Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jan 18, 2023

Amid speculation that the US could be slipping into a recession, upcoming flash PMI data will be eagerly assessed to gauge the business climate in the opening month of the year. The surveys from S&P Global have been sending especially weak signals for output and demand growth, albeit with labour markets remaining relatively resilient, which has in turn led to a marked cooling of inflationary pressures. Putting all of the signals together will provide insights into the potential future path of monetary policy.

Below we list the five key areas of analysis to focus on for the upcoming survey data.

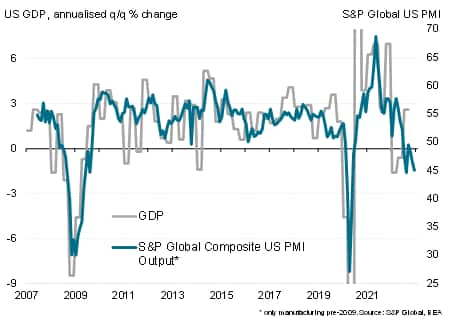

US composite PMI output index vs. GDP

The headline output number from the PMI survey is typically always the first port of call when assessing the current underlying economic climate, and the recent PMI data from S&P Global have been mostly gloomy. In December the composite output index covering manufacturing and services hit the second-lowest since the global financial crisis if early pandemic lockdown months are excluded. While backward-looking GDP estimates are so far showing surprising resilience for the fourth quarter in the face of Fed rate hikes, the PMI is an early warning indicator that all is not well in corporate America. Any further weakness in January would add fuel to recession worries.

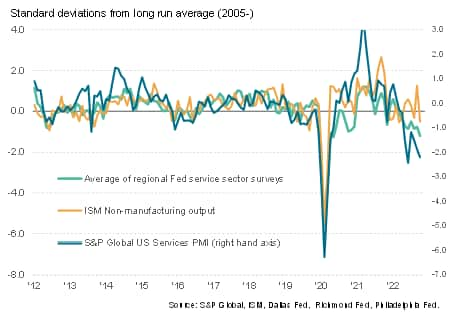

While the plethora of manufacturing surveys have sent a consistent message of industrial malaise, the picture has been more varied for the service sector. However, a plunge in the volatile ISM non-manufacturing index in December has brought the institute's gauge somewhat more back into line with the other surveys, albeit with the service sector index from S&P Global showing a particularly worryingly pace of contraction .

However, note that, unlike the ISM survey, the S&P index excludes government-provided services (which tend to sustain growth in a recession) and energy (which has been performing well since the Ukraine war) - and instead focuses on more cyclical corporate-provided services, both B2B and B2C.

The S&P services PMI data will therefore likely be a key gauge to watch in terms of testing the broader US business community's resilience in the face of higher borrowing costs. Note that financial services had led the decline in the closing months of 2022, adding to evidence that high interest rates are taking their toll.

US services survey comparisons

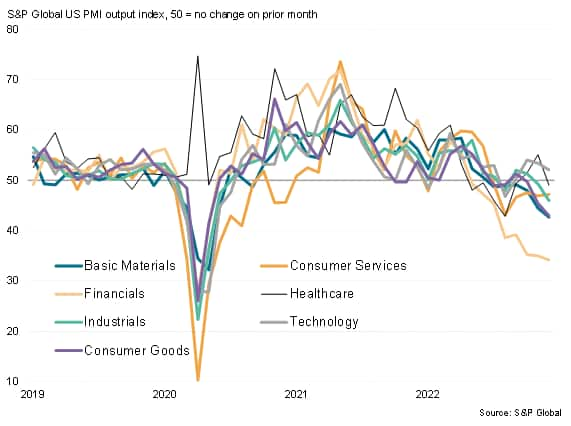

US sector output

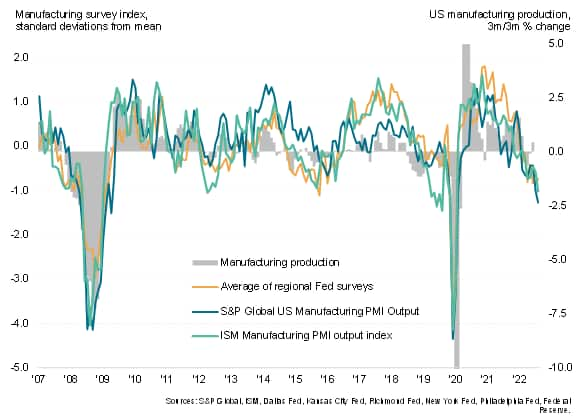

US manufacturing survey comparisons

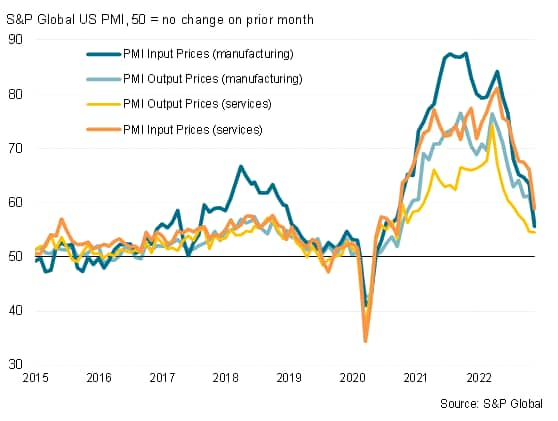

Another important aspect of the PMI surveys will be the inflation indicators. Perhaps most eagerly awaited will be the input cost indices - especially for services, as this gauge includes staff costs.

