Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — May 02, 2023

By Matt Chessum

The first quarter of 2023 was one of the most financially tumultuous since the end of the financial crisis. Despite this, securities finance revenues flourished, and the first quarter of 2023 was one of the best for many years. Along with Bitcoin (+71.2%) and tech stocks (Nasdaq 100 +20.5%), securities finance was one of the big winners during Q1 2023.

During the quarter, both equity and fixed income markets experienced sustained volatility. The quarter started with government bond yields falling as positive sentiment regarding economic growth and the avoidance of a global recession in developed markets took hold. The direction of global interest rates and inflationary moves remained fluid however as the turmoil in the banking sector unfolded and economic data surprised to the upside. Despite the collapse of Credit Suisse in Europe and Silicon Valley Bank and Signature Bank in the US, equity markets generally rose during the quarter, outside of the banking stocks. Growth stocks did particularly well, outperforming value stocks. In the fixed income markets, yields fell (prices increased) over the period despite continued increases, albeit in smaller increments, in benchmark interest rates in the UK, and the US whilst the ECB remained more hawkish increasing rates twice over the quarter by 50bps.

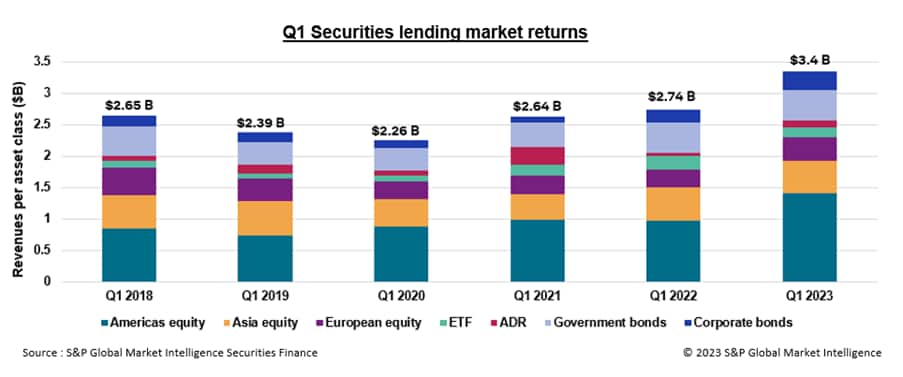

During the first quarter of 2023 $3.415B in revenues were generated, reflecting a 24.5% increase on Q1 2022. During 2023, during every month of Q1, revenues exceeded the $1B mark with the lowest revenue generating month being February ($1.054B, January revenues $1.116B). The Q1 2023 average fee of 53bps increased by 39% when compared with Q1 2022 (38bps). Over the period balances declined by 10% and utilization declined by 1% YoY depicting a more expensive borrowing environment.

Securities finance activity was particularly strong across the Americas and EMEA equity markets over the period. Revenues increased 45% and 36% respectively YoY. US equities specials activity (defined as a volume weighted average fee of greater than 500bps) generated over $1B during the quarter for the first-time, pushing Americas equities to one of the best Q1 revenue numbers on record. Within EMEA, strong March revenues, particularly across Swiss equities, had a similar impact in pushing regional revenues higher. Within the APAC region revenues declined 4% when compared with Q1 2022 after declines were seen in both revenues and average fees across Taiwan, and South Korea.

Exchange Traded Products (ETPs) experienced a 25% decline in revenues when compared with Q1 2022. A few specials in Americas ETPs pushed revenues higher last year in response to the unprecedented speed in interest rate increases. Average fees also declined because of softer demand for these names and a growing consensus surrounding a slowdown in future interest rates moves.

American Depositary receipts produced significantly better returns over the period. Revenues increased 94% to $102M. Average monthly revenues over the Q1 period were higher than during any month of 2022, apart from August. The Electric Vehicle stocks dominated these revenues and continued to attract a lot of demand from borrowers.

Fixed income assets continued to outperform over the period. Both Government and Corporate bonds sustained their near record performance seen over 2022. Corporate bonds became more expensive with average fees and revenues climbing higher despite a decline in on loan balances. Government bonds remained in focus given the volatility seen over the period. Interest rate and inflation concerns continued to benefit government bond demand with short-dated bonds, which remain sensitive to immediate changes in interest rates, remaining the most popular over the quarter.

In conclusion, securities finance revenues over the first quarter of the year were incredibly strong. Despite the increased levels of uncertainty within the macro-economic environment and the market turmoil seen in financial stocks, securities finance activity continued to thrive. With interest rates reportedly close to their peaks and the fallout from the recent banking problems still not fully understood, securities lenders will no doubt be heading into Q2 with cautious optimism.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.