Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jul 07, 2023

Detailed S&P Global sector PMI survey data have shown resilient worldwide economic growth in early 2023 to have been fuelled by resurgent demand for consumer services amid a post-pandemic shift in spending away from goods towards activities such as travel, recreation and tourism. Along with rising demand for financial services amid higher interest rates and recent market gains, this demand surge has led to sticky global inflation, offsetting a marked cooling in goods price inflation. However, the latest June PMI survey data brought signs that this consumer services upturn - and the concomitant inflationary pressures - is showing signs of moderating, likely due to the growing impact of higher borrowing costs and the increased cost of living in major developed economies.

The implications are that global economic growth and inflation will slow as we move through the second half of the year.

The Global PMI - compiled by S&P Global across over 40 economies and sponsored by JPMorgan - continued to portray a worldwide expansion driven primarily by the services economy in June as manufacturing slipped into a deeper contraction. The divergence between the strong-performing services economy and the increasingly beleaguered goods-producing sector remains among the widest on record.

However, there are signs that the recent revival of growth in the services economy has lost some momentum, with the overall rate of growth in the sector down to its lowest for four months in June amid a slowing of demand growth, including for consumer services. The latter are notable in having played a major role in the global economic resilience seen in recent months, and have also been in focus as the major driver of sustained stubborn inflation in the major developed economies.

Digging deeper by broad industry, the strongest global growth of demand was again recorded for financial services in June, where new orders growth cooled from the two-year high seen in May but remained the second-strongest since October 2021. Within financial services, new orders growth was strongest for insurance services and accelerated for real estate services. Although banking and other financial services both reported notable slowdowns in new business growth, compared to near-record gains in May. Insurance was especially noteworthy in reporting the strongest expansion of demand of all sectors in June and which was also the second-fastest on record for the sector.

The news meanwhile deteriorated for consumer-facing sectors. Global new orders for consumer goods fell, albeit only marginally, for the first time in five months, while new business inflows into consumer services providers grew at the slowest rate since the rebound of this sector began at the start of the year.

Particularly notable weakness within consumer services was seen for tourism and recreation activities. While this sector had led the global sector rankings back in February amid a post-pandemic revival in bookings for leisure activities such as holidays and foreign travel, new business inflows rose at the slowest rate seen so far this year in June, pushing the sector into eighth place in the global rankings. A similar drop in demand growth has been evident for global transportation.

The drop in demand for consumer goods was meanwhile only exceeded by that seen for basic materials, the latter suffering in particular from a demand downturn being exacerbated by global inventory destocking. However, the steepest downturn in demand of all sectors monitored by the PMI was recorded for machinery and equipment goods, which represents a worrying signal for global capital expenditure and investment spending. A similar downturn in orders for construction materials adds to worries about global fixed asset investment.

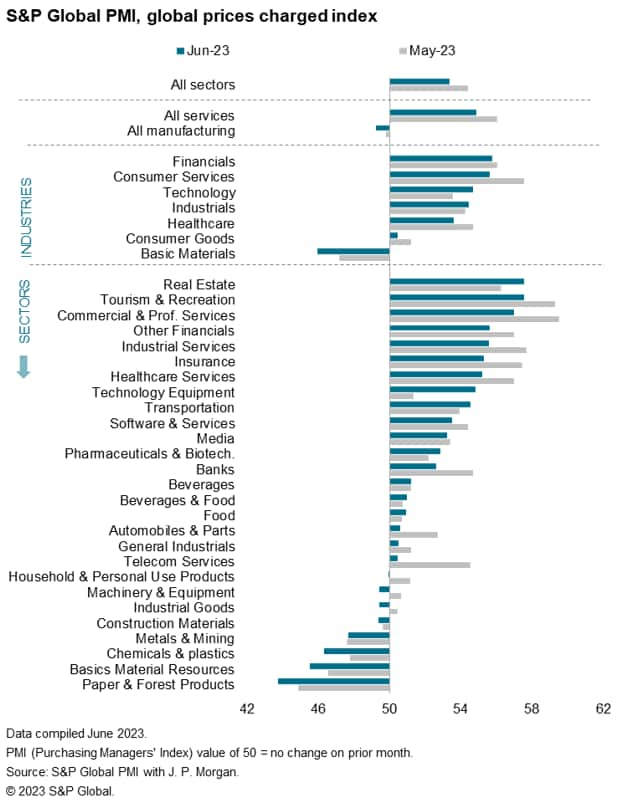

The resurgent demand for financial services also means that these companies have been able to charge higher prices, passing on higher interest rates and higher staff costs. The rate of output charge inflation for financial services products ran above the global average for all goods and services for a fifth successive month in June, seeing the steepest rise of all broad industry categories. Real estate services meanwhile saw the sharpest increase in charges of all sub-sectors.

An especially steep rise in prices meanwhile continued to be recorded for consumer services, and in particular travel and tourism, reflecting the recent upsurge in demand and the need to offer higher pay in response to staff and skill shortages. However, these rates of inflation cooled sharply compared to May, dropping for a third and second successive respective month for both the broader consumer services economy and the narrower travel and tourism sector, hinting at a peaking in this recent upturn in price pressures.

Prices charges by manufacturers for goods meanwhile barely rose, growing at the slowest rate since the initial pandemic lockdowns in early 2020.

Mapping the global PMI goods and services selling price index data against global consumer price inflation illustrates how the PMI tends to act with a lead of around six months on the annual rate of change in global inflation.

The cooling of global inflation so far in 2023 has clearly followed the moderating trend signalled by the PMI, though the PMI points to some stickiness of inflation over the third quarter due to the resurgent demand for services and the impact of higher interest rates on prices levied for financial services. However, this latter kick-up in inflation pressures is now also showing signs of moderating again, suggesting a further easing of inflation in the fourth quarter. Progress in the further calming of these service sector price pressures will be crucial in helping policymakers push headline inflation closer to targets.

Access the global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location