Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 20 Oct, 2021

By Anthony Yang and Min Jiang

Highlights

An Overlay Model Specializing in the Analysis of LGFVs in the China Domestic Market

This article is written and published by S&P Global Market Intelligence, a division independent from S&P Global Ratings. The opinions herein are not reflective of those of S&P Global Ratings. S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.

Introduction

In China, most local and regional governments (LRGs) are not allowed to raise debt directly from the bond market.[1] As a result, they set up LGFVs as separate entities to engage in public service mandates, such as infrastructure and land development, and to perform related financing functions. Most of the infrastructure investments cannot generate enough profit to cover the cost in the short term, or even in the long term, thus LGFVs rely heavily on the LRG’s support, ultimately the LRG’s revenue. However, the support may be selective depending on many factors, such as the availability of resources and the number of peers in the same region. To evaluate the overall credit risk profile of an LGFV, it is necessary to assess the credit quality of the LRG and the likelihood of extraordinary government support.[2]

An LGFV is a special type of government-related entity (GRE), or an entity potentially affected by extraordinary government intervention in an economic or financial stress scenario. There are some differences between LGFVs and Non-LGFV GREs:

Because of these differences and the importance of LGFVs in the China credit market, S&P Global Market Intelligence developed a quantitative support overlay model to assess the credit risk of LGFVs in an automated and scalable way.[3]

Extraordinary Government Support

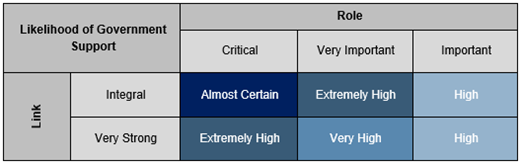

The assessment of the likelihood of extraordinary government support for a particular LGFV starts with the assessment of two major dimensions: the importance of an LGFV’s role to the government and the strength of the link between the government and an LGFV.

The importance of an LGFV’s role to the LRG is classified into one of three categories:

The strength of the link between an LGFV and the LRG is classified into one of two categories:

Once these two factors are assessed, the likelihood of extraordinary government support can be obtained with a Role-Link Matrix in line with the S&P Global Ratings’ rating criteria.

Table 1: Role-Link Matrix for Assessing the Likelihood of Extraordinary Government Support

Source: General Criteria: Rating Government-Related Entities: Methodology and Assumptions, S&P Global Ratings, 2010. For illustrative purposes only.

Purpose and Scope of the Model

The goal of the quantitative overlay is to use a standardized, automated, transparent, and consistent process to assess the importance of the LGFV’s role to the underlying LRG, the strength of the link between the LGFV and the underlying LRG, and the likelihood of extraordinary government support.

The overlay applies to entities that are classified as LGFVs based on the following criteria:

Methodology

A decision tree algorithm is employed for this overlay because of the simple classification rules, robust performance, and high interpretability. A decision tree is a hierarchical model composed of decision rules, which are applied recursively to partition the feature space of a dataset into pure, single-class subspaces. Decision tree algorithm is used to discover features and extract patterns that are important for discrimination and predictive modeling. Moreover, decision tree algorithm is easy to understand with intuitive interpretation.

Final Credit Score Adjustment

The credit quality of an LGFV is not linked to the credit quality of a central government directly but with an LRG, since the central government's support for LGFV sector is a system-wide phenomenon, rather than entity specific. The assessments of government support for LGFVs therefore focus on the credit quality of an LRG instead of a central government.

The overlay implements the Role-Link Matrix (shown in Table 1) for mapping the “importance” and “link” to the likelihood of support, and then adjusts the LGFV’s credit score based on the estimated likelihood and the credit quality of the corresponding LRG.

For most cases, the impact of government is positive but, in some rare cases, the impact of government can be negative when an LRG has poorer credit qualities than an LGFV. Under a situation of financial stress, an LRG may intervene to redirect an LGFV’s resources to the government and weaken the LGFV's credit quality.

Performance

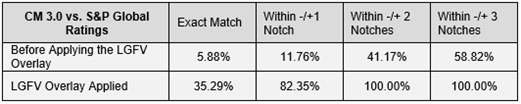

The overlay model, trained on S&P Global Ratings, aims to assess a potential uplift or downgrade of the stand-alone credit score of an entity due to potential extraordinary government support. One of the most intuitive measures of relative model performance is obtained by looking at the difference between the model outcome and S&P Global Ratings credit ratings. To validate the model performance, we compared the results of applying the overlay on the stand-alone credit scores generated by CreditModelTM 3.0 (CM 3.0) with the issuer credit ratings from the S&P Global Ratings’ research database.

Table 2 reports the percentage notch difference between the estimated scores and the actual ratings, based on the model training sample. The table shows that adding the government support overlay significantly enhances the ratings agreement for LGFVs.

Table 2: Summary of performance (applying LGFV overlay on CM 3.0 output)

Source: S&P Global Market Intelligence. Data as of July 29, 2021. For illustrative purposes only.

Case Study

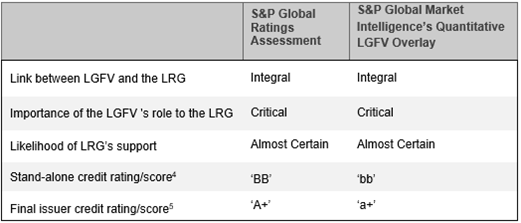

Company X is an LGFV in Beijing providing a range of public services, including metro investment and operation, land development, and toll road investment and operation. According to an S&P Global Ratings report, the strength of the link between the company and the Beijing government is integral because of robust government control over the business and the important public services being provided. The role of the company to the Beijing government is critical, since its infrastructure project is “too big to fail”.

Table 3 below compares the government support assessment between S&P Global Ratings and the quantitative LGFV overlay.

Table 3: S&P Global Market Intelligence’s Quantitative Government Support Overlay for LGFV vs. S&P Global Ratings Assessment

For illustrative purposes only.

We see that the outcomes of the quantitative LGFV overlay model match well with the S&P Global Ratings assessment for this specific case.

Conclusion

S&P Global Market Intelligence has built a quantitative government support overlay model for the LGFV sector in the China domestic market. The model was trained on S&P Global Ratings data. It aims to produce differentiated credit score outputs and to offer an automated and scalable solution for gauging the credit risk of LGFVs, some of the largest bond issuers in China.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we know that not all information is important—some of it is vital. Accurate, deep, and insightful. We integrate financial and industry data, research, and news into tools that help track performance, generate alpha, identify investment ideas, understand competitive and industry dynamics, perform valuations, and assess credit risk. Investment professionals, government agencies, corporations, and universities globally can gain the intelligence essential to making business and financial decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI), which provides essential intelligence for individuals, companies, and governments to make decisions with confidence. For more information, visit www.spglobal.com/marketintelligence.

[1] “Why We Don't Link The Ratings On Local Government Financing Vehicles Directly To The Sovereign Rating On China”, S&P Global Ratings, January 29, 2019.

[2] We have a separate credit model for LRGs, trained on S&P Global Ratings issuer credit ratings data.

[3] As one of the major bond issuers, LGFVs account for about 50% of the corporate credit market by issuer number. See “Charting China’s LGFVs”, S&P Global (China) Ratings, December 9, 2020 for more details.

[4] Stand-alone credit score prior to government support, generated via S&P Global Market Intelligence’s CM 3.0 using financials for FY 2019.

[5] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit model scores from the credit ratings issued by S&P Global Ratings.