Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jun 03, 2022

Supplies of Russian gas to Poland and Bulgaria were suspended on April 27th. Poland's state-controlled gas supplier PGNiG informed that "the company refused to pay Gazprom for gas under the Yamal contract in rubles", this is after the change in Russian law made on 31 March that required gas payments to be made into new, special Gazprombank accounts, with payment made in the prescribed contractual currency (typically euros or US dollars) for onward conversion into rubles.

From the global or regional perspective, both economies are not considered large players in the gas market in absolute terms. In 2021 Poland and Bulgaria were ranked 10th and 18th largest importers in the EU and responsible for 1.5% and 0.02% of total EU imports, respectively. On the other hand, such signals sent by Russian officials to the EU Member States began a broad discussion on a potential further escalation of intentional supply disruptions and other forms of retaliation for the whole Community. Below, based on the GTAS Forecasting data, we try to estimate the degree of EU diversification of gas trade and formulate implications for the short and long-term.

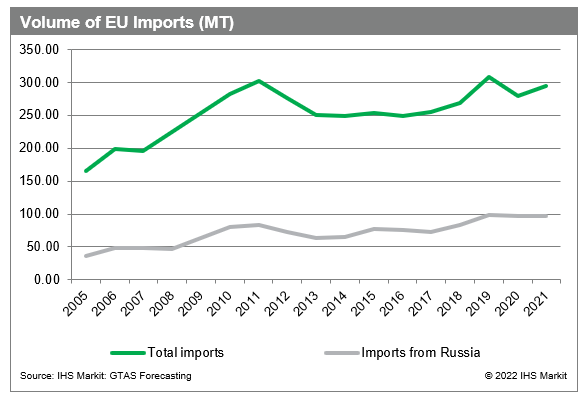

According to GTAS Forecasting estimations, over the period 2005-2021, the volume of natural gas, petroleum gases, and gaseous hydrocarbons imports to the European Union followed a slightly increasing trend, reaching the maximum value of 308.7 MT in 2019. In 2021 imports equaled 294,6 MT, which was approximately 25% of the total World trade of this commodity.

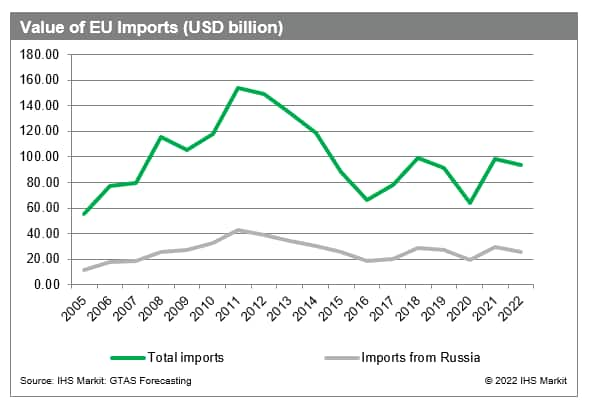

In terms of value, total imports were more volatile as a consequence of gas prices pass-through among others. The maximum value of imports was observed in 2012 with two major declines over the last decade - in 2014 and 2020. In general, over the period 2005-2021, the value of EU total imports of gas followed volatile horizontal trade.

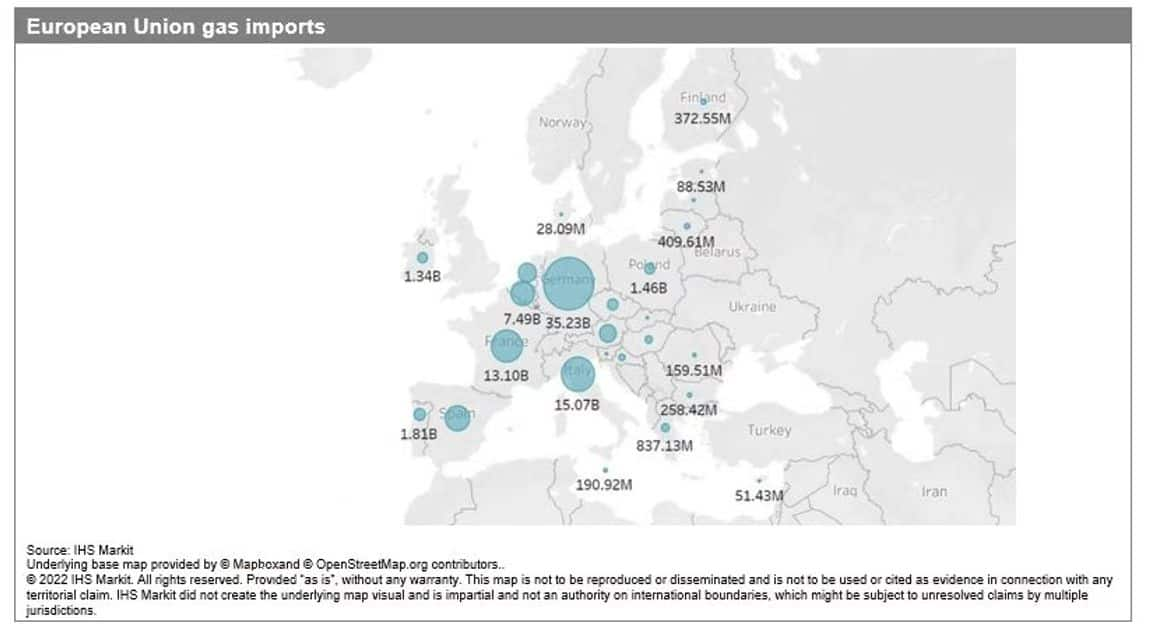

At the country level, the largest importer of gas in the EU in 2021 was its largest economy - Germany - responsible for over one-third of all EU gas imports in terms of value (USD 35.2 billion), followed by Italy (USD 15.0 billion) and France (USD 13.1 billion). The value of imports of the top-3 countries in the EU sums up to nearly two-thirds of total imports.

