Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Dec 15, 2023

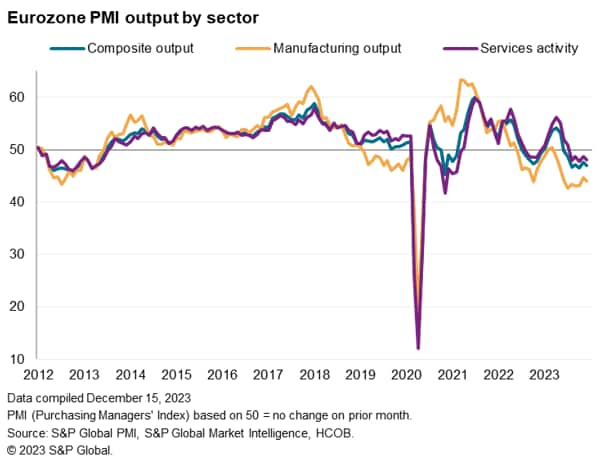

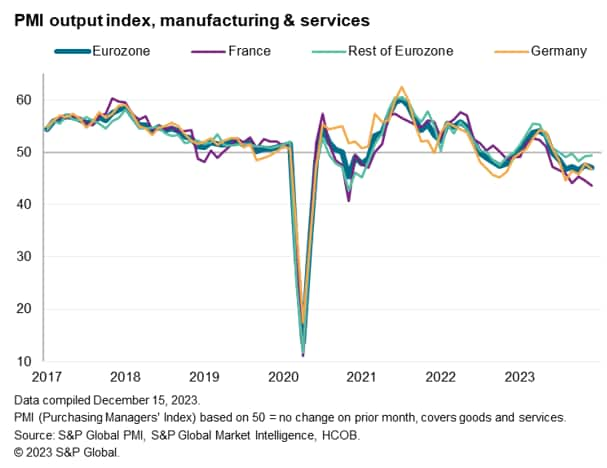

Business activity in the euro area fell at a steeper rate in December, according to provisional PMI survey data, closing off a fourth quarter which has seen output fall at its fastest rate for 11 years barring only the early-2020 pandemic months. Downturns were again recorded across both manufacturing and services.

Jobs were cut for a second month running as firms scaled back operating capacity in line with a worsening order book situation and persistent gloomy prospects for the year ahead. Factories also cut inventories of inputs at a rate not seen since 2009.

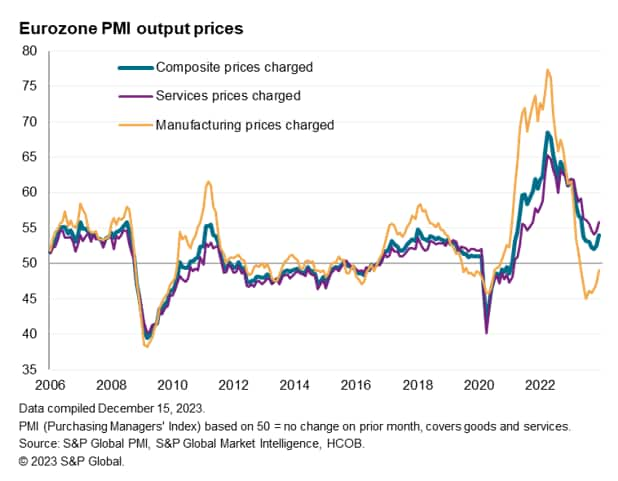

Inflation signals were mixed: input cost inflation cooled but selling price inflation accelerated, the latter notably remaining elevated by historical standards.

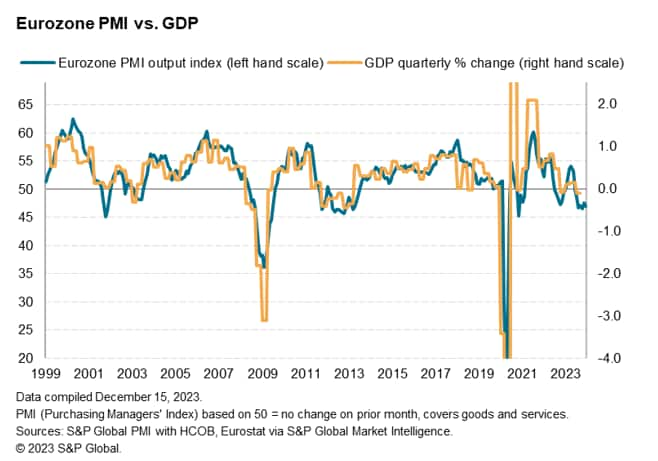

The seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses and compiled by S&P Global, registered 47.0 in December, down from 47.6 in November to signal a seventh consecutive monthly reduction in business activity across the euro area. The weak reading rounds off the sharpest average quarterly decline in activity recorded by the survey since the fourth quarter of 2012, if early pandemic lockdown months are excluded.

