Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

WHITEPAPER — Dec 18, 2023

A spate of events and actions have hit the headlines in recent months regarding Russian trade sanctions and the enforcement of its various components, most notably the Group of 7 (G7) coalition's oil price cap.

Five vessels have been sanctioned in October and November 2023 for violating the price cap. The first two added to the Office of Foreign Assets Control (OFAC) specially designated nationals (SDN) list in October were a United Arab Emirates (UAE)-based registered shipowner with clear association to a Russian group owner and a tanker owned by a Turkish entity. In November, a further three vessels were added to the list. These were all Russian group-owned but with technical or registered ownership in the UAE. US regulators have also implied an impending crackdown on the refining of Russian oil through third countries and its subsequent reexport to G7 nations. Furthermore, a US investigation into 30 shipowners and 100 vessels suspected of breaching the oil price cap is now underway. Alongside these specific sanctioned entities and investigations, the imminent EU's 12th package of Russian trade sanctions is also expected to strengthen the working principles of the price cap. One rumored action being considered is for tankers loading at northern Russian ports and transiting through Danish waters to be inspected by Denmark's coastal authorities to ensure they have appropriate insurance and documentation for their cargo.

The backdrop to these actions is the continuing adaptation of Russia to the price cap and its restrictions. S&P Global Market Intelligence recently highlighted 55%-60% of Russian oil is being shipped outside the remit of a G7 or allied country for insurance services, ownership domicile or ship nationality. The price cap, since its inception in December 2022, has not been revised despite the rising price of Russia's main oil grade, Urals. This has effectively led to a scenario where large volumes of Russian crude oil are being shipped across the world without any bearing to the original price cap figure.

Outside of the maritime space, general containerized trade in goods, including dual-use items, has been uncovered at several new countries where exports to Russia have increased. Trade data for Turkish exports to Russia within the Harmonized System (HS) Code categories recently identified as high-priority goods or economically critical by US and EU regulators have displayed rising values. Other countries have also demonstrated similar attributes.

This paper will identify and analyze the key changes to Russian trade in the preceding 12 months as found in maritime and trade datasets to understand potential changes to trade risk. Equally, patterns and themes within the data that may assist trade finance and supply chain compliance teams and allow them to enhance their screening programs will also be recommended.

