Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Jan 23, 2023

By Matt Chessum

$6.4bln in securities finance revenues generated during H2 -2022, the best performing year since 2008

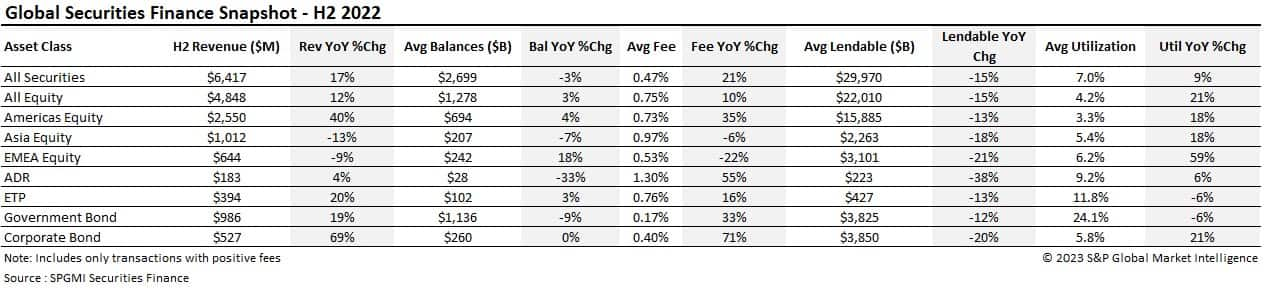

Following on from an impressive H1 2022, a remarkable H2 generated $6.417bln in securities finance revenues. This represents a 17% increase YoY and places 2022 as one of the best years for securities finance revenues since 2008 ($13.2bln) having produced a combined $12.522bln over the full year.

Despite an 8% decline in balances throughout the period, revenues of $6.417bln were still achieved in the six months to December representing an increase of 5% over H1 2022. Average fees for the period increased by a respectable 21% when compared YoY and average utilization followed suit with an increase of 9% when compared with H2 2021. Average utilization for H2 for all securities was 7%.

A combination of increased market volatility, a return of geopolitical risk and the aggressive rise in interest rates produced fertile ground for securities finance participants to generate strong returns across both fixed income and equity asset classes. Americas equities, ETPs, corporate bonds and government bonds all outperformed when compared with previous six-month periods, contributing to the impressive results seen over both the half year and the full year periods.

In the equity markets revenues over the period increased 12% YoY to $4.848bln. Average fees increased 10% to 75bps and utilization increased 21% to 4.2%. The increase in revenues over the period was the result of a fervent specials market in the US. Specials activity in the region peaked during July when 3.9% of the balance in Americas equity contributed over 80% of the regions revenues. Over the period the automobile and components, retail and media and entertainment sectors were all in demand. These sectors remained popular throughout the year.

In the EMEA equity markets Sweden, Switzerland, Netherlands, Turkey, Finland, and Austria all saw impressive increases in revenues. Sweden became the third most profitable market in the region for lenders generating $108m in revenues. Real estate and media and entertainment stocks remained the focus of borrowers in this market. Across the region revenues declined 9% YoY. Average fees also declined (-22%) but utilization increased 59%.

In APAC, YoY revenues decreased 13% to $1.012bln. The only two markets in the region that experienced increases in revenues were Japan and Australia. Australia was the market that shined in APAC throughout the period with revenues increasing 50%, average fees increasing 62% and utilization increasing 3% YoY. Equities in the materials sector remained popular borrows throughout the period. Across other APAC markets, revenues declined significantly in both South Korea and Malaysia along with average fees. Japan was the most important market in the region in terms of revenues contributing 26% of the total figure. Utilization increased significantly over the period to 6.5%.

ETPs experienced a bumper six months. $394m in revenues were generated over the period and balances increased 3%. Most of the revenues were derived from Americas ETPs which contributed 85% of the total. Despite utilization falling 8%, average fees increased by 20% when compared YoY. Nine of the top ten revenue generating ETPs were US ETFs. Popular borrows followed the trend seen across the first six months of the year. Corporate bond related ETFs such as the Ishares Iboxx High Yield Bond ETF (HYG) and main index equity ETFs such as the SPDR S&P 500 ETF (SPY) remained the most popular borrows.

Corporate bonds continued their impressive run throughout the second half of 2022 increasing revenues over each quarter. $527m was generated from the asset class over the period which represents an increase of 69% YoY. Over the period, average fees increased 70% to 40bps and utilization increased 21% to 5.8%. Corporate bond borrowing increased throughout the period as the rate of interest rate rises continued at pace. Falling prices and a decrease in market liquidity increased sustained demand which has yet to show signs of dissipating.

Fee based revenue for government bond lending came in at $986m over H2, the largest over several half year periods and an increase of 19% YoY. US treasury borrowing generated $565m over the period and European government bonds contributed $365m, representing increases YoY of 10% and 32% respectively. Both asset classes profited from impressive increases in average fees. Emerging market government bonds also experienced a strong six-month period. Revenues increased 110% over the period and average fees increased to 47bps representing a 114% increase YoY. Government bonds experienced sustained demand over H2 with a steady increase in fees to December. Short-dated government bonds remained popular as market liquidity dried up across this maturity bucket. Looking towards 2023, without any major change in current market conditions, borrowing activity across this asset class is predicted to remain strong.

Conclusion

2022 was an outstanding year for securities finance revenues. Demand was spread across multiple asset classes with fixed income assets in particular experiencing widespread borrowing interest. Despite a decrease in balances over the period, a strong increase in both average fees and utilization meant that revenues continued to outperform previous half year periods. The simultaneous fall in asset prices across both fixed income and equities throughout 2022 has proved difficult for many investors to successfully navigate. The securities finance markets have played an important role throughout this period, not only in their ability to add value to investors through the generation of increasingly important returns but by providing essential liquidity to financial markets during periods of stress and uncertainty.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.