Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 22 Mar, 2022

By Scott Robson

Introduction

Combined distribution revenues at the nine major publicly traded cable network companies grew 5.7% year over year in the fourth quarter of 2021 as digital subscription fees and contractual rate hikes boosted distribution revenues.

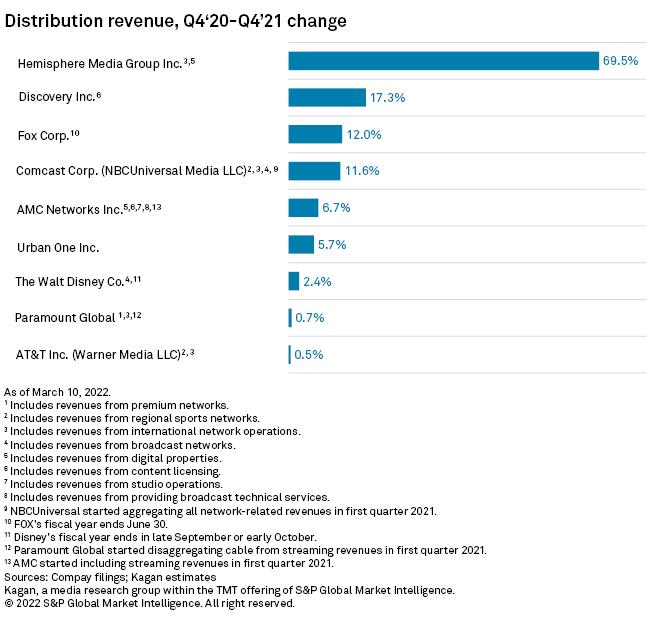

All nine companies reported year-over-year growth in distribution revenue in the fourth quarter, with Hemisphere Media Group Inc. leading all groups with a 69.5% increase. The increase in distribution revenue at Hemisphere Media Group was the result of $13.6 million in subscription revenues generated by the company's Pantaya LLC streaming service. Without the revenue generated by Pantaya, we estimate that Hemisphere's distribution revenue declined by 1.6% in the quarter.

The Discovery Inc. U.S. Networks business segment increased distribution revenues by 17.3% in the quarter on a year-over-year basis to $832 million. The increase was largely caused by the inclusion of Discovery+ subscription fees in 2021. The company noted subscriber declines of about 4% for its fully distributed networks. The Discovery U.S. business segment derives only 41.4% of its total revenue from distribution, which is the smallest portion of any group in our database.

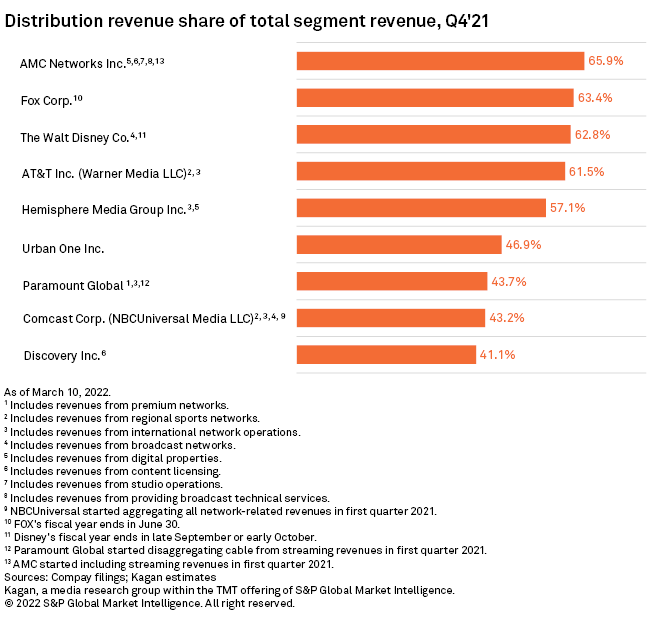

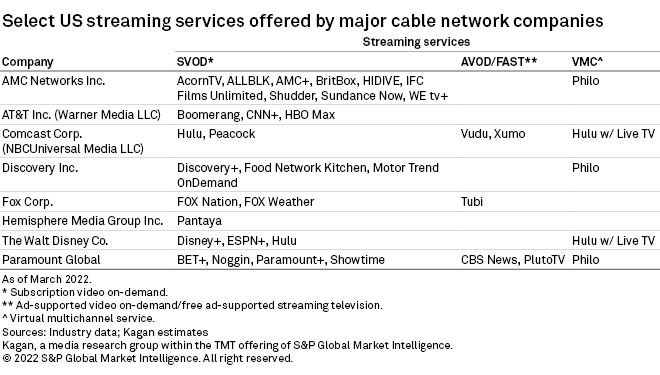

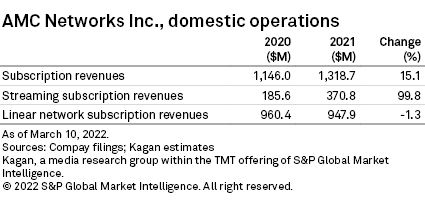

AMC Networks Inc. generated the largest share of total revenue from distribution in the quarter, with 65.9% of total revenue coming from subscription fees to its linear networks and niche subscription video on demand services. AMC reported full-year subscription streaming revenues of $370.8 million. The company grew its stable of SVOD offerings in January, when AMC announced it had acquired anime distributor Sentai Holdings, LLC and its direct-to-consumer platform HIDIVE.

Looking at full-year, nonstreaming subscription revenues, AMC's domestic networks experienced a 1.3% decline in 2021. Subscribers to the company's five linear basic cable networks fell by 3.6%, according to Nielsen Holdings PLC.

Fox Corp. noted a similar decline in subscribers on its earnings call, with CFO Steven Tomsic saying sub-losses at the linear cable networks continue "to run below 5%." Fox's distribution revenue grew 12% in the fourth quarter as the company benefited from distribution credits accrued in 2020 as a result of canceled college football games due to COVID-19. Excluding the distribution credits, affiliate revenues at the cable networks increased in the low single digits in the quarter.

Total distribution revenues across the nine companies in our database increased by 7.0% in 2021 versus 2020, with all nine companies reporting year-over-year growth. However, as highlighted by our analysis of Hemisphere Media and AMC Networks, declines in subscribers offset license fee rate hikes at some companies, resulting in declines in traditional distribution revenues paid by operators for carriage of the linear networks.

Economics of Networks is a regular feature from Kagan, a group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.