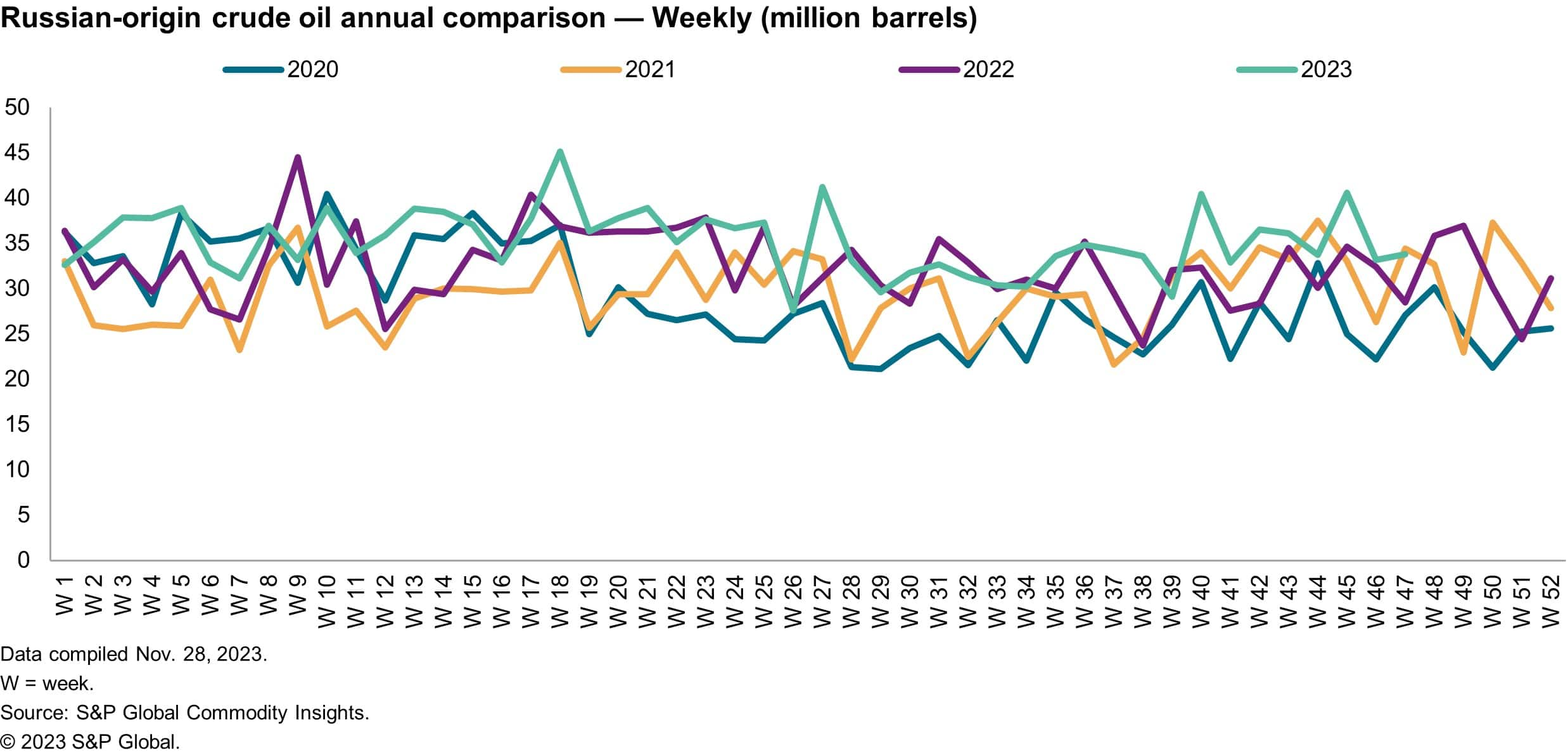

The current flow of Russian seaborne crude for 2023 remains high compared with previous years. In the most recent weeks, Russian exports have continued to increase despite several concerns, including poor weather in the Black Sea.

