Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 14 Mar, 2024

By Brian Collins and Monica Hlinka

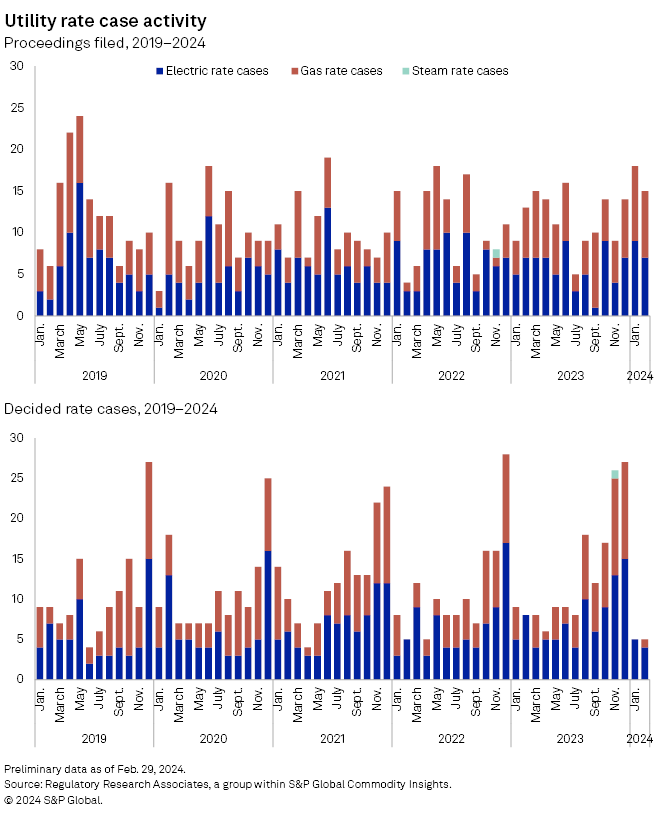

The number of rate case filings submitted to state regulators in February was one of the highest observed for the month in the last five years.

➤ Seven electric and eight gas rate case filings were fielded in February. The 15 filings exceeded the five-year average of 9.2 for the month but fell from January, when 18 proceedings were initiated.

➤ Five cases were decided in February, matching the previous month by volume but indicating one of the lowest decision levels observed for February in the prior five years.

➤ Regulators authorized returns on equity (ROEs) during the month ranging from 9.50% to 9.70%.

➤ A new ROE is being sought in 10 of the 15 cases filed in February, with those utilities requesting ROEs ranging from 9.75% to 11.50%. In two other proceedings, an ROE determined in a previous proceeding is being utilized. Other notable filings were four notices of intent, only one of which denoted a defined ROE.

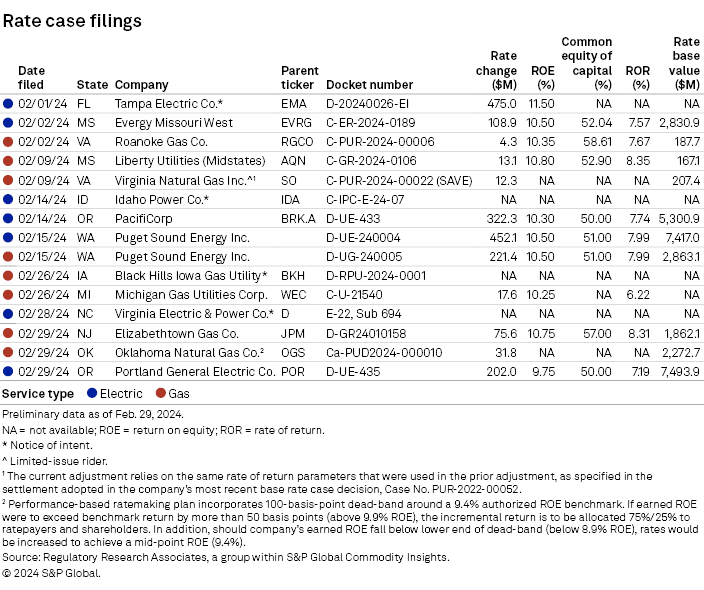

Energy utilities across the US filed requests for rate increases totaling over $1.9 billion in February. While these rate modification requests were split nearly equally by volume regarding electric and gas, a considerably greater net increase was requested in the electric filings of $1.56 billion, compared with $376.1 million in gas rate case filings.

The February monetary total for all filings was approximately $260 million lower in combined rate increases requested than the aggregate amount of $2.2 billion submitted in January.