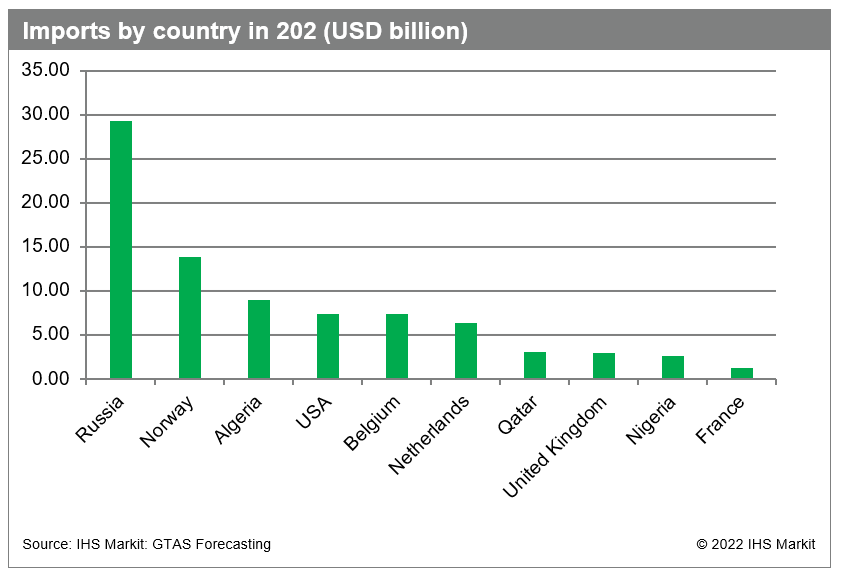

From the supply side, the largest gas exporter to the EU was Russia, responsible for 29.9% of total EU imports, over twice more than the second-largest exporter - Norway (14.1%), and three times more than the third - Algeria (9.1%). Excluding the intra-European Union trade, the dependency on Russian gas is slightly larger and equals 36.5% according to the GTAS Forecasting estimations.

As shown in the above charts, the volatility of both, Russian gas imports volume and value present lower volatility from 2005 to 2021 compared to total EU imports, at the same time following similar trends - slightly increasing volume and generally horizontal value. At the same time, the share of Russian gas in total imports increased from 21% in 2005 to the maximum of 31% in 2020.

In terms of transport modes, the majority of natural gas is imported by the 'overland and other' GTAS Forecasting category, which primarily includes pipelines in this case. The remaining imports are transported by the sea - over the period 2005-2021 the seaborne trade was ranging from 29% to 41%. The composition of transport modes is generally stable in time.

It is expected that the supply cutoff to Poland and Bulgaria should not start a wider cutoff in Russian supplies to Europe, this is still a strategic matter for both economies. Poland's contract with Gazprom was about to expire on 30 September 2022, by when it would have access to Norwegian gas via the Baltic Pipe, currently under construction. Till then Poland has to use revers on the Yamal pipeline and import gas from the German market, via the two interconnection points at the German-Polish border.

It doesn't look like there will be any cut in onward gas transit through Bulgaria either, but continued transit of gas through Poland to Germany is questionable given Poland's decision to freeze Gazprom's share in the EuRoPol (the entity that owns the Polish section of the Yamal-Europe pipeline). However, these flows had already significantly declined in the first quarter of 2022 and dropped to zero in April 2022.

Both Poland and Bulgaria have been developing infrastructure to reduce imports of Russian gas. Now Bulgaria can import LNG and pipeline gas via Greece through the current interconnection at Kulata and the new Interconnector Greece-Bulgaria (IGB) was connected to the Trans-Adriatic Pipeline (TAP) in March. Also, further connections with the Bulgarian and Greek grids are to follow soon, while on the Polish side building a new LNG terminal in Gdańsk is widely discussed.

From the international trade perspective, the EU's dependence on Russian gas imports is expected to remain stable despite the situation in Poland and Bulgaria. Further escalation of supply disruptions is unlikely. In the case of Poland and Bulgaria, the shift in trade will most likely take place, allocating shortages between already existing major trade partners and neighboring economies (e.g. imports from Germany to Poland).

On the other hand, in the longer perspective tendency to diversify gas sources is expected, not only in Eastern Europe but also in the largest EU economies, Germany included. In this case, the dependency on Russian gas will gradually decrease and be most likely replaced by already existing regional gas suppliers, such as Norway or Algeria, as well as the remaining world's largest exporters of gas - the US, Qatar, or Australia. Finally, with some probability, reshaping of European Union's energetic safety may create the chance for new natural resources exporters from emerging markets, such as Nigeria among others.

Posted 03 June 2022 by Agnieszka Maciejewska, Associate Director, Models & Scenarios, Global Intelligence & Analytics

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

How can our products help you?