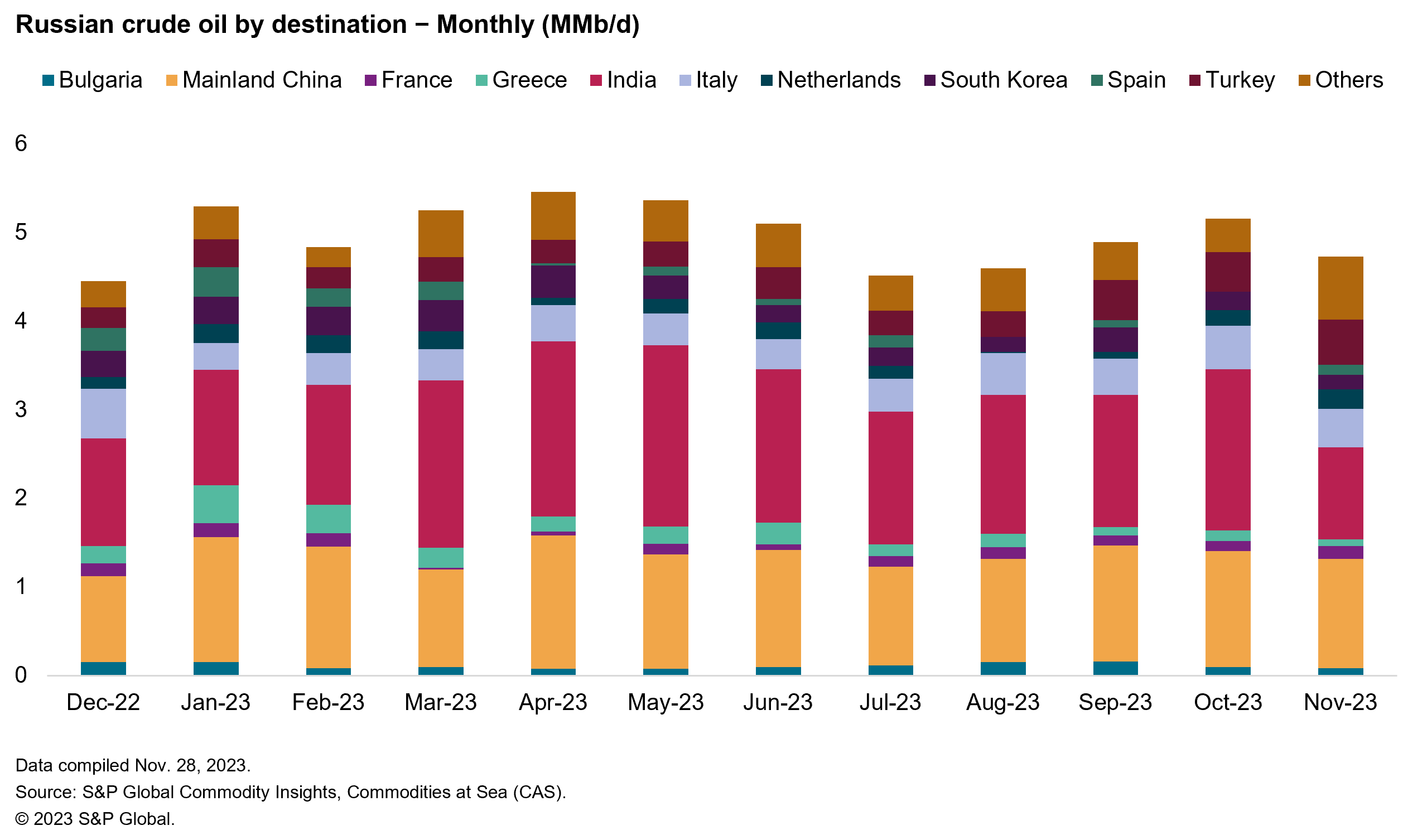

The destinations for Russian crude have remained largely spread across mainland China and India since the price cap introduction. There has been an increase in September through to November 2023 for Turkey as a destination.