The PMI data are roughly indicative of GDP falling on a quarter-on-quarter basis at a 0.2-0.3% rate in the fourth quarter. Following a 0.1% contraction in the third quarter, the fourth quarter decline would push the eurozone into a technical recession.

Manufacturing continued to lead the downturn, accompanied by a steepening drop in service sector output. Manufacturing output fell for a ninth month running, the rate of decline re-accelerating slightly after the moderation seen in November, albeit remaining less severe than seen in the four months to October. Services activity meanwhile fell for a fifth successive month, the pace of decline likewise gathering momentum again slightly to register the third-steepest fall since the lockdowns of early 2021.

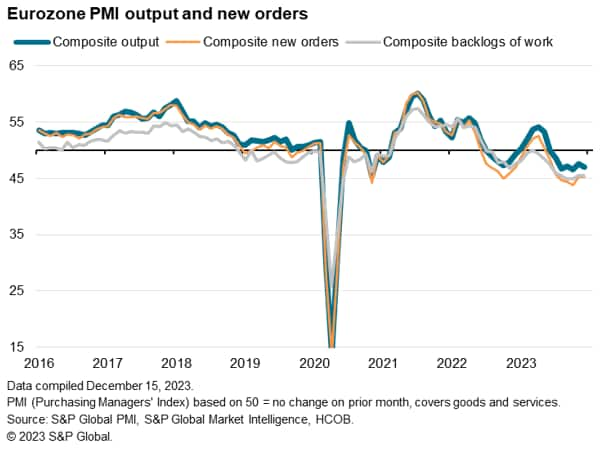

The overall reduction in business activity was again a reflection of deteriorating order books. Inflows of new orders fell for a seventh straight month, the rate of decline remaining unchanged on the steep pace seen in November (though somewhat less severe than witnessed in the three months to October). New orders for goods fell for a twentieth straight month, the rate of decline still sharp by historical standards despite easing for a second month in a row, while the rate of loss of new orders in the service sector remained among the highest seen over the past three years to register a sixth successive monthly fall.

Backlogs of work consequently also fell sharply, dropping for the seventeenth time in the past 18 months, the rate of decline ticking higher than in November. Manufacturing backlogs continued to fall especially sharply, but December also saw a sixth successive monthly fall in service sector backlogs, which were depleted at the fastest pace since February 2021.

A worrying trend persists whereby new orders - the survey's key measure of demand growth - continues to fall at a faster rate than output to a considerable, and unusual, degree by historical standards. This divergence hints at persistent downside risks to output in the near-term, barring any imminent upswing in demand growth, and certainly hints at the development of excess capacity.

