Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Feb 10, 2023

By . [pulled from SAP] and Jingyi Pan

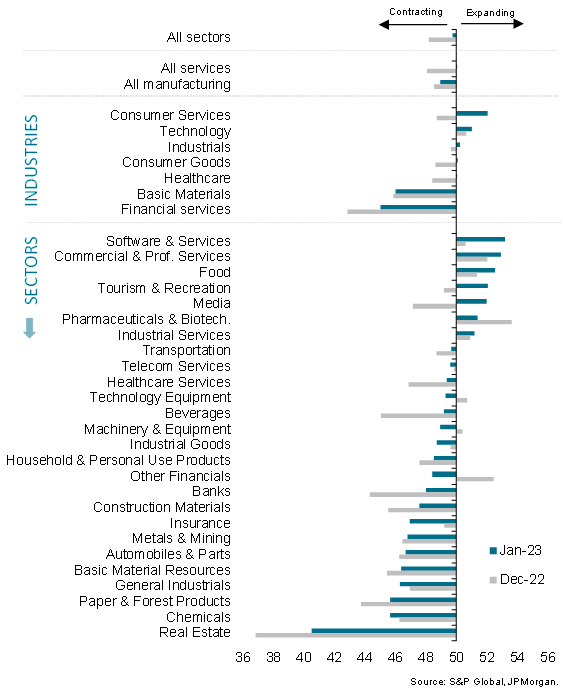

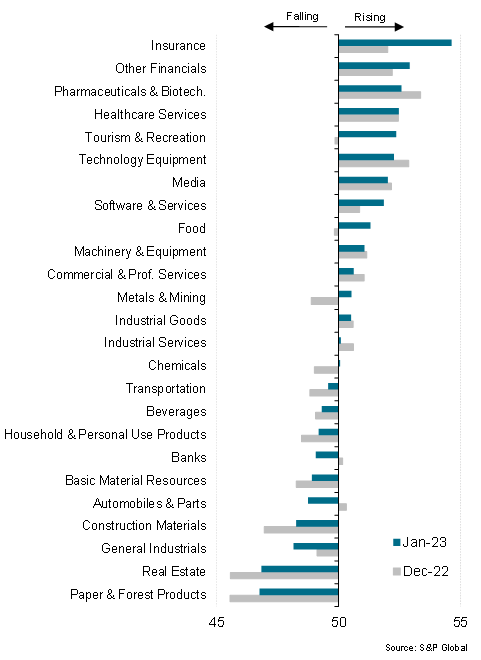

Purchasing Managers' Index (PMI) from S&P Global provide a unique insight into worldwide economic trends, allowing the analysis of business activity by detailed sector in the world's principal regions. The broad picture presented by the latest S&P Global Sector PMI is one of mixed conditions between the sectors, with growth noted in only a handful of industries, led by consumer services, while others remained in contraction, with the steepest decline seen in financial services.

That said, widespread improvements in business confidence about the year ahead were observed with the turn of the year. Meanwhile workforce expansions were recorded in 13 of the 21 sectors tracked, broadly supportive of a better near-term outlook for the global economy. We look closer at which are the sectors driving these positive changes, and which are lagging behind, at the start of 2023, diving into details to assess their near-term outlook.

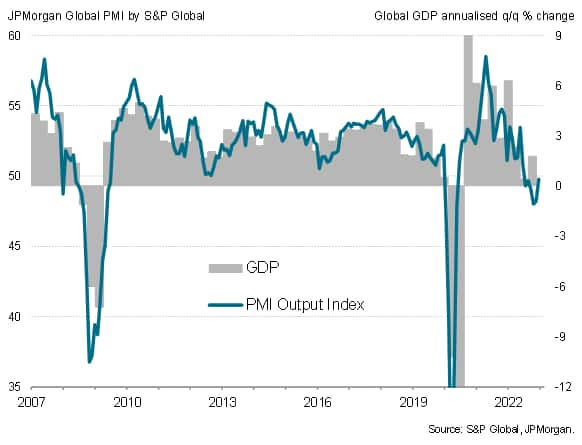

JPMorgan Global Composite PMI output

Global activity contracted at a shallower rate in the first month of 2023 according to the JPMorgan Global PMI - compiled by S&P Global across over 40 economies - which printed 49.8, up from 48.2 in December. This was the smallest drop in output recorded in six months with a divergence noted between manufacturing and services, whereby manufacturing output remained in contraction while services activity grew for the first time since last July.

Only with the more detailed S&P Global Sector PMI data, however, did we observe that this was supported primarily by the outperformance of consumer services activity in January. Global financial services activity meanwhile continued to contract, albeit at a shallower pace compared to December. Sector data further revealed the software & services and commercial & professional services sectors leading the pack in recording higher activity in January.

