Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Dec 09, 2022

By Marie Lechler, Ph.D. and Phil Smith

London was the UK's fastest-growing region during the third quarter of 2022, the latest Regional PMI data showed, underscoring the capital's economic outperformance — and its importance to the country's overall economy.

We expect London GDP to grow 5.0% year-on-year in 2022, outstripping all other areas of the UK and widening regional inequalities. These inequalities have relevance for retailers looking to strategically locate their operations, for banks seeking to assess the housing market, and for politicians seeking support for regions with lower growth rates and incomes.

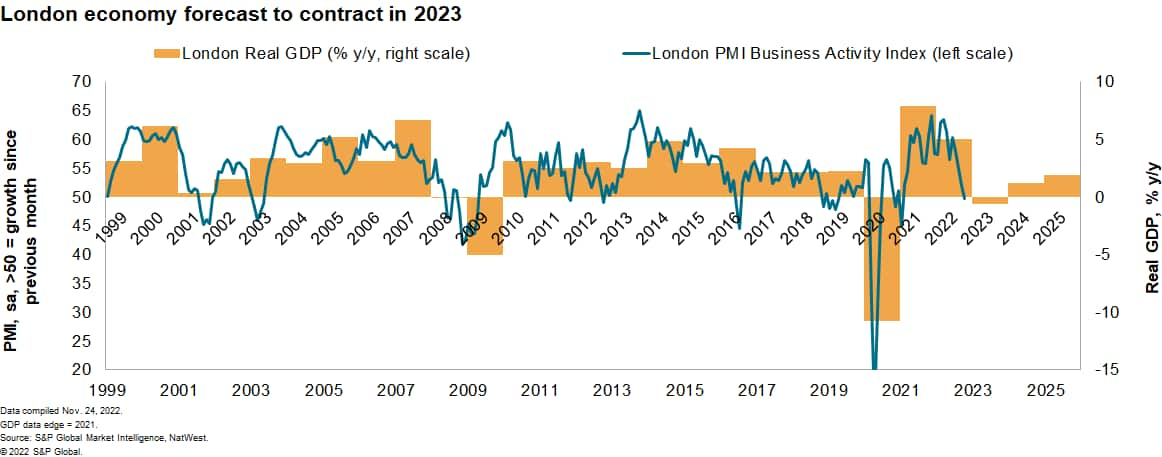

Our PMI surveys have signalled a slowdown in business activity across London in the final quarter of the year. We expect real GDP in the capital to decline -0.6% year-on-year in 2023, before returning to growth in 2024 (+1.2%) and 2025 (+1.9%).

London slowdown

According to the UK Regional PMI surveys, which are compiled by S&P Global on behalf of NatWest, the output of goods and services across London fell slightly in October, ending a run of growth that began with the easing of the third national lockdown in early 2021.

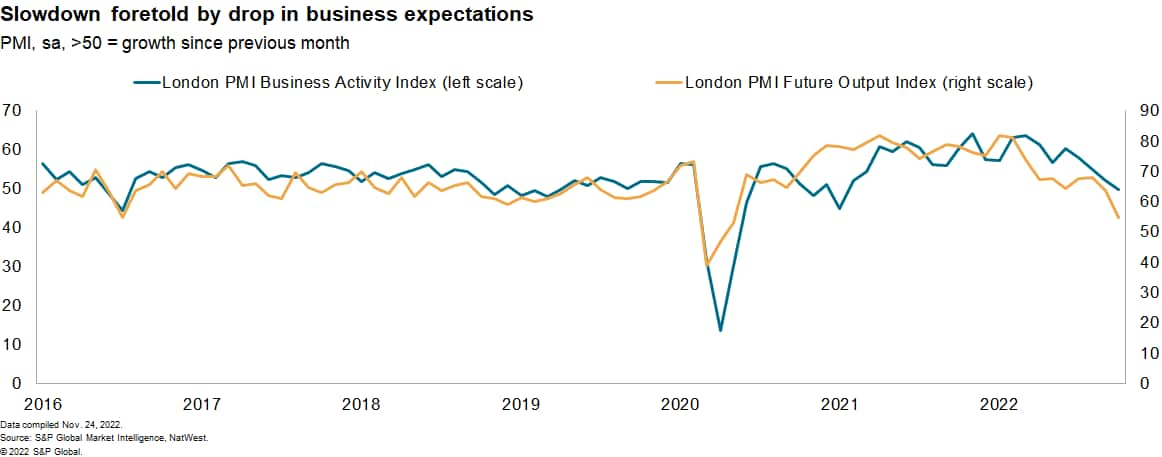

A combination of a worsening cost-of-living crisis, rising interest rates, and mounting economic uncertainty has weighed on demand for goods and services produced in London and put the brakes on growth. The slowdown was foreshadowed by an immediate downturn in business expectations following the outbreak of war in Ukraine in February.

The London Future Output Index — which measures business sentiment towards output/business activity over the next 12 months — sank 7.2 points in March, the most in the series history since 2012 excluding the initial COVID-19 shock in early 2020 and the period of heightened uncertainty around the Brexit vote. By October, business expectations in London had sunk to their lowest since May 2020.