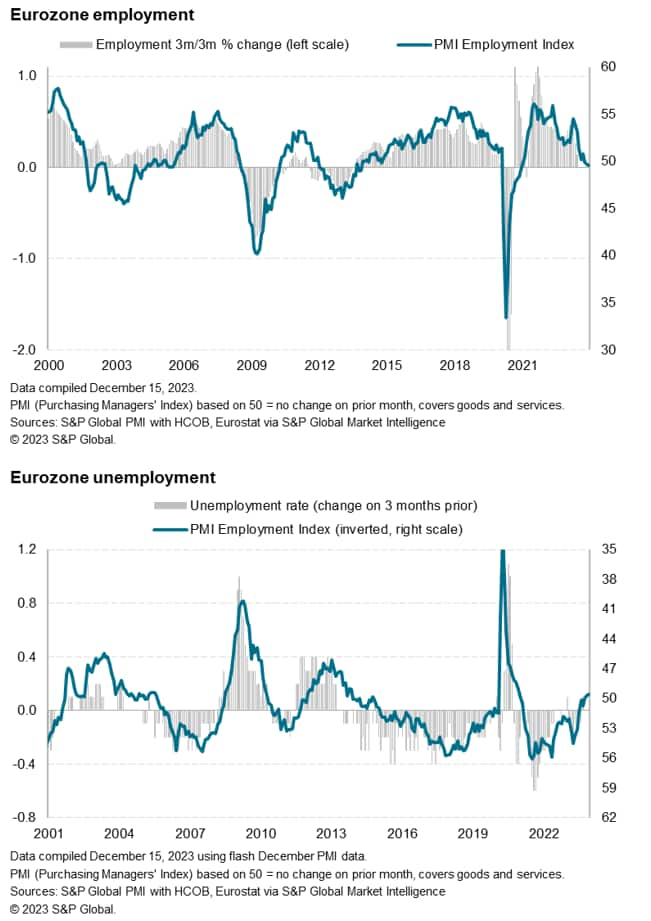

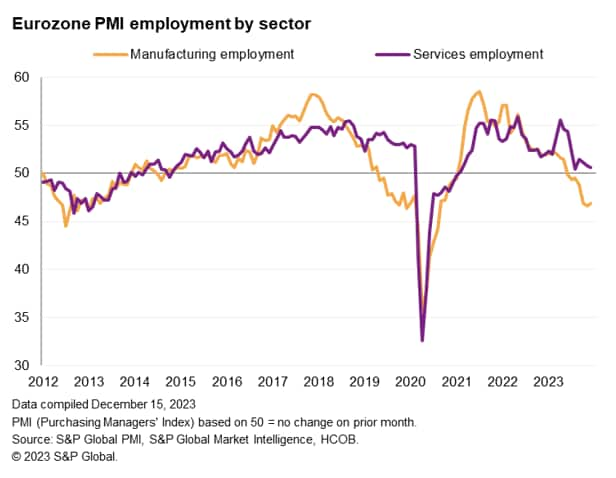

Employment fell for a second consecutive month as companies scaled back capacity in line with the weakened demand environment. Although only modest, the recent falls in employment are the first recorded since early 2021.

The PMI data and are broadly indicative of stalled employment in the economy and modest upward pressure on unemployment.

Manufacturing payrolls were cut for a seventh month in a row, the rate of job losses continuing to run at one of the highest seen since 2012 if pandemic months are excluded. Service providers meanwhile continued to pull back on their hiring, resulting in only a very modest expansion of their staffing levels, in marked contrast to the strong job gains seen in the sector earlier in the year.

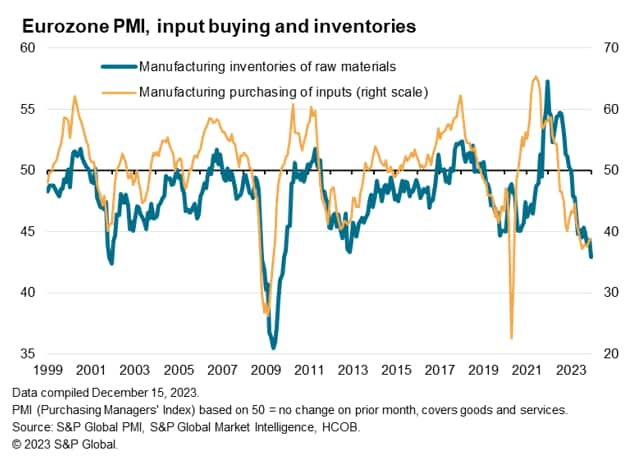

As well as reducing employment, manufacturers cut their purchasing activity at one of the steepest rates recorded since the global financial crisis, resulting in the largest fall in inventories of inputs since November 2009. Inventories of finished goods likewise continued to be scaled back, largely in response to cost cutting amid weak sales.

