Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Jul, 2016 | 10:00

Highlights

The impact of retransmission consent fee revenue outpacing traditional spot ad revenue growth is apparent in our latest U.S. TV station industry forecast.

The following post comes from our Media & Communications (SNL Kagan) solutions. To learn more about our retransmission coverage in particular, please request a call.

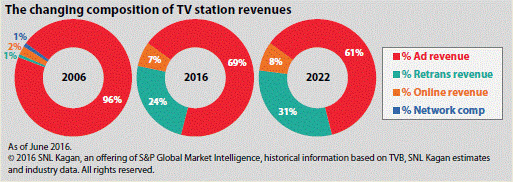

The impact of retransmission consent fee revenue outpacing traditional spot ad revenue growth is apparent in our latest U.S. TV station industry forecast with advertising’s share projected to decline from 69% in 2016 to 61% by 2022 while retrans share climbs from a 24% to a 31% share over the same period.

Over the projection period, the TV station industry is expected to become less reliant on the traditional spot ad revenue marketplace, with growing retrans fee revenues and more emphasis on digital revenues helping to smooth the effect of the ebbs and flows in political ad spending in election years.

U.S. TV station owners' retrans fees from multichannel operators are expected to reach $11.6 billion by 2022, versus the projected level of $7.7 billion this year, up 20% from $6.4 billion in 2015.

While recent negotiations with multichannel operators have seen TV station owners continuing to secure higher retrans fees, including annual dollar-per-sub rate step-ups, station owners' margins have compressed due to their affiliation renewal contracts reflecting larger network programming expense increases. Our reverse retrans projections call for major affiliate station group owners to send back over $2 billion to the major broadcast networks in 2016, up 36% from an estimated $1.5 billion in reverse retrans in 2015.

According to our latest projections, national and local spot ad revenues including political should decline from their highest share in our 2006 to 2022 study period, at 96% of total revenue in 2006 (prior to which the industry featured little to no retrans revenue), down to 69% in 2016 and 61% in 2022, while retrans revenues go from 1% of industry revenue in 2006 to 24% in 2016 and 31% by 2022.

TV station ad market volatility from political ad spending ebbs and flows has been leveling out over the past couple of election cycles as a result of double-digit annual rises in retrans revenue and the wave of station consolidation since the last recession. In 2016, total TV station revenues are forecast to grow 16% to $31.6 billion based on ad revenue growth of 15%, retrans growth of 20% and digital/online growth of 12%.

Over the projection period, TV station industry revenue is expected to grow to a high of $37.6 billion by 2022, including $2.9 billion in political, $11.6 billion in retrans, and $3.0 billion in digital/online revenue.

TV station industry revenues could get yet more diverse in the future should live station streaming OTT initiatives such as CBS All Access and broadcast carriage with virtual service providers (VSPs) like Sling TV and Sony Vue take hold, along with the incremental revenue opportunities from ATSC 3.0. These potential new revenue streams, not yet included in our analysis, could be additive as broadcasting expands outside of traditional delivery models.