US PMI input cost and selling price gauges

Both the manufacturing and service sector input cost indices have fallen sharply in recent months, down across both sectors as a whole to a two-year low, boding well for inflation to cool ̶ perhaps markedly ̶ in the early months of 2023 from its current rate of 6.5%.

US input costs vs. annual CPI inflation

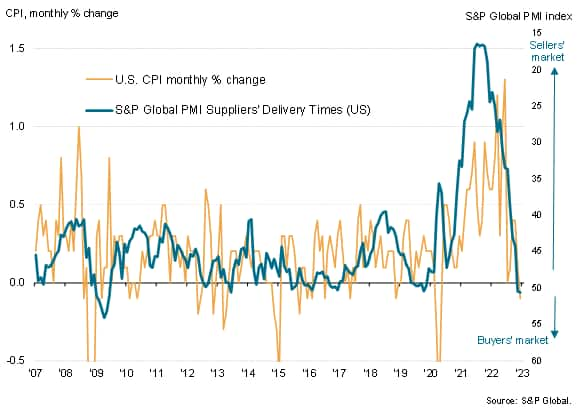

The cooling of inflation has been a function of demand (as measured by the PMI new orders index, which fell to a new post-pandemic low in December) being subdued in part by higher interest rates. However, weaker price pressures are also reflective of improving supply. December's survey showed average supplier delivery delays having eased markedly, to an extent which signifies the start of a theoretical shift from the sellers'- to a buyers'-market.

We therefore stress the need to not only watch the various PMI input cost and selling price gauges, but also closely monitor the suppliers' delivery times index.

US suppliers' delivery times vs. monthly CPI

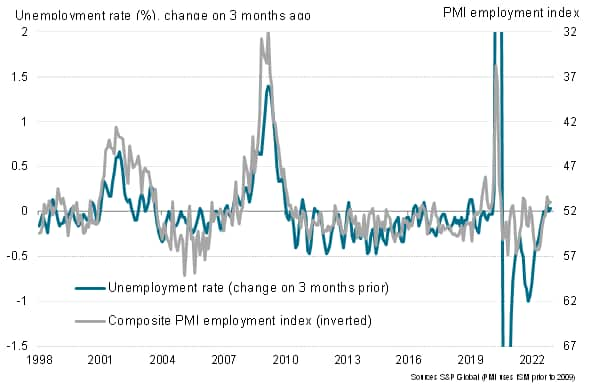

The economic picture is of course not complete without a labour market update, and the employment index from the PMI will help shed some light on the hiring trend at the start of the year. Recent survey data have signaled a marked cooling in the rate of employment growth, albeit with firms continuing to take on staff on average up to the end of the year. This is consistent with the labour market remaining broadly stable and hence showing encouraging resilience. There is as yet no evidence of employment starting to fall and unemployment starting to rise, as had been seen in the downturns of the early-2000s and the global financial crisis, meaning January's data will be keenly awaited for any indications of growing caution in relation to hiring.

US unemployment and the PMI employment index

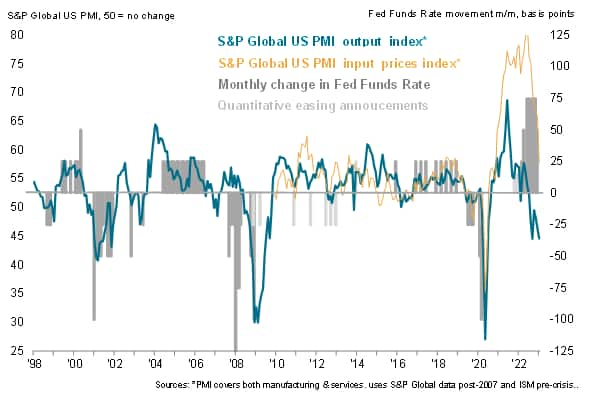

The other 'big picture' signals from the survey will be the assessment of the impact of recent FOMC policy tightening, and the likely future path of rate hikes. Markets are pricing in a less aggressive rate hike path after lower than expected inflation in December, and any further deterioration in the upcoming PMI output data alongside a further moderation of cost pressures will help us assess whether a hike pause could be in play late in the year. Alternatively, sticky input cost inflation in particular will suggest the Fed has more work to do.

US PMI output and price data vs. FOMC policy changes

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.