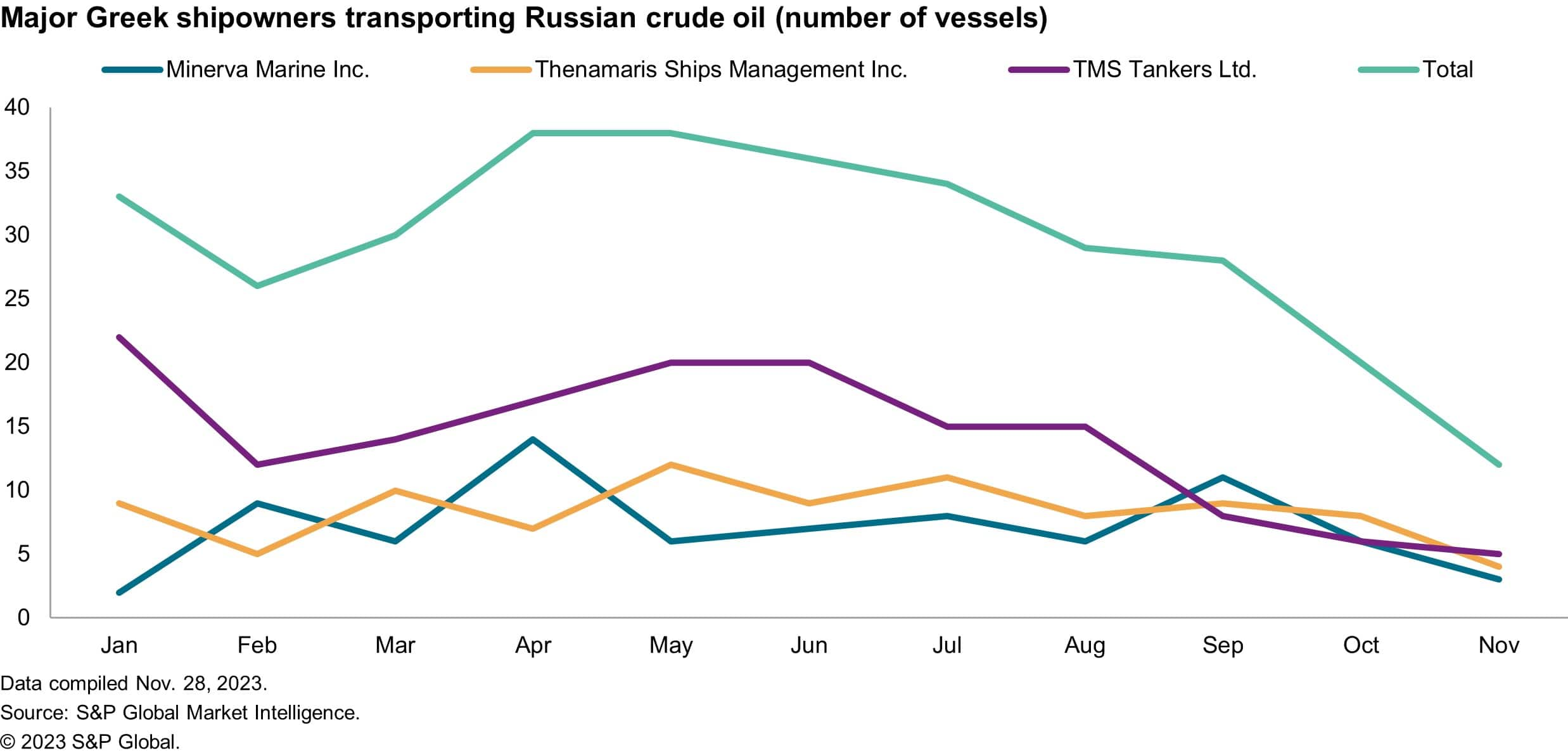

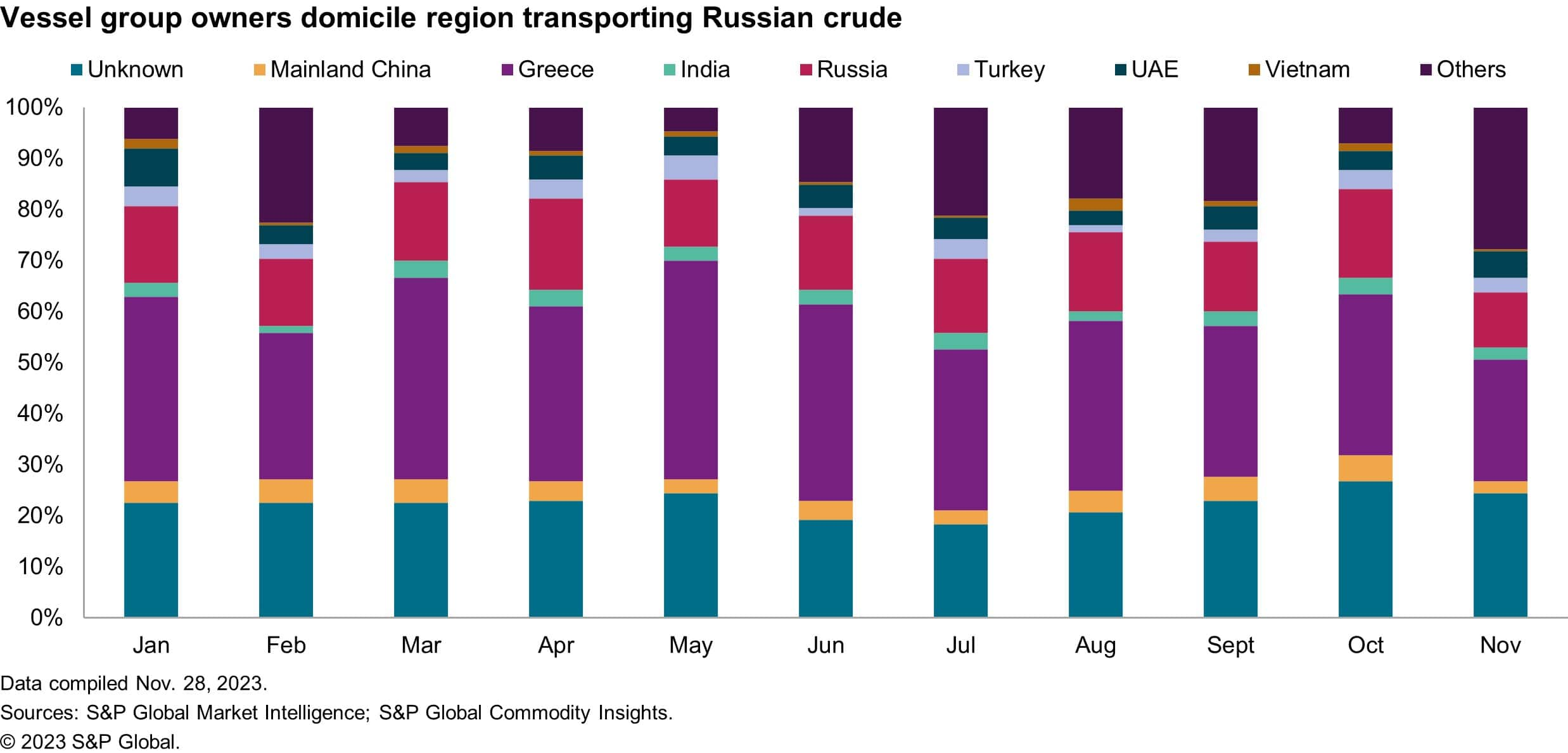

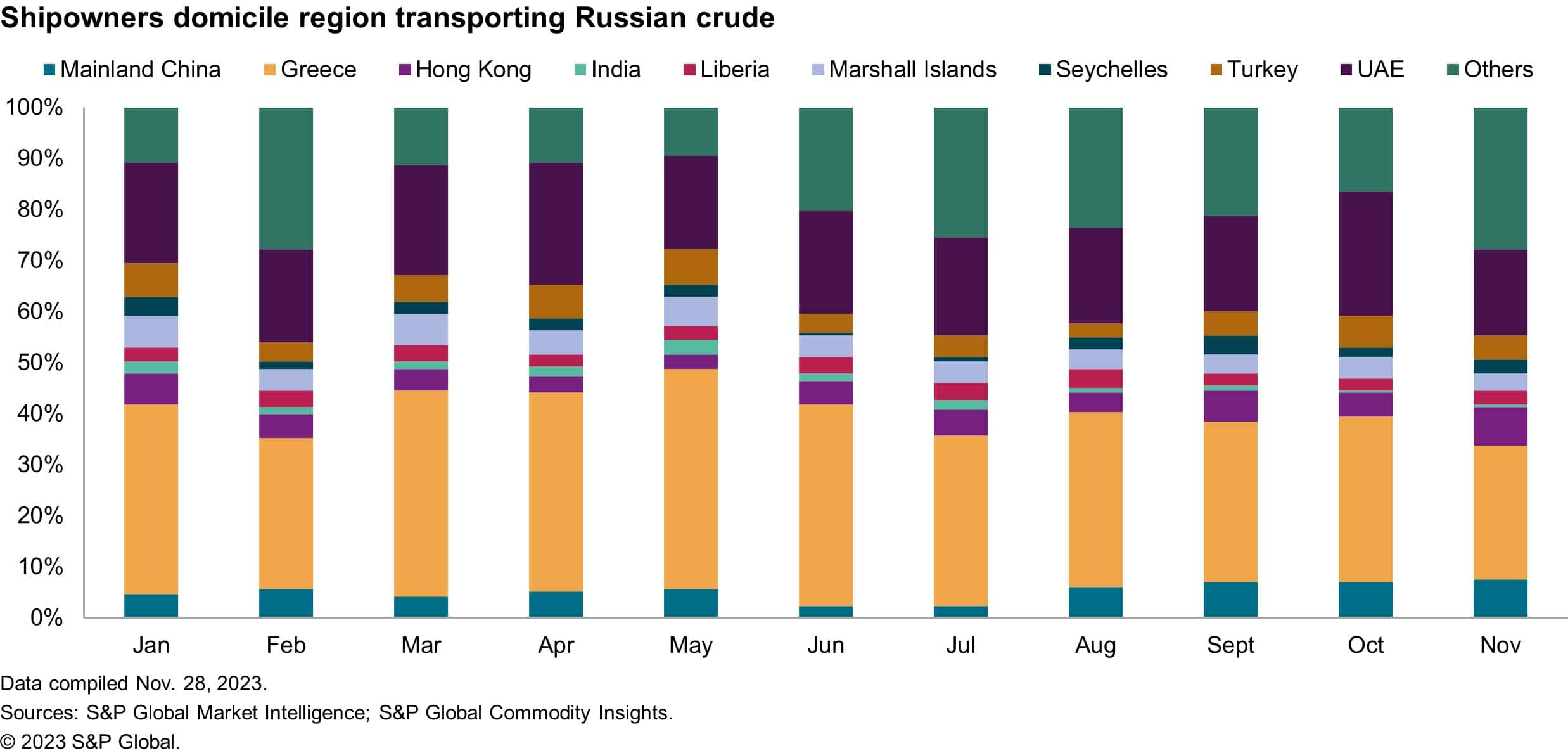

Greek shipping has been actively engaged throughout 2023 in transporting Russian crude oil. This has occurred despite the restrictions on certain maritime practices in the EU's 11th sanctions package on Russian trade and shipping. In the last two months, the number of vessels owned by the largest Greek firms involved in shipping crude has begun to decline.