S&P Global Sector PMI output

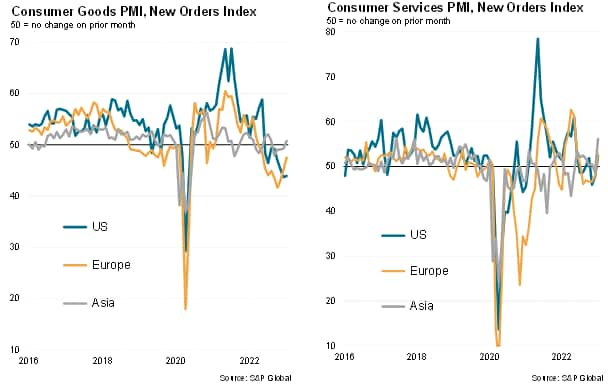

While improvements in both consumer goods and consumer services were recorded from the previous month, consumer services clearly showed a more marked expansion in January compared to consumer goods. With regional data spanning US, Europe and Asia, one is also able to dissect the performance by regions to find out that growth in consumer sectors were concentrated in Asia. Anecdotal evidence provided underscores how the easing of restrictions in mainland China around the turn of the year supported the latest uptick in consumer services with Asia's consumer services output expanding at the fastest pace since result collection began in January 2010.

Furthermore, the seasonally adjusted New Orders sub-index revealed that demand had risen sharply in Asia for consumer services, which bodes well for business activity performance in the coming months.

Consumer sectors new orders by region

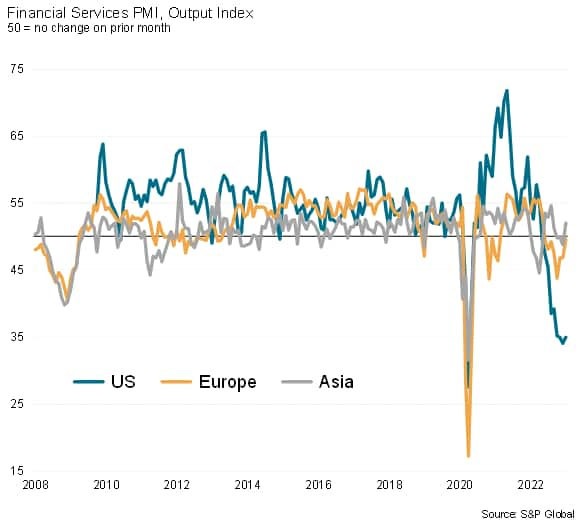

On the other end of the spectrum, financial services fared the worst amongst the industries tracked at the start of 2023. Although the sector's activity shrank at a slower rate compared to the recent December low, it remained faster than the latest 12-month average to reflect a persistent and marked downturn in conditions.

All of the financial services sub-sectors including banks, insurance, real estate and other financials saw business activity decline, led by real estate, which was also the worst performing sector amongst all the 21 sectors tracked in the PMI survey.

A breakdown by regions went on to show that this was driven primarily by a deterioration in financials activity in the US. US financials services output fell at the second joint-fastest pace on record (since 2009) in January as firms remained under pressure from economic uncertainties and the recent tightening of monetary conditions. Although some improvements in business sentiment were also present for US financials, the level of business confidence about future activity remained well below the series long-run average to reflect contained optimism for business activity in the coming 12 months.

Financial Services PMI output by region

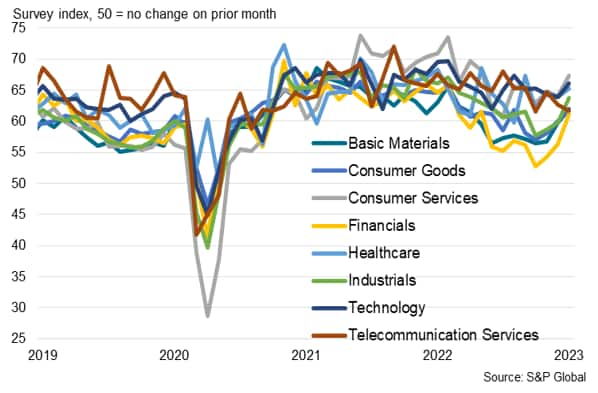

More broadly, however, business sentiment improved across the global sectors at the start of the year. Leading the group in January had been consumer services firms, which also saw the strongest output growth.

With the exception of consumer goods, financials and telecommunication services, the rest of the industries also saw the level of optimism above their respective long-run averages to signal strong expectations for near-term improvements in operating conditions.

As sector PMI hold the potential to provide important signals for investments, as shown here by our case study on utilising national sector PMI data for active equity investment strategies, the future output index will be an important one to watch for the earliest signals.

Global Sector PMI future output

Finally, amid the mixed conditions presented by the latest Global Sector PMI, a key metric that should be of interest is the employment sub-index. Jobs growth not only reflects the reaction by firms to current operating needs, but also their expectations towards future output through their willingness to hold onto staff or expand their workforce capacity.

The latest indications from the Global Sector PMI surveys showed that more than half of the sectors continued to raise their employment levels at the start of year, which is a positive sign. These hiring trends were also present in sectors that may appear surprising, including insurance and other financials, that had experienced steeper contractions in activity over January. Whether a turnaround will be staged in the coming months will be closely watched with our PMI data.

Global employment by sector

Read the accompanying press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.