Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Nov 13, 2023

Blank sailings on the eastbound trans-Pacific are accelerating this month as carriers seek to reestablish some control over the current low-growth market, but importers expect the moves will result in disrupted supply chains and higher spot rates.

"Carriers are blanking sailings, and they're doing it to stabilize the spot rates," Christian Sur, executive vice president of ocean freight contract logistics at forwarder Unique Logistics International, told the Journal of Commerce.

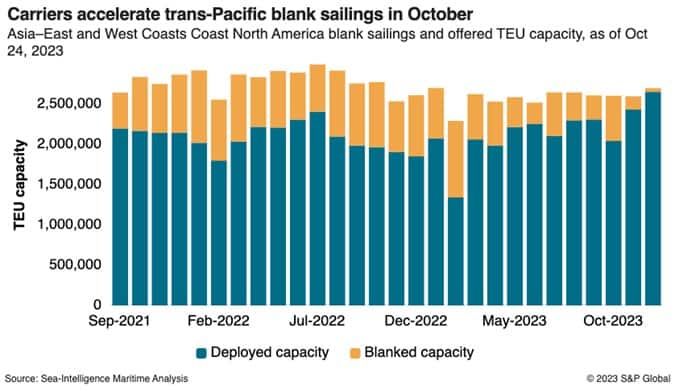

Facing the prospects of low-single-digit volume growth through the Lunar New Year in February, carriers so far this month have effectively reduced almost 22% of trans-Pacific capacity through blank sailings, according to Sea-Intelligence Maritime Analysis. That's up from 11.5% in September and 13.1% in August.

And while container lines have so far announced capacity cuts of just 6.4% in November and 1.7% in December, those numbers are expected to increase significantly in the coming weeks as more blanks are announced.

Retailers, forwarders and third-party logistics providers (3PLs) say the blank sailings have definitely intensified in October, resulting in scheduling woes.

"Absolutely. From late July to late September freight was moving consistently," said Weston LaBar, head of strategy at Cargomatic, a logistics provider with operations in 20 ports. "Now we're seeing delays of 40 days [due to rolled cargo]."

Sur said carriers will notify the trade of additional blank sailings either within, or more likely independently of, their shipping alliances. "To me, carriers seem to be acting more independently than they have in the past," he said.

Carriers in recent days have informed forwarders such as Unique they intend to implement general rate increases of $300 to $500 per FEU effective Nov. 1, Sur said.

The Asia-West Coast spot rate last week ranged from $1,216 to $1,746 per FEU and the Asia-East Coast spot rate range was $1,792 to $2,198 per FEU, according to data from Platts, Xeneta and the Shanghai Shipping Exchange. Each index measures spot rates differently, which accounts for the variations.

Current Asia-West Coast spot rates are about 12% lower than a year ago, according to Platts, with rates to the East Coast about 65% lower. Platts is a sister company of the Journal of Commerce within S&P Global.

Retailers are adjusting quickly to the changing landscape by diversifying their carrier mix so they can re-book rolled cargo with lines that have available space. They are also widening the windows in which they are telling customers to expect their cargo to arrive and working with their truckers to ensure sufficient drayage capacity.

"We've built lead time back into the supply chain, but that comes with a lot of additional cost," Morgan Jackson, director of global logistics/delivery at Walmart, told the South Carolina International Trade Conference last week. Jackson said Walmart is also building trailer capacity into its private fleet and asking third-party vendors to do the same.

Bob Fredman, principal at the consulting firm SF Global Insights and former logistics manager at Limited Brands and Big Lots, said that in today's volatile environment in the trans-Pacific, mid-size retailers should be looking closer at their lead times and be prepared to prioritize shipments both at Asian load ports and when the shipments reach US ports.

If shipments begin to back up at marine terminals due to the erratic shipping patterns, mid-size retailers should ask their carriers for more free storage time on the docks, Fredman said. "If cargo bunches up, you will need more free time," he said.

Meanwhile, retailers and forwarders are reaching as far back into their supply chains as they can to identify blank sailings as soon as they are announced.

"We really rely on our origin offices," Christopher Hope, vice president of sales for forwarder Star Asia International, told the South Carolina International Trade conference. "They're checking in with the carriers, they're preparing, they're letting you know as far in advance as possible the schedule of blanks sailings."

When shipments arrive at a US port, importers must prioritize which ones are truly the most important, said a home furnishings retailer.

"When it arrives, we hot-list it with our drayage operator. We hot-load it at the warehouse," said the retailer, who did not want to be identified.

But importers must be careful not to prioritize too many shipments, given the limited drayage capacity many retailers have. "If everything is a priority, nothing is a priority," the retailer said.

Amid the accelerating blank sailings, importers must be prepared for "massive imbalances" in demands on their drayage and warehouse capacity, LaBar said. In a hypothetical example, if an importer's logistics operation is designed to receive 100 shipments each week in a Shanghai to Los Angeles service, but the containers booked on the first sailing are rolled to the next week's sailing and the following week's sailing is also blanked, then 300 containers may arrive on the third week's sailing, creating a "capacity crunch" for the retailer and its drayage provider, LaBar said.

Carriers in THE Alliance are sensitive to the needs of their customers and have "gone to great pains" to avoid the last-minute blanking of sailings that their customers find so damaging to their supply chains, an executive with a carrier that is part of the alliance told the Journal of Commerce. The source said THE Alliance is now giving customers at least three weeks advance notice of blanked sailings and providing at least four weeks advance notice 10% of the time.

The executive said he personally prefers to adjust capacity by suspending an entire service in trade lanes with multiple weekly sailings. Carriers can then add port calls to the remaining services and re-deploy some of the available vessels to maintain schedule integrity on those services, he said.

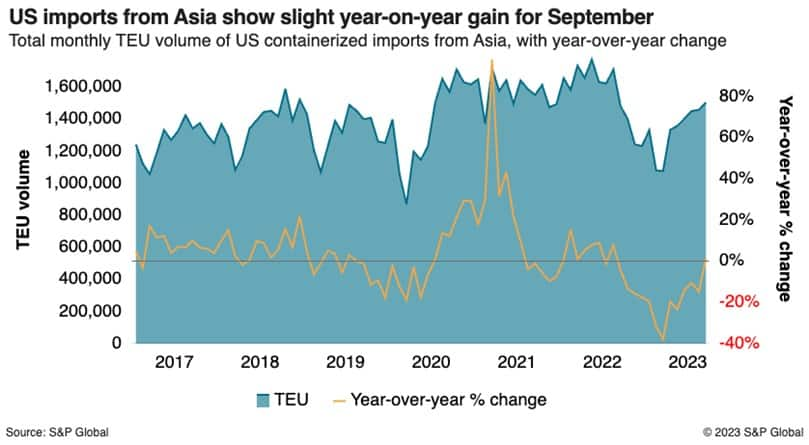

While carriers are wary of the tepid growth forecasts over the next few months, volumes on the eastbound trans-Pacific are nonetheless on the rise. US imports from Asia have risen sequentially in every month since March, while September's imports of 1.5 million TEUs were the most since August 2022 and up 1.4% from September 2022, according to PIERS, a sister product of the Journal of Commerce within S&P Global.

*Originally published in the Journal of Commerce on October 25, 2023

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthly Insights Newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

How can our products help you?