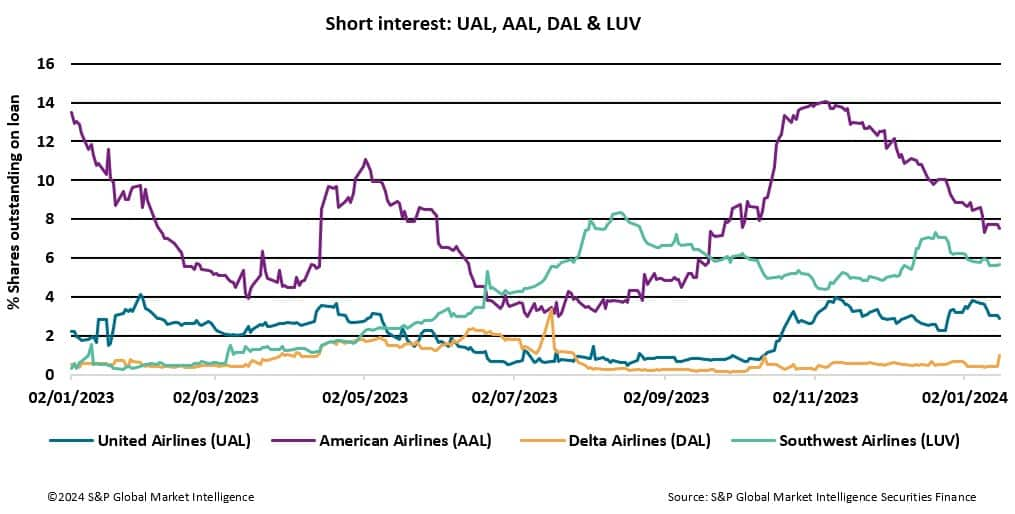

Across the US, the four largest carriers - United Airlines (UAL), American Airlines (AAL), Delta Airlines (DAL) and Southwest Airlines (LUV) control 80% of the domestic market. Short interest has been fluctuating across these companies over the last twelve months but remains subdued in comparison to their smaller rivals. American Airlines is the most shorted company across the top four, with short interest seen reaching a peak during November, when 14% of the company's outstanding shares were on loan.

For more information on how to access this data set, please contact the sales team at:

h-ihsm-global-equitysalesspecialists@spglobal.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.