Potential reasons for this stem not only from the effects of the EU's 11th package, but also the recently sanctioned vessels that US regulators have designated. While the designation of these vessels does not have Greek association, the action itself increases the risk for any ship-owning entity if working closely with Russian crude cargo.

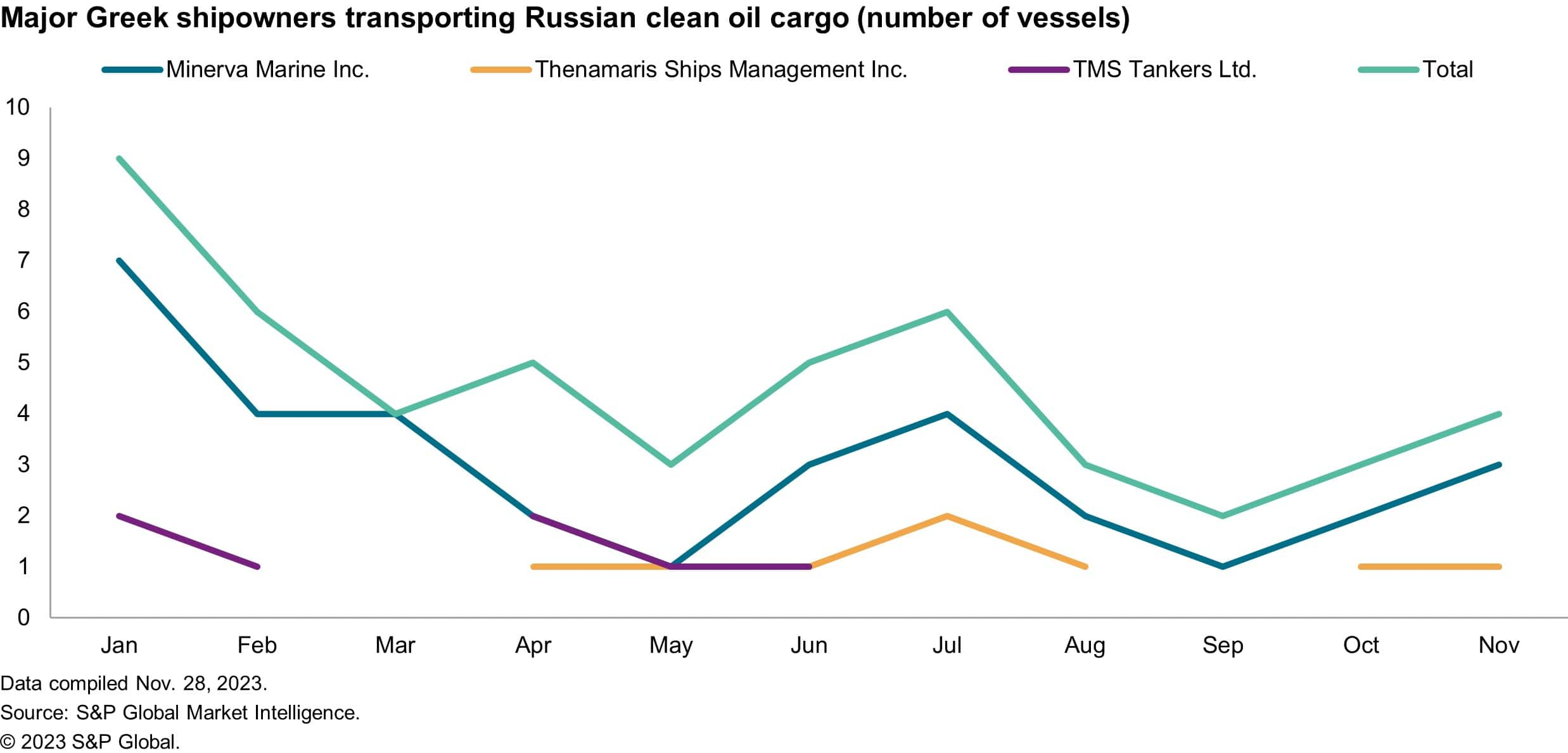

A similar pattern of lower Greek ownership involvement on the transportation of clean oil cargos from Russia, such as diesel, gasoline and naphtha, was also visible during the same time period for the same firms.