Still outperforming

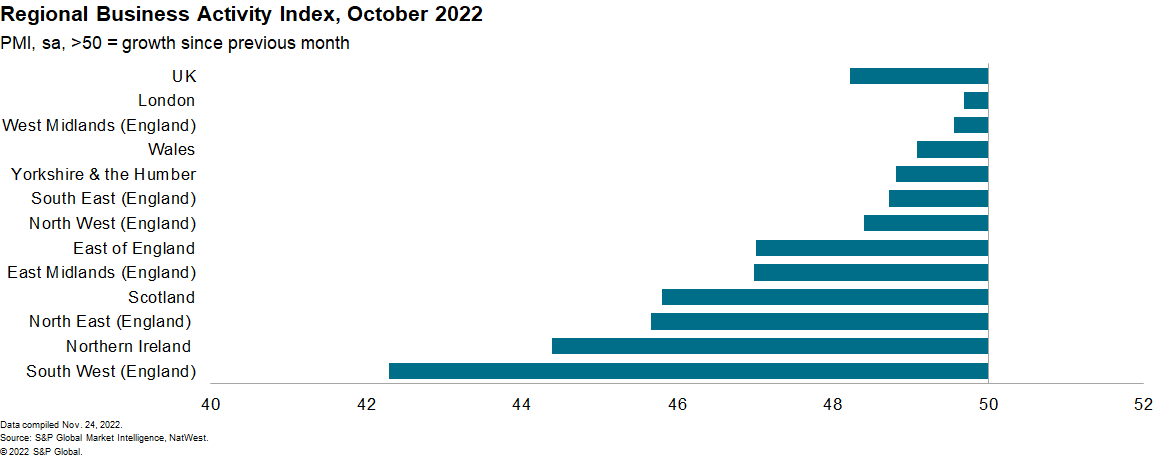

The PMI Business Activity Index was below the critical 50.0 threshold that separates growth from contraction in all regions in October. That said, London's 49.7 indicated only a marginal rate of decline and compared with a UK-wide reading of 48.2. London topped the PMI rankings for business activity for a seventh consecutive month.