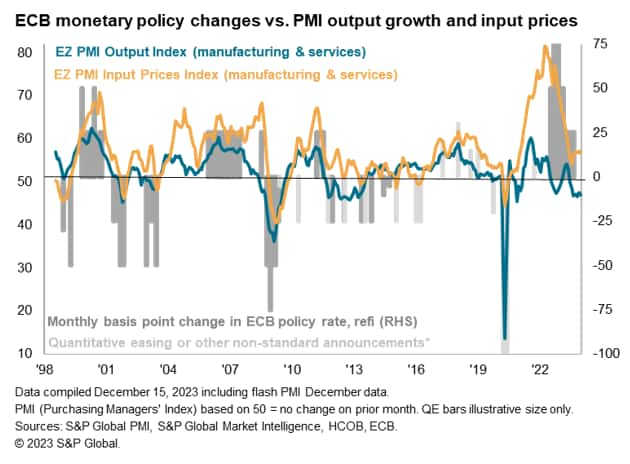

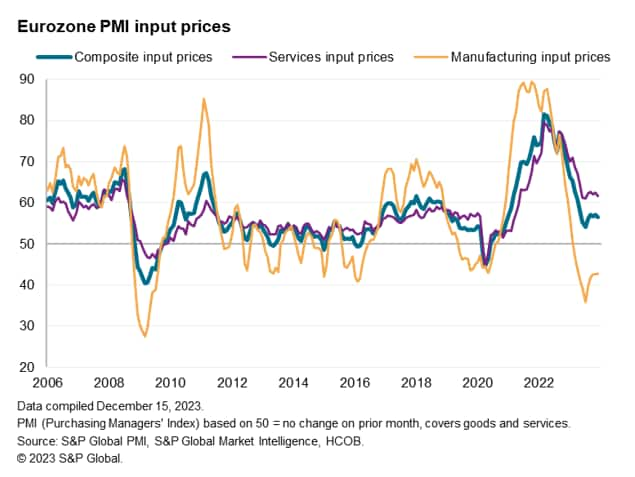

Eurozone companies recorded a slowing in the rate of increase in input costs, which registered the smallest monthly rise since August and an increase only marginally above the survey's pre-pandemic average. A tenth successive month of falling input prices in manufacturing, the rate of decline of which remained among the highest seen since the global financial crisis, was accompanied by a further cooling of service sector input cost inflation to the lowest since July, albeit the latter remaining elevated by historical standards.

While input cost inflation cooled in December, average selling prices rose at an increased rate, posting the largest monthly increase since May to remain high by the historical standards of the survey. Although goods prices fell for an eighth straight month, the decline was only marginal, and the smallest recorded since May. Charges for services meanwhile rose at a rate not seen since July.

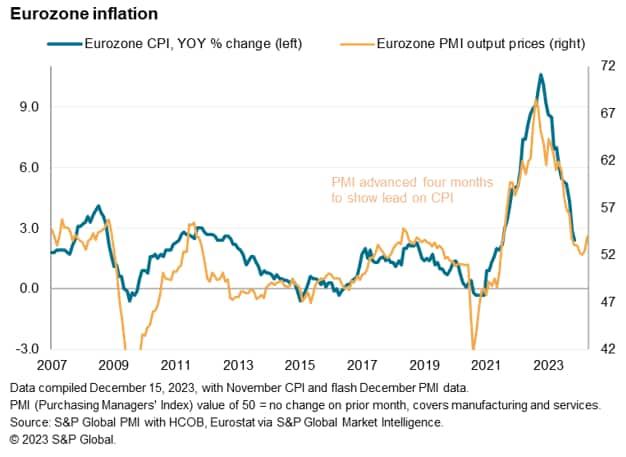

Looking at the inference for inflation, the overall signal from the PMI selling price gauge is for CPI inflation to continue to remain largely unchanged on average in the coming months, dropping slightly from its current 2.4% pace to close to the ECB's target of 2% before edging higher again in early 2024, albeit likely remaining below 3%.

The downturn was led by France, where businesses reported the sharpest reduction in activity since March 2013 (excluding the pandemic) thanks to rates of contraction accelerating in both manufacturing and services. However, output also fell at a sharp and accelerating rate in Germany amid steepening losses for both goods and services.

While the rest of the eurozone as a whole recorded a more muted decline by comparison to the falls seen in France and Germany, output here has now fallen for five successive months as a severe decline in goods production continued to offset only a very modest rise in services activity.

The flash PMI data for Germany are indicative of a 0.4% quarter-on-quarter GDP decline in Q4 and 0.4% quarterly decline run-rate in December.

The flash PMI data for France are indicative of a 0.2% quarter-on-quarter GDP decline in Q4 and 0.3% quarterly decline run-rate in December.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location