Authorized rate changes for February continued to shrink, dropping to $112.5 million across five decisions from $427.7 million in five January decisions, with no base rate reductions noted in either month.

A considerable level of other regulatory activity and a few alterations to utility commission membership were also observed in February.

Utility-related M&A or reorganization activity in the month was relatively minimal.

Rate case initial filings

The accompanying table details the seven electric and eight gas rate proceedings initiated in February. The rate changes requested aggregated to a net increase of approximately $1.94 billion, with $1.56 billion sought by electric utilities and about $376.1 million proposed in the newly filed gas cases.

Resolved rate cases

The table below details the four electric and one gas rate proceedings that concluded in February. The rate changes approved in the electric cases aggregated to an increase of $97 million, while the sole gas decision allowed a $15.5 million bump.

Significant rate case-related activity

Commission decision lacks typical premium associated with fair value rate base

Arizona — While the UNS Electric rate case decision is viewed as constructive overall for investors, the case conclusion was somewhat contrary to typical rate case decisions in that it included no premium associated with the fair value rate base. However, the authorized return on equity exceeded the average of returns accorded to electric utilities in 2023. For additional information, refer to "UNS Electric rate case decision viewed as constructive for investors."

Wildfire-related costs shape new rate increase request

Oregon — PacifiCorp, a Berkshire Hathaway Energy subsidiary, requested to implement the new rates based on the need to recover significant capital investments in transmission and wind projects and higher costs related to insurance, vegetation management and wildfires. See "Wildfire-related costs, power capex shape PacifiCorp's $322M Ore. rate request."

Significant non-rate case activity

Illinois, Missouri — Ameren Corp. management noted in a Feb. 23 earnings call the company is shifting more capital spending to its Missouri utility and slowing Illinois spending because of an unfavorable decision by the Illinois Commerce Corporation in late 2023. The regulator declined to adopt a detailed infrastructure investment proposal put forth by Ameren's Illinois utility subsidiary.

Commission, commissioner activity

California — Indicating an increased focus on affordability, Gov. Gavin Newsom recently appointed Matt Baker, director of the Public Advocates Office since 2022, as a California Public Utilities Commission commissioner. The Public Advocates Office is the state entity charged with helping ensure California ratepayer interests are represented at the commission. See "Consumer advocate appointed to California Public Utilities Commission."

Colorado — On Feb. 5, the Colorado Senate confirmed the reappointment of Colorado Public Utilities Commission regulator Megan Gilman to a new four-year term extending to January 2028.

Kansas — On Feb. 21, the Kansas Senate confirmed the reappointment of Kansas Corporation Commission Chairman Andrew French to serve an additional four-year term extending to March 2028.

Maryland — The Maryland Senate confirmed the appointments of Maryland Public Service Commission regulators Kumar Barve and Bonnie Suchman. Barve is serving a partial term extending to June 2024, and Suchman is serving a partial term expiring June 2027.

Missouri — A relative newcomer to the Missouri Public Service Commission was recently selected to serve as chair of the regulatory agency as it navigates a busy year. Kayla Hahn, who was initially appointed to the Missouri Public Service Commission in mid-2023, was chosen to lead the PSC. Hahn gained considerable experience with governmental policy issues prior to joining the commission. In addition to two rate cases filed this month, several bills have been introduced during the 2024 Missouri legislative session that could alter the composition of the PSC and impact the way it handles utility ratemaking. RRA intends to monitor the bills and others that could affect its perspective on the state's regulatory climate. Refer to "New chair to lead Mo. commission as potentially impactful legislation introduced."

Oregon — The state Senate recently confirmed Les Perkins to the Oregon Public Utility Commission for a term expiring Feb. 15, 2028, bringing the three-member regulatory body to full strength as it prepares to adjudicate several electric and gas rate cases and addresses broader issues tied to climate and clean energy. See "Ore. utility regulator adds new commissioner with water, energy experience."

Ohio — Gov. Mike DeWine on Feb. 9 reappointed Chair Jenifer French to the Public Utilities Commission of Ohio. French's new term expires in April 2029.

Tennessee — On Feb. 28, the Tennessee General Assembly confirmed the reappointment of Chairman Herbert Hilliard to the Tennessee Public Utility Commission. Hilliard's new term is set to expire in June 2029.

Wisconsin — Rebecca Cameron Valcq departed from the Public Service Commission of Wisconsin on Feb. 2. Valcq, who was the commission's chair, was serving a term that extended to March 2025. Following Valcq's departure, Summer Strand began serving as the agency's chair.

