Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Jun 08, 2023

By Matt Chessum

Global markets are on the cusp of a new bull market - the S&P 500 has gained 12% year to date, the German stock index, the DAX, recently hit an all-time high off the back of easing inflation data, and the Nikkei index in Japan hit a 33-year high as the Bank of Japan chose to retain its ultra-loose monetary policy, boosting confidence in the Japanese equity market. This renewed positive sentiment has been reflected across securities finance markets over the past month as loan balances have been in decline as short covering has taken place.

As investors seek to profit from the rally in the tech sector, increase their interest in companies that service AI, and find consensus regarding future interest rate expectations, bearish bets on stocks have become harder to call. The change in the market environment has become more difficult for investors to navigate as market fundamentals appear to have become less important, and concerns over missing any future market rallies has taken hold.

Across the S&P 500, S&P Global Market Intelligence Securities Finance data shows that daily short interest P&L remained negative throughout the month as the index trended higher.

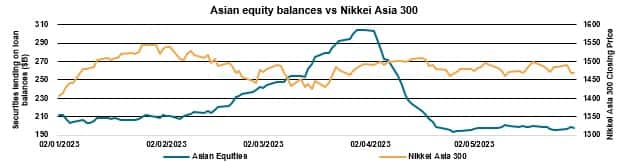

Regional securities finance balances also declined over the month as stock markets continued to make gains.

Moving into the second half of the year, despite a fall in balances, securities finance revenues continue to trend higher, year on year, as average fees have increased. The greater level of confidence in financial markets is likely to be reflected in securities finance revenues in the coming months as the recent volatility, that typically drives revenues higher, starts to dissipate.

For more information on how to access this data set, please contact the sales team at:

Global-EquitySalesSpecialists@spglobal.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.