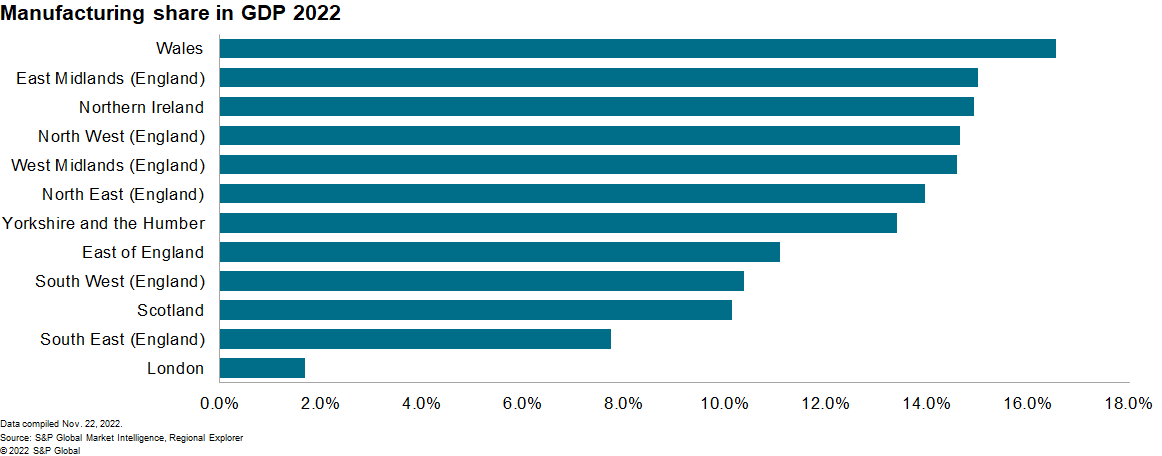

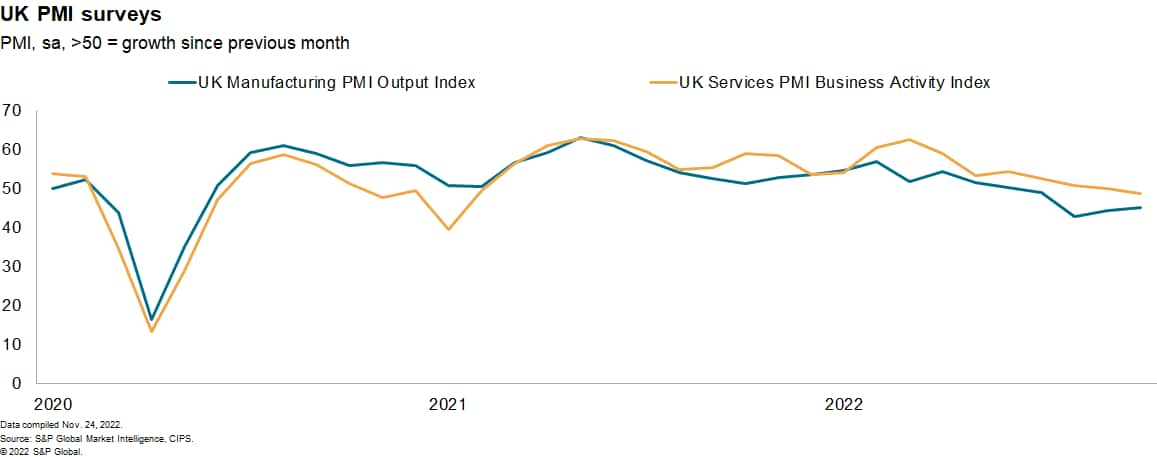

London's recent outperformance has been in part a reflection of a low exposure to manufacturing, which has seen output levels fall in each month since July, according to S&P Global / CIPS UK Manufacturing PMI data.

Specialization in relatively strong sectors, such as financial intermediation and computing & IT services, have helped buoy the London economy during 2022. Anecdotal evidence from businesses on the PMI survey panels also noted a further boost from increased travel activity following the easing of COVID-19 restrictions.

London has also enjoyed a strong showing on the employment front, recording the quickest rate of job creation in six of the past nine months, but slipped to sixth in the rankings in October. Pressure on business capacity — as evidenced by the persistent accumulation of backlogs of work —has led firms across the capital to recruit staff at a historically robust pace throughout most of 2022.

Widening income gap

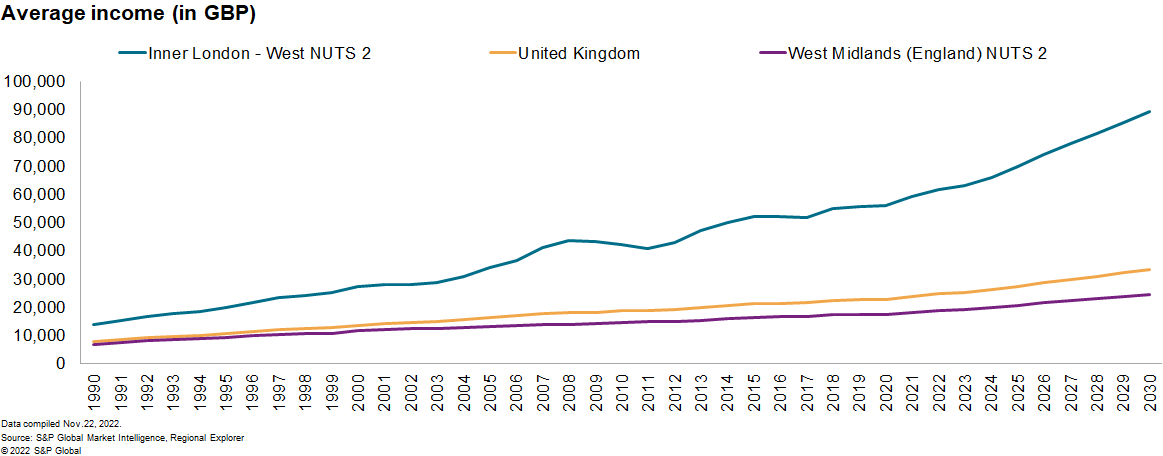

London is also likely to continue outperforming other regions in terms of average incomes.

Incomes are tightly linked to the structure of the local economy and relative performance of dominant sectors. In 2022, average disposable incomes in Inner West London — a Nomenclature of Territorial Units for Statistics (NUTS) 2 region with the highest income per capita in the UK — were 3.3 times higher than in the West Midlands, a NUTS 2 region with the lowest income in the UK. This inequality will increase to a factor of 3.8 by 2035.

The high-paying financial and real estate industries contribute a third to Inner West London's total GDP. In contrast, manufacturing and wholesale and retail trade dominate the economy in the West Midlands (combined 23% of GDP).

Average incomes in the capital are expected to grow faster than the UK average over the next 10 years, which reinforces the widening income gap.

These patterns are important indicators for consumer market trends and for spending patterns across regions. The drop in average incomes in 2022 combined with rising prices means that consumers across the UK are less likely to spend on non-necessities. This is particularly relevant for retailers faced with rising energy prices that might have to focus their activities on strategic locations.

In the context of rising mortgage rates, income trends are also relevant to assess the housing market. The UK housing market remains at great risk due to higher mortgage borrowing costs. In the beginning of November 2022, the Bank of England (BoE) raised its Bank Rate for an eighth meeting in a row, to a 14-year high of 3.0%. This will hit roughly 2.2 million people on variable rate mortgages and anyone who is looking for a new mortgage. As upward pressure on borrowing costs is likely to persist, many mortgage holders could face severe spending cutbacks as fixed terms expire.

Politicians across the political spectrum recognised the need for "levelling-up" in order to reduce household income inequalities and support regions with lower growth rates and incomes. Many of these policies have been postponed in light of fiscal pressures due to the current economic turmoil. The cost-of-living crisis will worsen these inequalities, and precise regional economic data and forecasts will be essential to design targeted policies addressing these concerns.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.