FERC — On Feb. 29, President Joe Biden announced his intent to nominate Democrats Judy Chang and David Rosner and Republican Lindsay See to the Federal Energy Regulatory Commission. Chang would fill Commissioner Allison Clements' seat for a term expiring June 30, 2029; Rosner would fill former Chairman Richard Glick's seat for a term expiring June 30, 2027; and See would fill former Commissioner James Danly's seat for a term expiring June 30, 2028.

M&A, reorganization activity

Louisiana, Mississippi — CenterPoint Energy Inc. said Feb. 20 that it reached an agreement to sell its Louisiana and Mississippi local gas distribution businesses to Bernhard Capital Partners Management LP for $1.2 billion. Criteria for reviewing and approving mergers and acquisitions of regulated utilities in Louisiana and Mississippi are relatively stringent, and there is no specific time frame under which the regulatory bodies are required to render a decision on a proposed transaction. Assuming all necessary regulatory approvals are secured, the parties expect the deal to be completed in the first quarter of 2025. Additional regulatory perspective on the matter is available in "CenterPoint agrees to sell its Southeast US gas utilities to Bernhard Capital."

Utah — Several intervenors in the Enbridge-Questar merger docket questioned the benefit for ratepayers of the proposed union. The Division of Public Utilities, part of Utah's Commerce Department, and the Utah Association of Energy Users, representing the state's large industrial customers, filed testimony in support of further ratepayer protections and tangible benefits prior to deal approval. The utility regulator, among other pledges, seeks a clear statement by the merger applicants that Questar customers will bear no responsibility to cover any costs associated with the transfer of ownership of the utility and requests a clarification of the intent of Enbridge's clean energy merger commitment. See "In Utah, intervenors unconvinced of Enbridge-Questar merger benefits" for additional details.

Legislation

Georgia — State lawmakers have advanced legislation that would create a consumer utility counsel to serve as a public advocate in electric rate cases. The Georgia Senate Committee on Regulated Industries and Utilities unanimously passed Senate Bill 457 on Feb. 22. The bill would reestablish the Office of the Consumers' Utility Counsel, a body that was shuttered in 2008. The Georgia PSC executive director told lawmakers at a Feb. 14 committee hearing that the proposal was redundant in some ways since the PSC has a public interest advocacy staff to represent residential and small commercial and industrial customers. The commission employs the PSC's public interest advocacy staff, who participate in utility rate cases with expert witness testimony, cross-examine witnesses on the public's behalf and make recommendations to the PSC with the public's interests in mind. See "Ga. lawmakers advance bill to reestablish consumer utility advocate."

Kansas — A prominent piece of legislation was recently introduced in the Kansas House of Representatives and could meaningfully alter aspects of the state's utility regulatory climate. House Bill 2527, a bill backed by Evergy Inc., which owns electric utilities that conduct operations in Kansas, includes provisions that would allow for the deferral of certain plant-related costs until such costs could be included in rates. The bill specifies procedures that would apply when a utility's return on equity and capital structure are determined in the context of rate proceedings. The bill includes provisions that would allow the use of cost-recovery mechanisms for gas-fired generation facilities while they are under construction. Predetermined ratemaking principles would be used to determine the revenue requirement associated with the facilities. If enacted, the legislation would provide for different sets of economic development rates based on an eligible customer's peak demand. Currently, different peak demand thresholds are used to apply discounts for eligible customers. See "Kan. bill backed by Evergy seeks to improve utility cost recovery prospects."

Missouri — Several bills have been introduced during the 2024 legislative session that could alter the composition of the PSC and impact the way it handles utility ratemaking. Senate Bill 758 would prevent any utility commissioner from serving more than three terms. House Bill 1747 would increase the number of PSC commissioners from five to seven, and at least three commissioners would be required to be actively engaged in "production agriculture." House Bill 2070 calls for the PSC to allow the electric utilities' commercial and industrial customers to choose a competitive generation provider beginning June 1, 2025; the PSC would also be obligated to allow residential customers to select a generation supplier no later than Jan. 1, 2028, at which point the utilities would become the default generation suppliers in their territories. The utilities would need to unbundle their rates for generation, transmission and distribution service before June 1, 2024. House Bill 2167 includes provisions that would meaningfully alter how utility rates are determined, establish a 230-day deadline for the PSC to adjudicate rate cases and require the use of the prevailing nationwide average ROE for a utility's applicable service type if the utility were to choose to be subject to this treatment.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

Monica Hlinka contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.