Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Sep, 2017 | 08:45

By Tom Manzella

Highlights

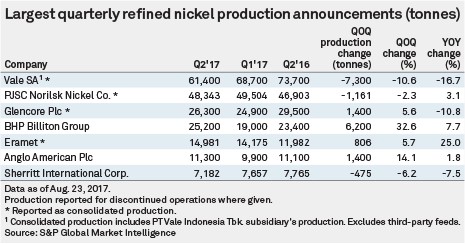

Production of refined nickel remained mostly flat in the second quarter compared with the first quarter, while declining year on year.

We now forecast refined nickel output to grow at 2.5% YOY in 2017; however, such a weak second quarter among the largest companies could lead us to revise our outlook.

In the second quarter of 2017, while refined nickel production among the largest producers increased slightly compared with the first quarter, output fell year-over-year, signaling a broad slowdown of supply growth in the face of weak global nickel prices. Production growth from the seven largest nickel-producing companies averaged less than half a percent quarter-on-quarter at the end of June and declined nearly 5% year-over-year. We now forecast refined nickel output to grow at 2.5% year-over-year in 2017; however, such a weak second quarter among the largest companies could lead us to revise our outlook.

Vale SA produced the largest refined nickel tonnage of any company in the June quarter at 61,400 tonnes. This figure includes 100% of the production attributable to Vale's 59.3%-owned PT Vale Indonesia Tbk. and excludes third-party feeds. PT Vale Indonesia's flagship mine, Sorowako, produced 19,700 tonnes of finished nickel in the second quarter, a 21% quarter-on-quarter increase, which the company attributed to a maintenance shutdown at its Matsusaka refinery during the first quarter.

Meanwhile, Vale's 100%-owned Ontario Division and Voisey's Bay, both top 10 nickel producers globally in 2016, produced 7,900 tonnes and 14,800 tonnes in the second quarter, respectively. This marked a steep 56% quarter-over-quarter drop for Ontario Division (Sudbury), primarily due to Vale's ongoing transition to a single furnace, which will commence operating in the fourth quarter. Rebuilding of the company's Furnace #2 and transitioning to a single furnace was cited as the reason for the overall quarter-on-quarter and year-on-year decline in production for Vale.

PJSC Norilsk Nickel Co. ranked second in the list of top nickel producers for the second quarter, with 48,343 tonnes of consolidated production. Production from the company's Russian feed remained fairly consistent both quarter-over-quarter and year-over-year, with the former falling 2% and the latter rising 3%. The miner's Kola Division ranked number one in global nickel production in 2016, producing 38,403 tonnes of nickel in the second quarter, which excludes production from third-party feeds.

Nickel production at Norilsk's Harjavalta refining plant in Finland reached 9,940 tonnes from its Russian feed, marking a 25% decline quarter-on-quarter. The company attributed this to annual repairs at the refinery. Overall in the first half, nickel output from Norilsk's Russian feed was down 1% year-over-year, as the company continues to reconfigure production facilities at its Polar Division.

BHP Billiton Group's 100%-owned Nickel West produced 25,200 tonnes in the June quarter, accounting for all of the diversified miner's nickel production. Refinery output rose 33% quarter-over-quarter, the largest quarterly increase in this analysis, and 8% year-over-year. BHP attributed the improvements in refined metal production to debottlenecking activities at its Kwinana refinery.

Anglo American Plc saw its nickel production rise by 1,400 tonnes, or 14%, quarter-over -quarter to 11,300 tonnes. Production at the company's two 100%-owned primary nickel projects, Barro Alto and Codemin, rose 17% and 5% quarter-over-quarter, respectively. The company attributes an overall 2% year-over-year increase in production to stable performance in its smelting operations at Barro Alto, which ran slightly above nominal capacity in the second quarter. Full-year production guidance stands at 43,000 tonnes to 45,000 tonnes.

Learn more about our mining industry research and analysis.

Gain vital insights into the commodities market - request a demo.