Overall, the wider picture supports the current viewpoint that Greek-based owners are shifting away from the transportation of Russian crude. October and November 2023 witnessed partial downward movement but not a complete shift. For vessel group owners involved in Russian crude shipments, there remains substantial Greek participation of at least 20% share of the overall commodity shipments.

The same is also found when considering the same shipment of Russian crude oil by Greek shipowners — again, 30% involvement during August-October 2023 and a slight fall in November to 23%. The high point was 40% in both May and June 2023.

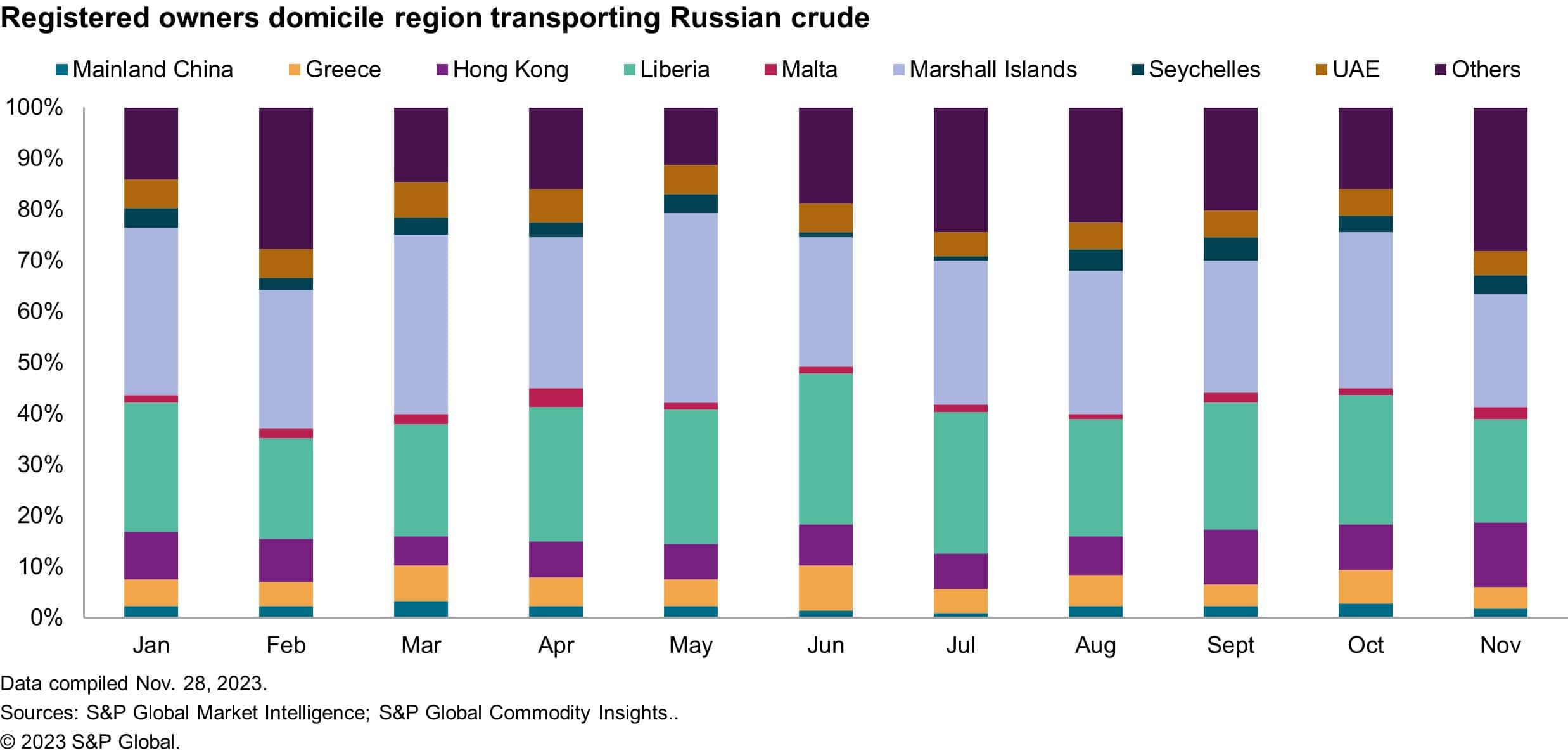

Only for Greek-registered owners do we see significantly low levels of Greek involvement, and this is mainly explained by the domiciled nationality of the vessels covering locations such as Liberia and the Marshall Islands where representation is considerably higher in this ownership type.

