Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Feb 25, 2021

By Jola Pasku

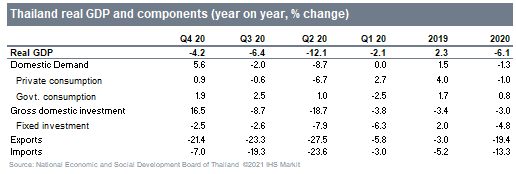

Latest GDP data suggest that Thailand's economic recovery continued through the final quarter of 2020, as the magnitude of contraction eased to 4.2% year on year (y/y) in the fourth quarter, up from 6.2% y/y in the third. Even so, the Thai economy posted the fastest annual contraction (6.1% y/y) in over two decades, reflecting the huge blow from the coronavirus disease 2019 (COVID-19) virus pandemic in 2020.

Public spending struggles to reignite the economy

Private consumption improved in the last quarter on the back of government stimulus measures and special long holidays. Spending on both durable and non-durable goods expanded during the final quarter, but not nearly enough to pull the economy out of negative territory. Private consumption fell by 1% y/y during 2020.

The contraction in private investment eased to 2.5% y/y in the fourth quarter due to higher investment in machinery and equipment. This was from higher imports of capital goods from the launch of new mobile phone models. Investment in construction continued to contract, but the pace of contraction eased as the sales of construction materials picked up. Although this improvement was slightly exaggerated from the low base effect from last year when the budget for fiscal year (FY) 2020 was delayed. Public investment driven by both the government and state enterprises showed a robust growth in Q4, offering the biggest support to growth, but not enough to put the domestic economy in a meaningful recovery path.

COVID-19 disruptions are weighing on Thailand's external sector

On the trade front, high frequency data for merchandise exports reflected some improvement in the fourth quarter, but not necessarily because of market conditions. Exports of goods fell by 1.5% y/y, easing the pace of contraction thanks to a marginal improvement in exports of automotive and petroleum-related goods, which were supported by the modest recovery in trading partners' demand and also the base effect from last year when a lot of oil refineries were closed down for maintenance. Exports of services suffered a 74.8% y/y contraction in the meantime, as the Thai borders remain shut to most tourists.

Lingering COVID-19 related restrictions will delay economic recovery

The latest fourth-quarter GDP result came in line with IHS Markit expectations and confirms our view that the pace of Thailand's economic recovery will disappoint in the near-term. Although 2021 growth will most likely be lifted by favorable base effects, Thailand's growth outlook remains clouded by restrained domestic conditions and an uncertain global economic environment. IHS Markit downgraded the real GDP growth forecast for 2021 to 3.1% in the February forecast round which remains unchanged for now.

The government rolled out a USD7-billion stimulus package last month in response to the second virus wave, which will likely soften the shock from the new wave of infections somewhat. Going forward, private consumption is likely to improve gradually as long as the new wave of infections is contained within the first half of the year. However, high household debt, together with the COVID-19 virus pandemic shock, will remain a major drag on private consumption growth.

On the fixed investment front, the outlook remains dim as sluggish domestic and external demand are expected to trigger some delay in investment decisions by businesses. The hope for better near-term growth prospects lies with the government funded infrastructure projects, as opposed to private sector investments. Therefore, the speed of economic recovery will be dependent on the government's ability to meaningfully jump-start these initiatives.

On the trade front, exports should recover somewhat in 2021 assuming the vaccine rollout drive proceeds in line with expectations around the world. Having said that, the role of exports in driving Thailand's recovery will likely be impeded by a strong currency.

Posted 25 February 2021 by Jola Pasku, Senior Economist, Economics and Country Risk, S&P Global Market Intelligence