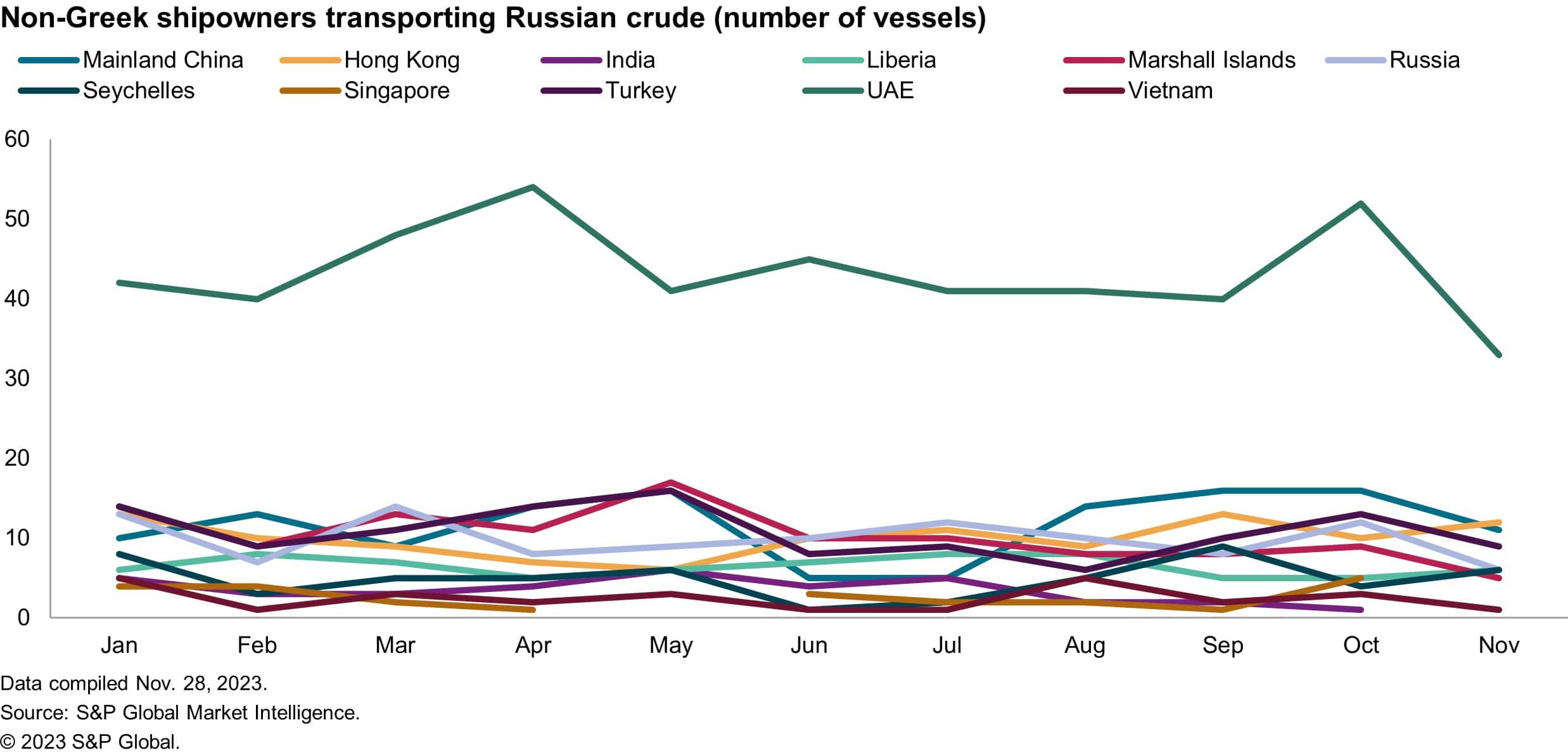

The small shift in scaling back by Greek firms has allowed others to maintain a stable foothold. The UAE, as the recent sanctioning of registered owners domiciled in the country by the US Treasury Department attests to, has a prominent role in shipping Russian crude. Hong Kong, Turkey and Russia account for the majority of the remainder.

Click here to download the full complimentary paper, where we will cover:

Subscribe to our complimentary Global Risk & Maritime quarterly newsletter, or listen to Maritime and Trade Talk podcast for the latest insight and opinion on trends shaping the shipping industry from trusted shipping experts.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

How can our products help you?